Japanese conglomerate SoftBank is making headlines with its substantial return to the cryptocurrency market. The firm has committed $900 million to Twenty One Capital, a newly formed Bitcoin investment company launched in collaboration with crypto heavyweights Tether and Bitfinex, along with financial services firm Cantor Fitzgerald. With over 42,000 BTC under management, Twenty One Capital is poised to become the third-largest corporate holder of Bitcoin globally.

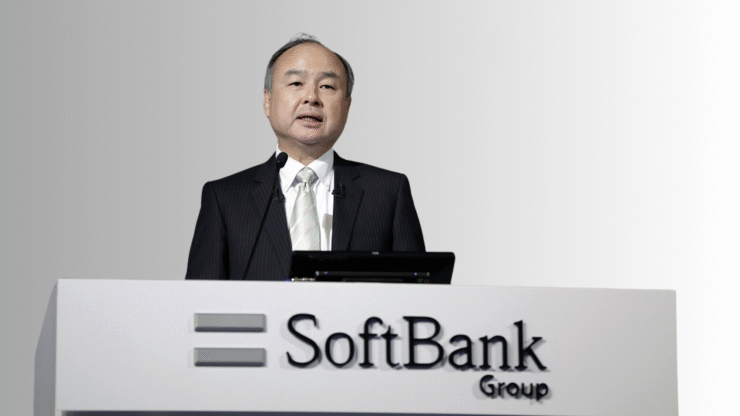

This move marks a notable strategic shift for SoftBank, particularly given its previous $130 million loss from a personal Bitcoin investment made by CEO Masayoshi Son in 2018. The company’s renewed foray into digital assets reflects a broader strategy to diversify its investment portfolio and tap into the next wave of financial technology.

Twenty One Capital: A New Player with Ambitious Goals

Twenty One Capital aims to replicate the success of firms like MicroStrategy by focusing on aggressive Bitcoin accumulation and related financial services. The venture will be led by Jack Mallers, CEO of Strike, and will introduce proprietary performance metrics—such as Bitcoin Per Share (BPS) and Bitcoin Return Rate (BRR)—to improve transparency and better align shareholder interests with Bitcoin’s price performance.

The company’s structure includes a planned merger with Cantor Equity Partners, a special-purpose acquisition company (SPAC), allowing it to become publicly listed. This approach is intended to provide traditional investors with easier access to Bitcoin exposure through regulated capital markets.

Market Reactions and Institutional Implications

For many, SoftBank’s return to crypto signals a new level of institutional acceptance. Often viewed as Japan’s unofficial sovereign wealth fund, the firm’s investment is being interpreted as further validation that digital assets are maturing into investment-grade financial instruments. Jeff Park of Bitwise noted that SoftBank’s involvement adds “major credibility” to the evolution of crypto into mainstream finance.

However, not all observers are convinced. Critics point to SoftBank’s earlier misstep in 2017, when CEO Masayoshi Son bought into Bitcoin near its then-all-time high of $20,000—only to sell early in 2018 amid the crash, realizing a $130 million loss. Had he held the position, it would now be worth nearly five times more as Bitcoin trades near $93,000.

With the latest move arriving during another overheated market cycle, skeptics question whether SoftBank’s reentry signals confident optimism—or yet another case of poor market timing. Either way, the move has reignited a debate over whether institutional entry into crypto always signals long-term bullishness—or occasionally marks euphoric peaks.

The news generated mixed reactions across the financial world. Shares of Cantor Equity Partners surged 130% following the announcement, reflecting investor excitement. Analysts at TD Cowen suggested that the emergence of Twenty One Capital could further legitimize and potentially strengthen the Bitcoin-focused playbook pioneered by firms like MicroStrategy.

Still, some experts caution that SoftBank’s aggressive reentry may echo the kind of frothy enthusiasm that has historically preceded downturns. The firm’s long-standing appetite for high-risk, high-reward bets adds an extra layer of complexity to its latest crypto venture.

Quick Facts

- SoftBank has invested $900 million in Twenty One Capital, a Bitcoin-focused investment firm.

- The venture—launched with Tether, Bitfinex, and Cantor Fitzgerald—will manage over 42,000 BTC.

- Twenty One Capital plans to go public via a SPAC merger with Cantor Equity Partners.

- The move reflects growing institutional adoption of cryptocurrencies amid favorable U.S. regulatory shifts.