In a major legal win for Coinbase, the state of South Carolina has officially dismissed its lawsuit against the crypto exchange over its staking program, following a similar move by Vermont and signaling a potential policy pivot at the state level.

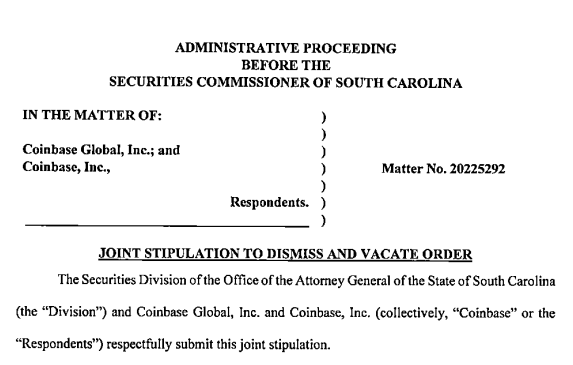

The lawsuit, which accused Coinbase of offering unregistered securities through staking services, was formally dropped on March 27 via a joint stipulation filed between Coinbase and the South Carolina Attorney General’s securities division.

“South Carolina just joined Vermont to dismiss its unfounded staking lawsuit against Coinbase,” said Paul Grewal, Coinbase’s Chief Legal Officer, in a post on X.

“This is not just a victory for us, but for American consumers and we hope it’s a sign of things to come in the few states left that restrict staking,” he added.

The legal actions stemmed from June 6, 2023, when 10 U.S. states launched coordinated enforcement against Coinbase’s staking services, the same day the Securities and Exchange Commission (SEC) filed its federal lawsuit. The SEC officially dropped that case on February 27, 2025.

Coinbase claims the lawsuit cost South Carolina residents an estimated $2 million in missed staking rewards and is urging other states to follow suit. The remaining states involved include Alabama, California, Illinois, Kentucky, Maryland, New Jersey, Washington, and Wisconsin.

Momentum Builds Toward Crypto-Friendly State Policy

South Carolina’s move to drop enforcement comes as the state takes a surprising pro-crypto turn. On the same day the lawsuit was dismissed, Rep. Jordan Pace introduced the Strategic Digital Assets Reserve Act of South Carolina—a bill that could see the state treasurer allocate up to 10% of certain state funds to digital assets, including Bitcoin.

The bill proposes creating a Bitcoin reserve with a cap of 1 million BTC, a ceiling that echoes ambitions laid out in recent federal-level proposals under the Trump administration’s digital asset initiatives.

If passed, the bill would authorize South Carolina Treasurer Curtis Loftis to include Bitcoin in the General Fund, Budget Stabilization Fund, or any other investment vehicle managed by the state.

Unlike other crypto reserve bills, South Carolina’s version mentions Bitcoin explicitly multiple times, but does not include stablecoins, Ether, or NFTs—though the reserve wouldn’t be limited to Bitcoin alone.

According to Bitcoin Law, a legislative tracker, 42 Bitcoin reserve bills have been introduced across 19 U.S. states, with 36 of those bills still active. South Carolina joins a growing list of states looking to add Bitcoin to public coffers, following in the footsteps of Texas, Oklahoma, Arizona, and North Carolina.

At the federal level, President Donald Trump recently signed an executive order to establish a Strategic Bitcoin Reserve and Digital Asset Stockpile, initially backed by crypto seized in criminal cases.

What’s Next?

South Carolina’s dual developments—dropping the Coinbase lawsuit and introducing Bitcoin reserve legislation—highlight a growing shift in state-level crypto policy from aggressive enforcement to strategic adoption.

As Coinbase continues to fight for regulatory clarity and consumer rights, and as states increasingly position themselves to benefit from blockchain innovation, the U.S. may be heading into a new phase of crypto normalization at both the state and federal level.