Solana’s latest governance shakeup may not have gone as planned, but it left an important lesson: failing fast is better than getting stuck in indecision. That’s the message from Solana co-founder Anatoly Yakovenko following the community’s rejection of the Solana Improvement Document (SIMD)-0228.

While the proposal to introduce a dynamic inflation model in Solana’s tokenomics was shot down, Yakovenko remains optimistic. His takeaway? Governance must be fast and decisive, even if some proposals don’t pass.

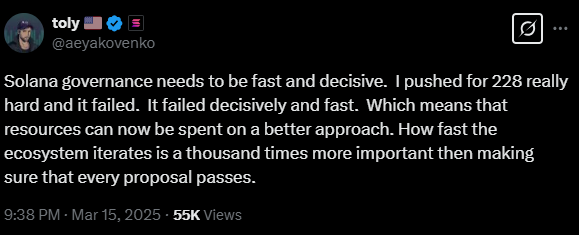

“How fast the ecosystem iterates is a thousand times more important than making sure that every proposal passes,” said Yakovenko.

With over 74% of validators participating in the vote, the debate was heated. Big names, including VanEck, backed the proposal, hoping it would drive SOL’s price higher. But concerns over centralization risks and disadvantages to smaller validators led to its rejection.

Instead of dwelling on the setback, Yakovenko believes Solana should focus on rapid iteration. The failed bid wasn’t a loss—it was a stress test for the network’s governance. With quick resolutions, resources can be redirected toward better solutions that align with the community’s vision.

Will SOL Defy the Odds and Surge?

Despite the governance hiccup, bullish sentiment around SOL remains strong.

The network has been under pressure, with Alameda Research unstaking large amounts of SOL, sending jitters through the market. At the same time, Solana’s DEX volume has plummeted, raising concerns about the asset’s short-term price action.

But analysts are pointing to a different story—one that mirrors Solana’s explosive rally in 2021. Some even predict a $4,000 price target, arguing that Solana’s rapid adoption could propel it past Ethereum’s market capitalization.

For now, traders are eyeing SOL at $200 before March’s end, despite technical indicators flashing warning signs like a looming death cross.

What’s fueling this optimism?

- On-chain activity is soaring, with more projects deploying on Solana than ever before.

- Institutional interest continues to rise, with major funds showing confidence in the network.

- Solana’s developer ecosystem remains one of the strongest in the crypto space.

The market is at a crossroads. If SOL holds its ground and breaks key resistance levels, a parabolic move could be on the horizon. If not, bears may regain control.

The Bottom Line

Solana’s governance experiment isn’t about getting everything right the first time—it’s about learning fast and adapting even faster. Yakovenko’s stance reinforces that decisiveness, not delay, will define the network’s long-term success.

And while governance debates unfold, all eyes are on SOL’s price. Will it break out, or will headwinds stall its momentum? One thing’s for sure—the next few months will be a defining moment for Solana.