In a significant regulatory crackdown, South Korea’s Financial Intelligence Unit (FIU) has suspended Upbit’s ability to onboard new customers for three months, citing violations of anti-money laundering (AML) and Know Your Customer (KYC) policies. The move is a stark warning to crypto exchanges operating in one of the world’s most tightly regulated digital asset markets.

With Upbit’s trading volumes plummeting by 70% since January, the decision signals a broader shift toward stricter compliance enforcement in South Korea—one that could reshape the nation’s crypto landscape.

Why Did South Korea Ban Upbit from New Customer Transactions?

According to an FIU statement released on Feb. 25, the three-month restriction prevents new users from depositing or withdrawing funds on Upbit. Regulators claim the exchange failed to comply with South Korea’s strict prohibitions against transactions with unregistered crypto asset service providers (CASPs).

This enforcement follows months of scrutiny. Reports surfaced in November 2024 alleging that Upbit breached KYC protocols up to 600,000 times, triggering investigations into the platform’s customer verification procedures.

The FIU formally warned Upbit in January 2025 that punitive measures were imminent, setting the stage for this latest regulatory strike.

Upbit Responds, Hints at Possible Amendments

In response to the suspension, Upbit issued a public statement on its website, apologizing to users for the inconvenience while maintaining that it has already taken corrective actions to address regulatory concerns.

“Upbit has reviewed the necessary improvements made in response to this sanction by the financial authorities and completed the measures,” the exchange stated.

However, Upbit suggested that the restrictions could be revised or lifted, depending on ongoing discussions with regulators. The exchange emphasized that some “specific facts and circumstances” had not been fully considered in the FIU’s decision, leaving room for potential amendments.

“The sanctions imposed this time may be subject to change through procedures in accordance with relevant regulations, and if the effect of the relevant measures is suspended or terminated, new members will also be able to use Upbit’s services without restrictions.”

For now, the restrictions only affect new customers, with existing users still able to trade freely.

A Major Blow to Upbit—Trading Volumes Plunge 70%

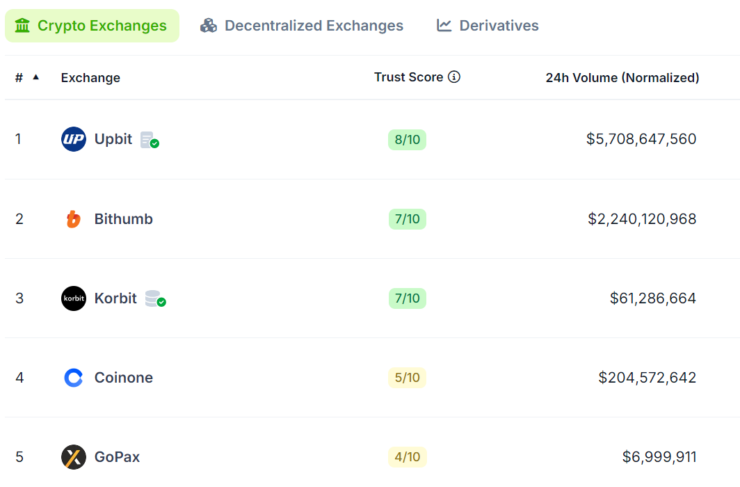

The regulatory hit comes at a critical time for Upbit, South Korea’s largest crypto exchange and a dominant player in the global market.

Once a major hub for crypto trading, Upbit has seen its daily trading volume nosedive from over $15 billion in early January to just $4.6 billion at the time of writing a staggering 70% decline.

The prolonged uncertainty around the exchange’s regulatory standing could further shake investor confidence, especially as South Korea tightens its grip on the digital asset sector ahead of new crypto tax laws set to take effect in 2025.

What This Means for Crypto Exchanges in South Korea

Upbit’s regulatory troubles are part of a larger crackdown on crypto compliance in South Korea, where authorities are ramping up enforcement against AML breaches, fraudulent activities, and unregistered exchanges.

The move underscores a clear message: Crypto exchanges must adhere to the country’s strict compliance framework or face severe penalties.

With upcoming legislation poised to increase tax obligations and compliance requirements for crypto businesses, other South Korean exchanges may soon find themselves in Upbit’s position if they fail to meet regulatory expectations.

Looking Ahead—Can Upbit Recover?

The next three months will be critical for Upbit’s future. The exchange is pushing for amendments to its sanctions, and if successful, it could restore its ability to attract new users sooner than expected.

However, if regulatory scrutiny intensifies, South Korea’s crypto ecosystem could undergo a major shakeup, forcing exchanges to double down on compliance or risk exclusion from the market.

For now, Upbit remains operational for existing users, but its battle to regain regulatory favor and rebuild trading momentum is far from over.