The world of Bitcoin mining is dominated by industrial-scale operations running fleets of high-powered ASIC miners. Yet, in a stunning stroke of luck, a lone miner using a budget-friendly, pocket-sized rig managed to beat the odds and claim a full 3.15 BTC reward, worth approximately $263,000.

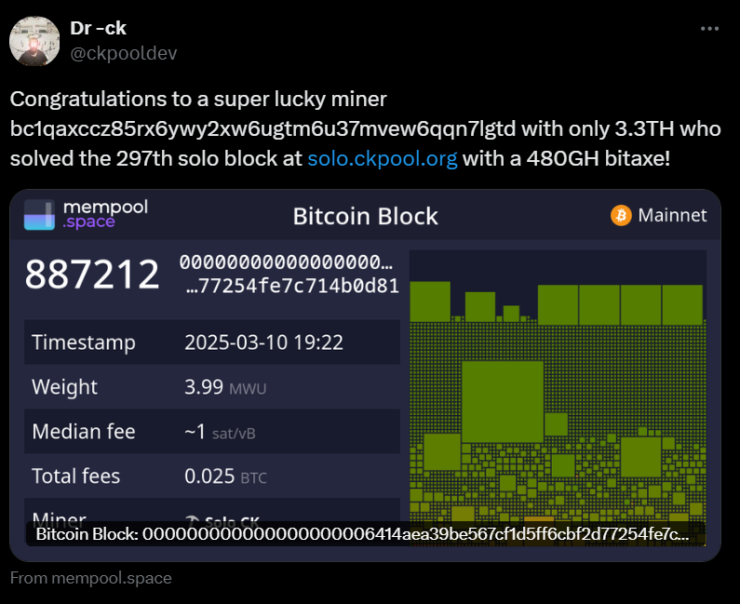

On March 10, a miner connected to the solo.ckpool Bitcoin mining pool defied statistical probability by solving block 887,212 using a modest 480 GH/s Bitaxe miner. To put this in perspective, the mining giants operate machines with speeds exceeding 230,000 GH/s, making solo victories like this exceedingly rare.

According to solo.ckpool developer Con Kolivas, a miner with such limited hash power has a 1 in a million chance of successfully mining a block on any given day. If left to probability, a similar setup would take an estimated 3,500 years to replicate this feat. Yet, against all expectations, this miner struck digital gold.

A Small Miner, A Huge Reward

The miner’s reward comprised the 3.125 BTC block subsidy and an additional 0.025 BTC transaction fees. While mining rewards fluctuate due to Bitcoin’s fee market and periodic halvings, this windfall is a testament to the unpredictability of Bitcoin mining.

Remarkably, the hardware that made this possible, a Bitaxe Gamma 601, priced at around $158, is considered one of the least powerful mining machines available. According to ASIC Miner Value, such devices generate only about $20 per year in revenue, barely covering electricity costs, with an annual profit of less than $3.

What are the odds of a Bitaxe Gamma 601 mining a solo block on any given day? A staggering 1 in 4.6 million. Over a year, those odds improve only slightly to 1 in 12,700.

The mining sector is overwhelmingly controlled by massive mining pools such as Foundry USA, MARA Pool, and publicly traded firms like Cipher Mining, Bitfarms, and Hut 8. These corporations invest millions into high-performance ASIC rigs, optimizing power consumption and computational efficiency to maximize their block discovery rates.

Against such heavyweights, solo miners stand little chance—unless sheer luck intervenes. However slim, this event underscores the possibility that Bitcoin’s proof-of-work system remains open to anyone willing to participate.

The Rise of Open-Source Mining

While solo Bitcoin mining remains financially unviable for most, small-scale miners are emerging as part of an open-source movement pushing back against industry centralization. Skot, a Bitaxe developer, has been vocal about challenging the secrecy and exclusivity of Bitcoin mining.

“Most ASIC miners, like those from Bitmain, operate as closed-source products,” Skot noted in a 2023 interview. “The advent of open-source mining projects sheds light on this often opaque area, making it more transparent and accessible to the public.”

The goal? To democratize Bitcoin mining, individuals should be allowed to participate without relying on corporate-controlled mining infrastructure.

What This Means for the Future of Bitcoin Mining

This rare solo mining success highlights a fundamental truth: Bitcoin mining is still a game of chance. While large-scale mining farms dominate the landscape, the occasional lone miner can still break through, reinforcing the decentralized nature of Bitcoin’s network.

However, mining profitability will become even more challenging as Bitcoin’s next halving event approaches in April 2024. Solo miners must weigh their odds more carefully with the block reward dropping from 6.25 BTC to 3.125 BTC.