The U.S. Securities and Exchange Commission and crypto exchange Gemini have filed a joint motion seeking a 60-day stay in their ongoing legal battle over the now-defunct Gemini Earn program.

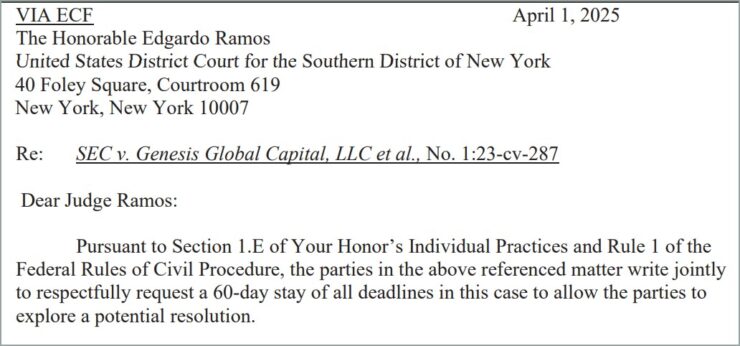

The request, submitted to the U.S. District Court for the Southern District of New York on April 1, asks the court to pause all current deadlines to allow both sides time to negotiate a potential resolution.

The SEC initially filed the lawsuit in January 2023, alleging that Gemini Earn—Gemini’s crypto lending platform—constituted an unregistered securities offering that raised billions in crypto deposits.

While the joint motion did not clarify whether the resolution being discussed would be a settlement, dismissal, or alternative agreement, both parties emphasized that the proposed pause would serve judicial efficiency and the public interest.

The motion follows a February update from Gemini co-founder Cameron Winklevoss, who stated that the SEC had ended a separate investigation into the company and would not pursue enforcement action if the court grants the stay, Gemini and the SEC plan to file a joint status update within 60 days to inform the court of their progress.

Genesis Fined $21M as SEC Softens Stance on Crypto Enforcement

Genesis Global Capital, the crypto lending firm at the center of the Gemini Earn controversy, agreed in February 2024 to pay a $21 million civil penalty to resolve its portion of the SEC’s lawsuit.

The penalty followed the platform’s collapse after it froze customer withdrawals in late 2022 and ultimately filed for bankruptcy in January 2023—at the time holding roughly $900 million in deposits from 340,000 Gemini Earn users.

The enforcement against Genesis came during heightened regulatory scrutiny under former SEC Chair Gary Gensler, who often likened the crypto industry to the “Wild West.” However, since President Donald Trump’s return to office, the SEC has notably scaled back its enforcement posture under acting Chair Mark Uyeda.

In recent months, the agency has dropped multiple high-profile cases, including lawsuits against Coinbase and Binance, and has withdrawn pending enforcement threats against Robinhood, Uniswap, and OpenSea.

The joint motion between the SEC and Gemini to pause litigation reflects a broader de-escalation of regulatory aggression across the digital asset sector.

Winklevoss Twins Reposition Gemini as IPO Rumors Resurface

As Gemini works to put its legal battles behind it, the company appears to be preparing for a broader corporate shift. Bloomberg reported earlier this year that Gemini is exploring the possibility of an initial public offering, with no formal timeline yet disclosed. The company recently appointed a new chief financial officer to help oversee the next phase of its financial strategy.

Meanwhile, Gemini’s co-founders, Cameron and Tyler Winklevoss, have remained politically active. Last year, they made a $2 million Bitcoin donation to support Donald Trump’s presidential campaign. However, the contribution was ultimately returned because it exceeded federal limits.

The joint motion to pause litigation between the SEC and Gemini underscores the evolving tone of crypto regulation in the United States. With Genesis already having settled and other high-profile enforcement actions recently withdrawn, the SEC appears increasingly open to negotiated outcomes rather than prolonged legal battles.

For Gemini, the development offers an opportunity to resolve a high-profile dispute while potentially paving the way for renewed strategic initiatives, including a possible IPO.

Quick Facts

- The SEC and Gemini have jointly requested a 60-day pause in their ongoing lawsuit over the Gemini Earn program.

- The SEC alleges Gemini Earn was an unregistered securities offering that raised billions in crypto assets.

- The motion follows news that the SEC dropped a separate investigation into Gemini in February.

- If approved, both parties will submit a joint status update within 60 days on the outcome of their resolution talks.