A sweeping proposal to overhaul Solana’s inflation system has been rejected in a historic governance vote, marking one of the most significant decisions in the network’s history. Despite the proposal’s failure, stakeholders have hailed the process as a milestone for decentralized governance.

“Even though our proposal was technically defeated by the vote, this was a major victory for the Solana ecosystem and its governance process,” said Multicoin Capital co-founder Tushar Jain on 14 March.

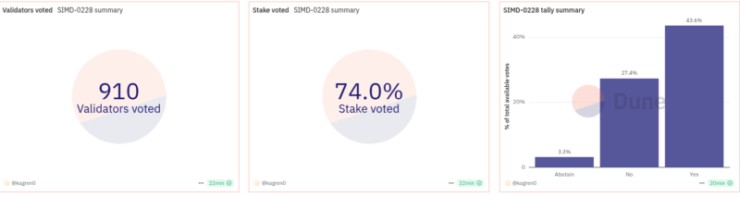

According to Dune Analytics, the vote on proposal SIMD-228 saw unprecedented participation, with 74% of the staked supply casting votes across 910 validators. The proposal received 43.6% support, with 27.4% voting against it and 3.3% abstaining. It required approval from at least 66.67% of participating voters to pass but fell short at 61.4%.

Jain described the event as the largest governance vote in crypto history by both the number of participants and the market capitalization of the staked assets involved. “This was a meaningful scaling stress test — a social, rather than technical, stress test — and the network passed despite a wide stratification of diverging opinions and interests.”

Solana’s official X account echoed this sentiment, emphasizing that voter turnout surpassed every U.S. presidential election in the last century.

Proposed Inflation Model and Its Implications

SIMD-228 sought to transition Solana’s inflation system from a fixed schedule to a dynamic, market-driven model. Under the current structure, inflation starts at 8% annually and decreases by 15% per year until it stabilizes at 1.5%. The new proposal aimed to adjust inflation rates based on staking participation, potentially reducing them by up to 80%.

Proponents argued that a flexible inflation model could stabilize the network, minimize unnecessary token issuance, and encourage active participation in decentralized finance (DeFi).

According to Solana developer tools provider Helius, benefits included enhanced network security, real-time adjustments to staking levels, and increased incentives for SOL holders to engage with the ecosystem.

Despite these potential advantages, the proposal was criticized for its complexity and potential impact on smaller validators. Lower inflation rates could have made it difficult for them to remain profitable, while sudden fluctuations in staking participation could have created instability.

SOL’s price showed little immediate reaction, dipping 1.5% to just below $125. However, the asset has declined nearly 60% over two months following a downturn in the memecoin sector. Solana’s network revenue has also plummeted over 90% due to reduced memecoin trading activity.

Jain noted that the proposal was revised multiple times over seven weeks, incorporating community feedback before reaching a final vote. He described the process as a testament to Solana’s decentralized governance and emphasized the importance of continued public discourse.

While the proposal’s rejection maintains Solana’s current inflation trajectory, it has sparked discussions on refining the governance process. Jain acknowledged areas for improvement, noting that institutions played a larger role in this vote than in previous proposals, signaling growing institutional involvement in Solana’s ecosystem.

“This vote is evidence that the network is thriving and fully decentralized,” he said, adding that lessons learned will inform future governance proposals. Stakeholders, including validators, developers, and investors, are now assessing potential modifications to enhance the network’s decision-making framework.