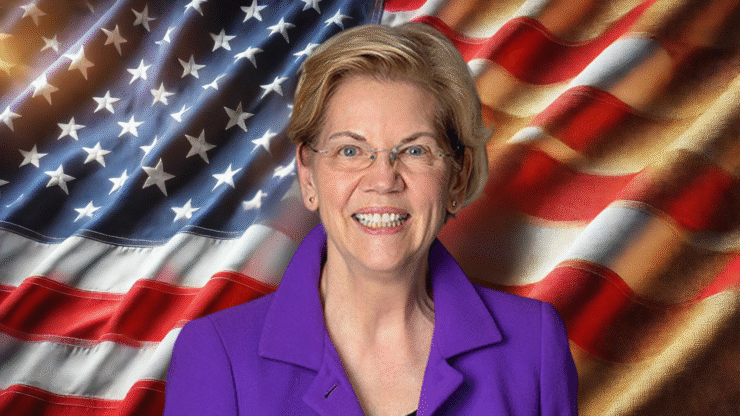

U.S. Senator Elizabeth Warren has issued a stark warning over President Donald Trump’s renewed push to remove Federal Reserve Chair Jerome Powell, calling the move a potential catalyst for financial turmoil and a threat to democratic norms.

Speaking on CNBC, the Massachusetts senator argued that the president lacks the legal authority to unilaterally dismiss the Fed chair and cautioned that any such attempt would deal a serious blow to the credibility of U.S. capital markets.

“If Chairman Powell can be fired by the President of the United States, it will crash the markets,” Warren said.

“The infrastructure that keeps this stock market strong and, therefore, a big part of our economy strong, and a big part of the world economy strong, is the idea that the big pieces move independently of politics.”

Warren further warned that politicizing interest rate decisions would erode the foundational checks that separate the U.S. financial system from those of authoritarian regimes.

“If interest rates in the United States are subject to a president who just wants to wave his magic wand, this doesn’t distinguish us from any other two-bit dictatorship,” she said.

Trump Renews Attacks on Powell Over Rates

Warren’s comments come amid growing speculation that Trump may seek to remove Powell before his term expires in 2026, following a series of renewed attacks on the Fed chair last week over what Trump termed Powell’s sluggishness in addressing interest rates proactively.

The latest criticism—most recently delivered in a Truth Social post on April 17—has intensified speculation that Trump may attempt to oust Powell if market conditions remain strained.

Trump’s longstanding frustration with Powell stems from what he views as the Fed’s failure to act swiftly enough to ease monetary policy during periods of economic tension. Lower interest rates are traditionally seen as a stimulus for risk assets, including equities and cryptocurrencies—two sectors that have struggled under the weight of persistent inflation, tighter financial conditions, and lingering geopolitical uncertainty.

While the Fed has signaled a more cautious approach to rate cuts, Trump has consistently argued that a looser policy would help reverse economic stagnation and fuel market recovery.

GOP Support Grows for Fed Shake-Up

Support for removing Federal Reserve Chair Jerome Powell is gaining traction among Republican lawmakers, with Senator Rick Scott publicly backing President Trump’s calls for a shake-up at the central bank. In a recent Fox News op-ed, Scott argued that the Fed needs leadership aligned with the interests of everyday Americans, writing:

“It’s time to clean house of everyone working at the Federal Reserve who isn’t on board with helping the American people and fighting for their best interests.”

Prominent investor and analyst Anthony Pompliano added fuel to the conversation, recently suggesting that Trump may have allowed financial markets to falter in order to pressure the Fed into cutting rates. At the time of his comments, the yield on the 10-year U.S. Treasury had slipped to 4%—a move often interpreted as signaling economic uncertainty. Yields have since rebounded to 4.3%, but market watchers remain on edge over the increasingly politicized tone of U.S. monetary policy debates.

Quick Facts

- President Trump has intensified his criticism of Fed Chair Jerome Powell, suggesting his termination “cannot come fast enough.”

- Senator Elizabeth Warren warns that firing Powell could crash financial markets and undermine the Fed’s independence.

- Legal experts debate the president’s authority to dismiss the Fed Chair without cause, with recent court decisions adding complexity.

- Financial analysts caution that compromising the Fed’s independence could lead to increased market volatility and economic instability.