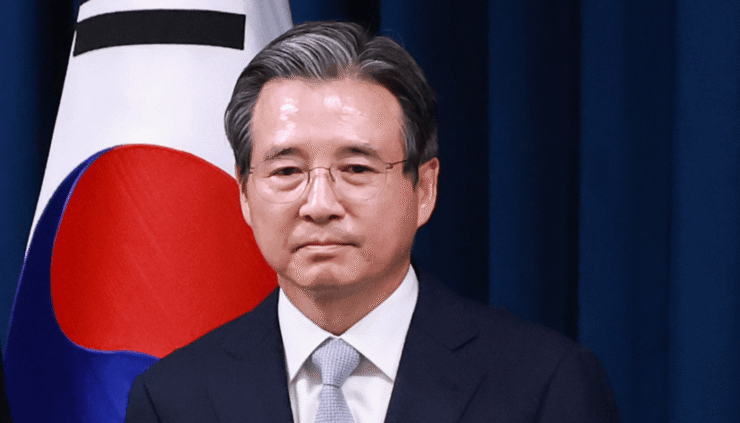

South Korea is tightening its grip on the digital asset sector with a sweeping new bill aimed at establishing a formal licensing system for stablecoin issuers. On Tuesday, Min Byeong-deok, a prominent lawmaker from the ruling Democratic Party, introduced the “Digital Asset Basic Act,” positioning it as a strategic foundation for Korea’s role in the global digital economy.

The proposed legislation goes beyond the country’s existing Virtual Asset Investor Protection Act, which took effect in July 2024. While the earlier law focused on consumer protection, the new bill introduces a more comprehensive framework—clarifying the legal status of digital assets and requiring licenses for entities issuing stablecoins pegged to fiat currencies like the Korean won.

New Bill Sets Capital Threshold for Stablecoin Issuers

At the heart of the Digital Asset Basic Act is a bold requirement: stablecoin issuers must hold more than 500 million Korean won (about $368,000) in owner’s capital to operate under the new rules.

The capital threshold is designed to ensure financial stability and accountability for firms offering stablecoins in South Korea. The move also reflects the agenda of newly elected President Lee Jae-myung, who has prioritized boosting Korea’s digital finance leadership on the world stage.

Lee’s administration has shown strong support for a won-pegged stablecoin market, which it sees as a strategic tool to limit capital flight via foreign-currency stablecoins. Min Byeong-deok, who led digital asset policy during Lee’s campaign, called the measure critical for preserving Korea’s monetary sovereignty while advancing domestic innovation.

Stablecoin Regulation Gains Ground Globally

South Korea’s proposed Digital Asset Basic Act joins a growing global push for stablecoin oversight. In the United States, the Genius Act—backed by President Donald Trump—is gaining traction as a foundational digital asset policy. Hong Kong, meanwhile, has already implemented its own licensing regime for stablecoin issuers, setting a precedent South Korea appears ready to follow.

Lawmaker Min referenced global models—from the U.S. and EU to Japan—where rules cover issuance, circulation, and trading of digital assets. These evolving standards are shaping South Korea’s regulatory playbook and influencing the design of its new crypto framework.

Digital Asset Act Extends Beyond Stablecoins

The bill’s scope reaches far beyond stablecoins. It offers a formal definition for digital assets, introduces rules for service providers, and proposes the formation of a presidential-level Digital Asset Committee to oversee market development.

In addition, the act outlines legal consequences for misconduct in the crypto space, signaling a broader effort to legitimize and stabilize the market. If passed, the legislation could transform Korea into a key hub for regulated digital finance in Asia.

Quick Facts

- South Korea introduces Digital Asset Basic Act to license issuers

- New law requires ₩500M ($368K) in capital for issuers

- President Lee Jae-myung backs a won-pegged stablecoin strategy

- Bill proposes a presidential Digital Asset Committee

- Legislation follows Hong Kong and U.S. regulatory trends