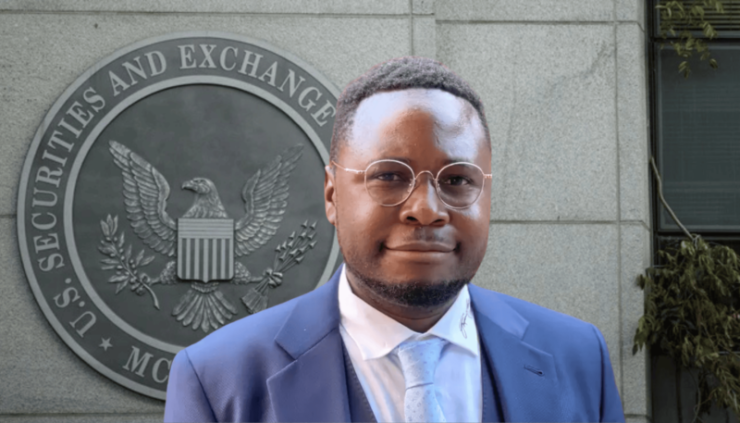

After nearly three years of legal proceedings, Token Metrics CEO Ian Balina announced that the U.S. Securities and Exchange Commission (SEC) is expected to dismiss its case against him. The lawsuit, which began in September 2022, accused Balina of violating U.S. securities laws by failing to disclose compensation while promoting the Sparkster (SPRK) initial coin offering (ICO).

Balina took to social media to share the update, stating, “It’s official: The SEC is dropping its case against me. This was never just about me—it’s about fairness in crypto.” His company, Token Metrics, reinforced the claim, tweeting that the charges had been “dropped” and suggesting that this could mark the beginning of a broader shift in regulatory enforcement trends.

While the SEC has yet to make an official public announcement regarding the dismissal, the development aligns with recent enforcement shifts under the new administration, where several crypto-related lawsuits and investigations have been quietly closed.

Background of the Case

The U.S. Securities and Exchange Commission first filed charges against Token Metrics CEO Ian Balina in September 2022, accusing him of promoting Sparkster (SPRK) tokens during its 2018 initial coin offering (ICO) without disclosing that he received a 30% bonus on his $5 million investment. The agency argued that this undisclosed incentive violated securities laws, as it misled his audience regarding the nature of his promotions.

In May 2024, a U.S. federal judge ruled that SPRK tokens qualify as securities, reinforcing the SEC’s stance that the offering fell under its jurisdiction. Following the ruling, Balina’s legal team immediately announced plans to appeal, challenging both the classification of the tokens and the enforcement approach taken by the SEC.

Initially, a jury trial was set for January 2025, but in July 2024, the court approved a continuance motion, pushing back the trial to a later, undetermined date. At the time of publication, no official court filing had appeared in the U.S. District Court for the Western District of Texas to confirm the SEC’s withdrawal of the case as observed by Cointelegraph.

SEC’s Shifting Stance on Crypto Cases Continues

If the SEC formally drops its case against Ian Balina, it would mark yet another major shift in the agency’s approach toward crypto-related enforcement actions since President Donald Trump took office on January 20, 2025. Since the administration change, the SEC has halted investigations into Robinhood Crypto, Gemini, Uniswap, and OpenSea, and has also dropped active cases against Coinbase, Consensys, Kraken, and other crypto firms.

Despite these dismissals, the SEC continues to pursue legal action against Ripple Labs, following an August 2024 ruling that resulted in a $125 million judgment. The case remains entangled in appeal and cross-appeal proceedings, with recent reports suggesting that the SEC is going to drop the case in the coming days or weeks.

Critics argue that the SEC’s sudden retreat from aggressive crypto enforcement stems from political influence after pro-crypto lobbying groups and industry leaders supported Trump’s 2024 presidential campaign. Speculation has grown over whether crypto firms leveraged political donations to push for a friendlier regulatory environment.

Adding to these concerns, the White House hosted a closed-door crypto summit on March 7, where executives from major digital asset firms—including Robinhood, Gemini, Coinbase, and Kraken—met with administration officials.

Quick Facts:

- The SEC charged Ian Balina in 2022 for allegedly promoting SPRK tokens without proper disclosure.

- Balina claims the SEC plans to dismiss the case, citing a shift in regulatory priorities.

- This move could indicate a more collaborative approach between the SEC and the cryptocurrency industry.