U.S. Senator Dave McCormick—former CEO of hedge fund giant Bridgewater Associates—has emerged as the most heavily invested member of Congress in Bitcoin, even as he helps lead the charge to craft digital asset legislation on Capitol Hill.

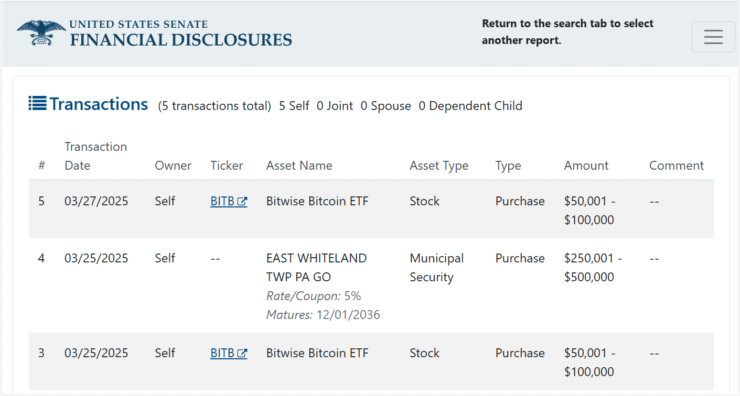

Now representing Pennsylvania, McCormick disclosed several sizable investments in the Bitwise Bitcoin ETF in recent months. His latest purchase, filed in March, is valued between $310,000 and $700,000, bringing his total reported Bitcoin exposure in 2025 to nearly $1 million. While congressional financial disclosures only provide broad value ranges, the filings clearly place McCormick at the top among lawmakers holding crypto.

What makes McCormick’s position noteworthy isn’t just the size of his investments—but the timing. As a sitting U.S. Senator helping shape federal cryptocurrency policy, his personal stake in Bitcoin blurs the line between investor and lawmaker.

Supporters argue that this alignment reinforces his commitment to the space: McCormick is backing the asset class he’s legislating. For critics, however, it raises questions about conflicts of interest as the Senate prepares to vote on industry-defining regulations.

Crypto-Heavy Portfolio Meets Legislative Power

Recent filings show that McCormick—widely known for his prior government and finance background—is becoming one of Washington’s most crypto-forward lawmakers. In addition to his March ETF buy, he disclosed a February investment of up to $450,000, also in the Bitwise fund, signaling sustained interest in the sector.

In contrast, other crypto-friendly lawmakers such as Rep. Marjorie Taylor Greene have disclosed far smaller holdings, with Greene’s investments limited to modest exposure through BlackRock’s iShares Bitcoin Trust (IBIT).

McCormick’s growing position in Bitcoin coincides with his appointment to the Senate Banking Committee’s Subcommittee on Digital Assets, a key venue for shaping the future of crypto legislation in the United States. As bipartisan interest grows around clearer federal regulation, McCormick now sits at the center of policy and personal stake.

During the subcommittee’s inaugural hearing earlier this year, McCormick stressed the need for congressional alignment with the Trump administration’s pro-crypto stance. “America must lead on crypto,” he said—echoing a message that featured prominently during his campaign for Senate.

Balancing Policy and Portfolio

Despite the attention his crypto holdings have garnered, McCormick’s broader financial disclosures reveal a diversified portfolio, with substantial holdings in municipal securities and other traditional assets. But his seven-figure bet on Bitcoin—and the fact that it aligns with his legislative influence—signals a deep and personal commitment to the digital asset economy.

As Congress prepares to advance a series of bills on digital asset classification, tax reform, and stablecoin frameworks, McCormick’s dual role as both investor and policymaker places him in a unique—and closely watched—position.

Quick Facts

- Senator Dave McCormick has invested nearly $1 million in Bitcoin this year, primarily through the Bitwise Bitcoin ETF.

- He serves on the Senate Banking Committee’s digital assets subcommittee, giving him direct influence over upcoming crypto legislation.

- McCormick is one of the few lawmakers combining active investment in Bitcoin with a leadership role in digital asset policy.

- He advocates for bipartisan crypto regulation to ensure U.S. leadership in financial innovation.