After failing to attach key tax provisions to President Trump’s recent reconciliation bill, Senator Cynthia Lummis (R-WY) has brought fresh legislation to the Senate floor that could reshape how Americans are taxed on digital assets.

The proposal, unveiled Thursday, seeks to provide what Lummis described as “key victories for the digital asset industry,” including measures that supporters say will modernize tax treatment and support innovation.

“In order to maintain our competitive edge, we must change our tax code to embrace our digital economy,” Lummis said in a statement.

“We cannot allow our archaic tax policies to stifle American innovation.”

The legislation marks another milestone in Congress’s intensifying debate over the role of digital currencies in the U.S. economy—and how to regulate them without hindering their growth.

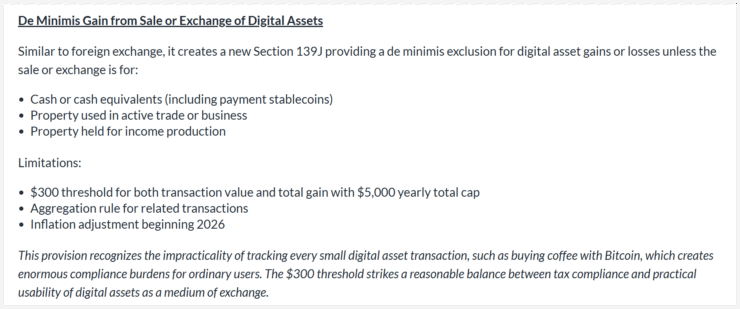

Everyday Transactions Could Get $300 Tax Exemption

One of the bill’s most prominent features is a $300 de minimis exemption for everyday crypto purchases. If enacted, this rule would let individuals spend cryptocurrencies like Bitcoin and Ethereum on routine expenses without incurring capital gains reporting requirements.

The exemption, which would cap out at $5,000 per taxpayer each year, would not apply to buying cash equivalents like stablecoins, or assets used for business or income generation. Supporters have argued that this small-purchase carve-out could clear a major hurdle preventing crypto from functioning as a viable payment method in the U.S.

Crypto advocacy groups have long called for this change, saying it will reduce administrative headaches and encourage broader adoption. Under current tax rules, every crypto transaction—even buying a cup of coffee—can be a taxable event if the asset has appreciated.

Mining, Staking, and Lending Also Addressed

Beyond small transactions, the Lummis bill proposes several other reforms designed to simplify compliance and bring clarity to gray areas in tax law. The legislation includes a provision allowing businesses to elect mark-to-market accounting, enabling them to report unrealized gains on digital assets more easily.

A separate rule would clarify that rewards from crypto mining and staking should not be taxed until the moment they are sold—an issue that has fueled legal battles in recent years over when tax liability should arise.

Other measures in the package would expand securities lending rules to cover digital assets, effectively treating crypto lending as a non-taxable event akin to traditional securities lending. Additionally, the bill aims to make it simpler to donate crypto to charities without triggering tax penalties.

The legislation is expected to draw strong interest from both crypto policy advocates and lawmakers seeking a more transparent framework for digital asset taxation.

Quick Facts

- Sen. Cynthia Lummis introduced a bill offering comprehensive tax relief for crypto users.

- The plan includes a $300 exemption on small crypto purchases up to $5,000 annually.

- New rules would also clarify taxation of mining, staking, and lending activities.