The U.S. Securities and Exchange Commission (SEC) has officially ended its investigation into Yuga Labs, the company behind the Bored Ape Yacht Club (BAYC) NFT collection, without pursuing enforcement action. This decision comes after two years of regulatory scrutiny, during which the SEC examined whether Yuga Labs’ NFT sales and ApeCoin (APE) token distribution violated federal securities laws.

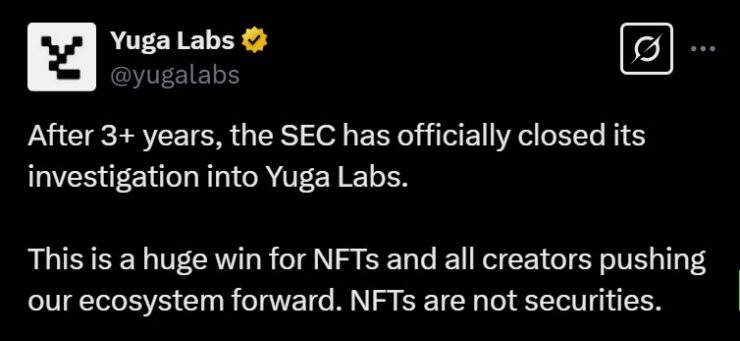

Yuga Labs celebrated the outcome, calling it a “huge win” for the NFT space and a positive signal for creators working to expand the digital asset ecosystem. In a public statement, the company reinforced its long-standing position:

“NFTs are not securities.”

Background of the SEC Investigation

The SEC’s decision marks a significant moment for the NFT industry, which has long faced uncertainty over how digital collectibles fit within traditional financial regulations. The probe into Yuga Labs began in 2022, at a time when the SEC was intensifying its crackdown on crypto-related projects. Regulators had raised concerns about NFTs offering specific utility or revenue-sharing models.

The SEC initiated its probe into Yuga Labs in October 2022 to assess whether the company’s NFT offerings and the distribution of ApeCoin (APE), a cryptocurrency associated with the BAYC ecosystem, violated federal securities laws. The investigation aimed to determine if these digital assets should be classified as securities under the Howey Test, a legal framework established by a 1946 Supreme Court case.

Market Reaction and the Bored Ape Yacht Club’s Declining Valuation

The closure of the investigation provided a short-term boost to Bored Ape NFT prices, with floor prices on OpenSea rising 3.8% on Monday, climbing from 13.39 ETH to 13.9 ETH. However, despite the uptick, Bored Apes have seen a sharp decline in value compared to their peak in the 2021-2022 bull run, when the floor price reached a staggering 153.7 ETH. According to CoinGecko data, BAYC has suffered a 91% drop from its all-time high, reflecting the broader downturn in NFT markets.

Once touted by celebrities and cultural influencers, Bored Apes have struggled to maintain momentum amid shifting market sentiment, reduced speculative hype, and a slowdown in NFT trading volumes. While the SEC’s decision removes a legal overhang, the long-term trajectory of NFT valuations and adoption will likely depend on broader crypto market cycles, institutional interest, and emerging real-world use cases.

Broader Regulatory Trends in the Crypto Industry

The conclusion of the Yuga Labs investigation aligns with a series of recent actions by the SEC, indicating a potential shift toward a more lenient stance on cryptocurrency regulation. In recent weeks, the SEC has closed investigations into several major crypto companies, including Robinhood, Gemini, Uniswap Labs, ConsenSys-owned MetaMask, and OpenSea. Additionally, the agency has reached settlements with Coinbase and is reportedly moving toward a resolution with TRON founder Justin Sun.

These developments suggest a broader regulatory trend toward providing clearer guidelines and reducing enforcement actions against crypto entities, potentially fostering a more supportive environment for the growth of the digital asset industry.

Quick Facts

- The SEC has officially closed its investigation into Yuga Labs without pursuing any enforcement action, determining that NFTs are not securities.

- This decision is considered a significant victory for NFT creators and may encourage further innovation and investment in the NFT space.

- The SEC has recently closed investigations into several major crypto companies, indicating a potential shift toward a more lenient stance on cryptocurrency regulation.

- Following the announcement, the floor price of Yuga Labs’ flagship Bored Ape collection saw a slight increase to 13.75 Ether (ETH), approximately $29,650, though it remains significantly lower than its peak in May 2022.