The U.S. Securities and Exchange Commission (SEC) is reportedly planning to cut its regional office directors, aligning with the Trump administration’s sweeping government cost-cutting measures. The move, linked to the Department of Government Efficiency (DOGE) initiative led by Elon Musk, raises serious concerns over regulatory oversight and enforcement capabilities particularly in the crypto sector.

SEC’s Plan to Restructure Regional Offices

According to a Feb. 24 Reuters report, the SEC informed directors of its 10 regional offices on Feb. 21 that their roles would be eliminated. The agency is expected to file an official plan next month.

Despite the leadership cuts, the SEC has no plans to shut down the regional offices themselves.

This development follows the SEC’s June 2023 closure of its Salt Lake City hub, citing “significant attrition”. The decision came just a week after a federal judge fined the agency $1.8 million for “bad faith conduct” in its lawsuit against crypto firm DEBT Box—a case that also saw the resignation of two SEC attorneys in April.

DOGE’s Influence and the Push for Cost-Cutting

The SEC’s restructuring is part of a broader wave of federal agency downsizing under the newly inaugurated Trump administration. President Trump’s initiative, spearheaded by DOGE, aims to slash federal spending by reducing government staff and streamlining operations.

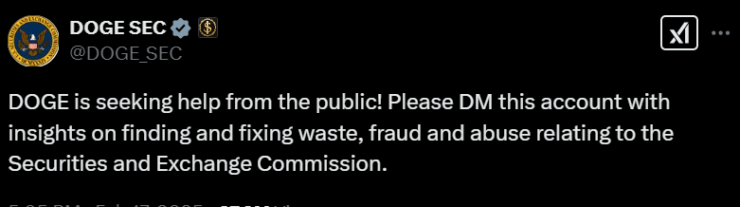

A DOGE-affiliated X account focused on SEC matters actively solicited public input on Feb. 18, asking users to report instances of waste, fraud, and abuse within the SEC.

Meanwhile, in its March 2024 budget justification report, the SEC requested $2.6 billion for its 2025 fiscal year while emphasizing that the budget remains “deficit neutral.”

Internal SEC Turmoil and the Looming Reshuffle

On Feb. 20, senior SEC staffers participated in a high-level call, during which agency leaders confirmed direct coordination with DOGE. One Reuters source revealed that all SEC departments must submit reorganization plans to acting SEC Chair Mark Uyeda by Feb. 25.

Currently, the majority of SEC staff operate from its Washington, D.C. headquarters. However, its 10 regional offices, located in financial and tech hubs like New York and San Francisco, as well as Atlanta and Boston, play a vital role in overseeing and investigating companies nationwide.

The decision to eliminate regional directors requires a formal vote by the three-person SEC commission, which consists of:

- Mark Uyeda (Republican, Acting Chair)

- Hester Peirce (Republican, Commissioner)

- Caroline Crenshaw (Democrat, Commissioner)

What This Means for Crypto Regulation

The SEC has already pulled back on its aggressive crypto enforcement approach, which had intensified under former Chair Gary Gensler. Recent developments include:

- Downsizing and reshuffling of the SEC’s crypto enforcement team.

- Pausing multiple lawsuits against crypto firms.

- Reassigning its former top crypto litigator to the IT department.

These actions indicate a potential shift away from the SEC’s previous regulatory stance on digital assets—a change that could reshape crypto policy enforcement in the U.S.

What’s Next?

The proposed elimination of regional directors signals major structural changes within the SEC, raising questions about its ability to enforce securities laws effectively. As DOGE-led cost-cutting measures take effect, regulatory oversight especially in the volatile crypto market may face further disruptions.

With the SEC’s internal restructuring in motion, industry stakeholders, investors, and policymakers will be watching closely to determine whether these changes enhance efficiency or weaken enforcement in the evolving digital asset landscape.