South Korea’s crypto revolution has hit a remarkable milestone: over 16 million people now hold accounts with domestic crypto exchanges. That’s more than 30% of the national population—signaling adoption levels that rival participation in the traditional stock market.

According to a report on March 30th by Yonhap News, the figures were disclosed by Representative Cha Gyu-geun of the Rebuilding Korea Party, based on data from the country’s top five crypto exchanges: Upbit, Bithumb, Coinone, Korbit, and Gopax.

Importantly, individuals with multiple accounts were counted only once, underscoring the scale of unique user participation. The growth isn’t just organic, political developments appear to be accelerating the shift.

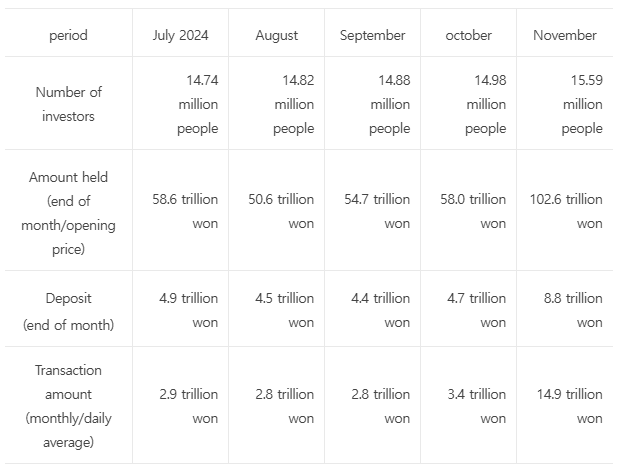

Following Donald Trump’s election victory last November, South Korean crypto user numbers spiked by more than 600,000 in a matter of weeks, pushing the total to 15.6 million. At that point, users collectively held ₩102.6 trillion (approximately $70.3 billion) in digital assets.

The momentum has continued into 2025, with user numbers now eclipsing the country’s stock investor base.

Crypto Now Rivals Stock Market Participation

According to the Korea Securities Depository, only 14.1 million South Koreans held listed stock investments as of December 2024, putting crypto users ahead in sheer numbers for the first time.

This inversion marks a critical shift in how South Koreans are choosing to invest and store value. While stocks remain foundational to many portfolios, crypto has become a primary financial channel—especially among younger and tech-savvy generations.

Some observers believe this signals a maturing market, with speculation emerging around a potential saturation point. But not everyone agrees.

“Some believe the crypto market has reached a saturation point,” one unnamed industry official told Yonhap. “But there is still an endless possibility for growth compared with the matured stock market.”

The trend isn’t confined to private citizens. According to a March 27 report from South Korea’s Ethics Commission for Government Officials, 20% of surveyed public officials—411 out of 2,047—disclosed crypto holdings totaling ₩14.4 billion (around $9.8 million).

The largest individual stake? A whopping ₩1.76 billion ($1.2 million) in crypto assets held by Seoul City Councilor Kim Hye-young.

These disclosures highlight crypto’s growing legitimacy across all levels of society—including among policymakers themselves.

While adoption soars, regulators are keeping pace. On March 26, the Financial Intelligence Unit of South Korea’s Financial Services Commission released a list of 22 unregistered crypto platforms, along with 17 others blocked from appearing on the Google Play Store.

The move reflects South Korea’s ongoing efforts to maintain transparency, consumer protection, and regulatory control in an industry that often moves faster than legislation can track.

The Takeaway

With 16 million users and counting, South Korea’s crypto market may be nearing its first adoption ceiling—but that doesn’t mean it’s slowing down.

Instead, it’s shifting into a new phase—one defined by regulation, institutional integration, and growing public accountability. Current trends suggest that 20 million users by year’s end won’t just be possible—it may become the new baseline.