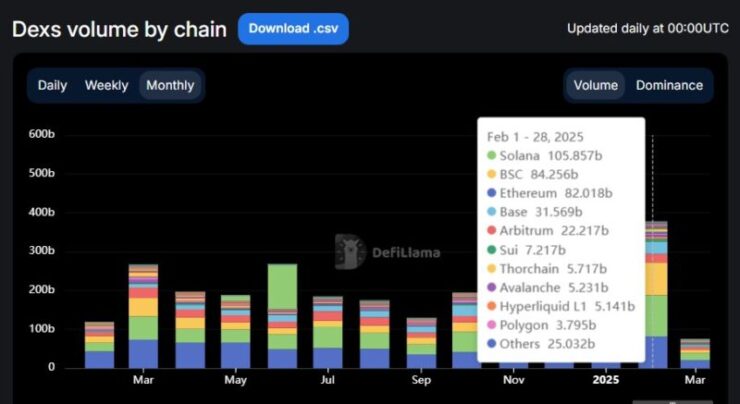

Solana has once again proven its resilience, maintaining its position as the leader in blockchain on-chain trading volume, despite a 60% decrease in overall volume last month. February saw the platform record a substantial $102.4 billion in trading volume, despite a significant cooling off in the memecoin market following the LIBRA token fiasco. This marks the fourth consecutive month that Solana has surpassed the $100 billion volume threshold, reinforcing its strength even as the broader market experiences volatility.

The downturn in trading volume is largely attributed to the collapse of the memecoin frenzy, which had dominated the crypto market in previous months. The LIBRA token’s sudden debacle triggered a sharp pullback in memecoin-driven activity, leading to a sharp drop in volume across the sector. Despite these setbacks, Solana’s continued performance above $100 billion in trading volume showcases its broader appeal beyond speculative tokens, solidifying its position as a utility-focused platform.

February’s Declining Trading Volumes

February’s total on-chain trading volume across all major blockchains decreased by nearly $200 billion, reflecting the market’s slowdown. While Solana managed to hold strong, many other platforms faced sharp declines, with most major blockchains registering significant losses. The exception to this was Binance Smart Chain (BSC), which saw a modest decline in volume to $81.1 billion—only $600 million short of its January performance.

Despite Solana’s impressive showing, it was unable to overtake Ethereum in terms of total volume for the month. Ethereum posted a trading volume of $100 million more than BSC, holding onto its second-place position. While Solana continues to impress, Ethereum remains a dominant force in the blockchain space.

Memecoin Market Decline and Its Effects

The crash of the memecoin market, which saw a massive 60% decline in value, significantly impacted several high-profile tokens, including Shiba Inu (SHIB) and Dogecoin (DOGE).

Memecoin prices, which had been propelled by speculative trading and high-profile endorsements, have started to reflect the cooling sentiment in the broader crypto market. The so-called “memecoin bubble,” which had inflated the value of tokens like FARTCOIN, WIF, POPCAT, and even established projects like PEPE, has burst. Once-prominent tokens have experienced drastic price reductions as the initial speculative frenzy wanes.

The launch of the Official Trump Memecoin and Melania Token added fuel to the fire, as it became a symbol of the speculative nature of the memecoin market. Critics argue that celebrity-backed tokens, such as the Trump family tokens, fueled a price manipulation strategy that led to inflated valuations, benefiting early investors at the expense of retail traders. This has raised serious concerns about the ethics of using public figures to manipulate market prices in a space already prone to volatility.

Adding to the controversy, Argentine President Javier Milei’s endorsement of the $LIBRA memecoin led to significant legal and political ramifications. After the memecoin suffered a dramatic collapse, opposition figures accused Milei of being involved in a fraudulent scheme. This scandal has further tarnished the reputation of memecoins, especially those backed by influential figures..

Solana’s Future in a Shifting Market

As the market continues to grapple with the fallout from the memecoin crash, Solana’s position as a leader in on-chain volume positions it well for long-term growth. Developers are increasingly focusing on Solana’s scalability and speed advantages, ensuring the platform’s relevance in the evolving crypto ecosystem. Additionally, Solana’s shift toward more sustainable applications, such as DeFi and NFTs, could mitigate future risks from speculative market movements.

Quick Facts:

- Solana leads the blockchain space in monthly on-chain transaction volume, despite a 60% decline in the memecoin market.

- The memecoin market faced significant declines, with many tokens dropping over 60% in value.

- Solana has maintained its strong performance due to its diverse use cases in DeFi, NFTs, and other blockchain applications.