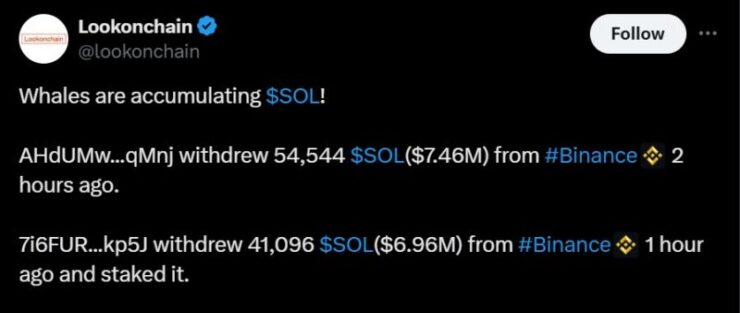

A massive Solana whale transaction has sparked renewed discussions about upcoming market growth as large investors continue to accumulate SOL and stake their holdings. Recent blockchain activity reveals that 96,180 SOL, worth approximately $12.45 million, was moved from Binance to a staking address, signaling a long-term holding strategy.

Shortly after the transaction, Solana’s price saw a brief 5% surge before correcting to $139.84, indicating that whale activity remains a strong influence on price movements. A second major transfer involving 49,999.99 SOL, worth $6.37 million, was also recorded, further reinforcing the bullish sentiment among institutional investors and high-net-worth individuals.

On-chain analysts highlight that whale staking reduces the circulating supply of SOL, which can ease selling pressure and create upward momentum over time. These moves suggest that large investors are positioning themselves for a potential price increase despite Solana’s recent market volatility.

Despite these significant accumulations, Solana’s price has faced downward pressure. As of March 1, 2025, SOL is trading at approximately $139.84, reflecting a 4.31% decrease over the past 24 hours. The cryptocurrency’s market capitalization stands at over $70.94 billion, with a 24-hour trading volume of $3.63 billion, marking a decline of over 50%. This drop in trading volume suggests waning market interest, even in the face of whale accumulation.

Historical Performance and Technical Analysis

Historically, Solana has exhibited sharp price declines followed by robust recoveries. Over the past four years, there have been ten significant drops exceeding 40%, each followed by substantial rebounds. The most recent correction saw a 57.8% decline, yet past patterns indicate resilience and potential for recovery.

Technical analysis shows that after a steep decline to $120, SOL stabilized and approached a short-term resistance zone between $145 and $147.50. Although the price briefly surpassed this resistance, it failed to maintain momentum, suggesting that sustained buying power is necessary for a confirmed breakout.

Broader Industry Trends and Implications

The accumulation of SOL by whales aligns with a broader trend of institutional interest in cryptocurrencies beyond Bitcoin. For instance, Franklin Templeton recently filed for a Solana exchange-traded fund (ETF), aiming to track the spot price of SOL. This move reflects growing confidence in Solana’s long-term potential and could pave the way for increased mainstream adoption.

However, the cryptocurrency market remains volatile, influenced by factors such as regulatory developments, technological advancements, and macroeconomic conditions. Investors should exercise caution and conduct thorough research before making investment decisions.

Quick Facts:

- Whale Accumulation: Significant SOL withdrawals from Binance by whale addresses suggest bullish sentiment.

- Price Volatility: SOL is trading around $139.84, with a 4.31% decrease over the past 24 hours and a notable drop in trading volume.

- Historical Resilience: Solana has a history of sharp declines followed by strong recoveries, indicating potential for future rebounds.