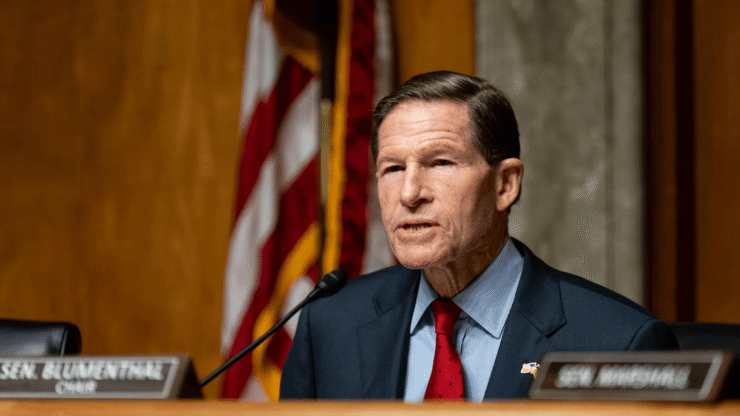

Senator Richard Blumenthal (D-CT) has intensified pressure on World Liberty Financial (WLF), a Trump-affiliated crypto venture, over what he called an “evasive and seriously inadequate” response to a Senate ethics inquiry. The Connecticut senator condemned the firm’s refusal to provide basic information about its ownership, foreign ties, and financial connections to Donald Trump.

“WLFI’s refusal to answer even the most basic questions about President Trump’s financial entanglements with the company raises serious concerns. And I will continue demanding transparency for the American people,” Blumenthal said in a statement Friday.

The inquiry was launched in response to growing concerns that WLF—a decentralized finance (DeFi) platform—could be exploited by foreign governments or investors to influence the U.S. presidency. The firm raised $550 million during its token sale and launched a proprietary stablecoin, USD1, in March 2025.

WLF is led by business associates of the Trump and Witkoff families, including Zak Folkman and Chase Herro. Its DeFi model enables crypto transactions without intermediaries—a structure that critics argue lacks sufficient regulatory oversight. With foreign capital backing several of WLF’s early deals, Blumenthal warned of potential national security implications during Trump’s re-election campaign.

Senate Scrutiny Deepens Over WLF’s Foreign Crypto Deals

As the ranking Democrat on the Senate’s Permanent Subcommittee on Investigations, Blumenthal launched the probe earlier this month, citing possible legal and constitutional violations, including concerns over the foreign emoluments clause.

At the center of the inquiry are two major transactions: a $2 billion agreement with the UAE government, and a financial advisory deal with Pakistan, both of which involve WLF’s stablecoin. These deals have alarmed ethics watchdogs due to reported partial ownership of WLF by Trump and his sons.

Blumenthal’s formal letter demanded detailed disclosures regarding Trump’s financial interest, WLF’s governance structure, and its sources of foreign capital.

WLF’s legal counsel, Teresa Goody Guillén, rejected the senator’s claims as “flawed and misleading,” and defended the firm’s compliance record. However, her response did not clarify Trump’s stake or respond to the specific concerns raised by the Senate—deepening suspicions around the firm’s inner workings.

Bipartisan Pressure Mounts as House Joins Investigation

In a parallel effort, House Democrats have also ramped up scrutiny of WLF. On Wednesday, several members sent a letter to Treasury Secretary Scott Bessent, requesting access to any Suspicious Activity Reports (SARs) linked to the president’s crypto-related enterprises.

This wave of congressional concern reflects a broader unease over how emerging financial technologies—particularly in the unregulated DeFi space—could be weaponized for political or geopolitical gain.

As WLF becomes increasingly emblematic of the collision between digital finance and public office, lawmakers are pushing for clearer boundaries and deeper transparency. With a presidential election approaching, the entanglement of crypto and politics is likely to remain a flashpoint in the regulatory discourse.

Quick Facts

- Senator Richard Blumenthal has condemned World Liberty Financial’s failure to respond transparently to a Senate ethics inquiry.

- The Trump-linked DeFi firm is under investigation for foreign financial ties, including deals with the UAE and Pakistan.

- WLF raised $550 million and launched its stablecoin, USD1, in March 2025, amid concerns of foreign influence.

- House Democrats have requested Treasury review of suspicious activity reports linked to Trump’s crypto ventures.