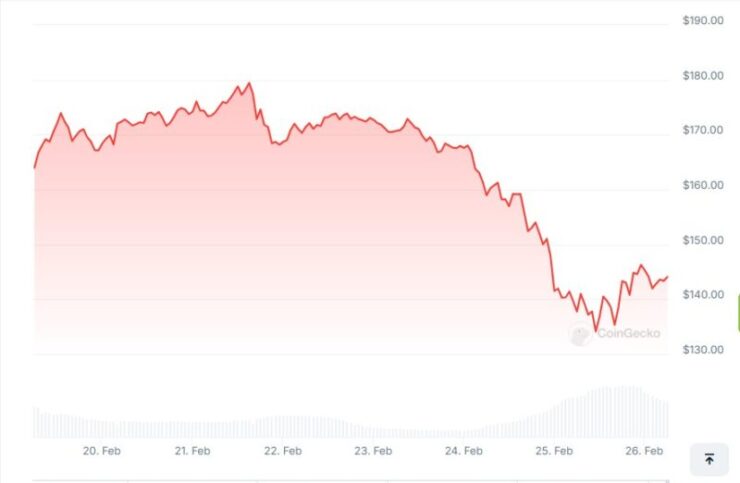

Solana (SOL) has taken a significant hit, plunging over 50% from its early January high of $293 as trading activity on its network slows and investor sentiment weakens. The token briefly dropped to $132 on Tuesday—its lowest level since October—before recovering slightly to around $144, marking a 5% decline in the past 24 hours, according to CoinGecko.

A key factor behind Solana’s downturn is the decline in decentralized exchange (DEX) trading volumes on its network. Last week, Solana-based DEX volumes fell to a five-week low of $2.61 billion, largely due to waning interest in meme coin trading, a major driver of activity on the blockchain. The downturn comes amid a series of rug pulls and scams, including the controversy surrounding the Libra meme token, which has further dampened confidence in Solana’s ecosystem.

With both market-wide selloffs and network-specific issues contributing to the slump, Solana faces increasing pressure to regain investor trust and stabilize trading activity in the coming weeks.

Market-Wide Cryptocurrency Decline

Solana’s price decline comes amid a broader slump in the digital assets market, with Bitcoin briefly dipping to nearly $86,000 on Tuesday—well below its all-time high of over $109,000. The downturn has impacted major cryptocurrencies across the board, with Ethereum, Dogecoin, and XRP all experiencing sharp drops as investors flee risk assets.

The selloff is driven by growing macroeconomic concerns, including fears of a potential trade war due to new U.S. tariffs, rising inflation, and increasing global political instability. As uncertainty mounts, traders have pulled back from speculative markets, contributing to the recent downturn in both crypto and traditional equities. The Nasdaq and S&P 500 were also in the red on Tuesday, sliding 1.45% and 0.5%, respectively, as broader market sentiment soured.

While top cryptocurrencies have started to recover some ground, with most assets down around 5-6% over the past 24 hours, market volatility remains high. The ongoing macroeconomic uncertainty could continue to weigh on digital assets in the short term, prompting investors to proceed with caution.

Impact of Meme Coin Scandals

Solana’s recent price decline has been further fueled by the controversy surrounding the Libra token, a project issued on the Solana blockchain that lost 90% of its value within hours. The collapse sparked widespread accusations of fraud and even led to political turmoil in Argentina, with critics calling for the impeachment of President Javier Milei.

Milei had personally promoted the Libra token on X, describing it as a tool to support small businesses in Argentina. However, after the token’s price crashed, he deleted the post and distanced himself from its creation, denying any involvement in its development. The fallout from the incident has led to negative sentiment toward Solana, as investors worry about the network’s association with failed projects and fraudulent schemes.

Despite Solana’s recent struggles, institutional interest remains high. Several major asset managers including Franklin Templeton, Grayscale, Bitwise, Canary, 21Shares, and VanEck have filed applications for Solana-based exchange-traded funds (ETFs). If approved, these ETFs could provide new avenues for institutional investment and potentially help stabilize the network’s reputation and market position.

Quick Facts:

- Solana’s value has decreased by more than 50% since January, currently trading at approximately $144.56.

- Active addresses on the Solana network have fallen by 60%, from 18.5 million to 7.3 million.

- The LIBRA token scandal, involving a 90% value drop, has negatively affected Solana’s image.