The U.S. Securities and Exchange Commission (SEC) has officially closed its investigation into OpenSea, bringing relief to the NFT sector and reinforcing the argument that NFTs should not be classified as securities.

Announced by OpenSea founder Devin Finzer on Feb. 22, the decision comes just hours after the SEC dismissed its lawsuit against Coinbase, marking a significant moment in the evolving relationship between U.S. regulators and digital assets.

“The SEC is closing its investigation into OpenSea. This is a win for everyone who is creating and building in our space,” Finzer wrote in an X post, signaling a victory for Web3 innovation.

The SEC’s investigation, which began in August 2024, centered on whether OpenSea facilitated the sale of unregistered securities, a claim that could have set a precedent for the entire NFT industry.

Industry Leaders Hail the Decision as a Major Win

The closure of the investigation has been widely celebrated within the crypto and NFT community.

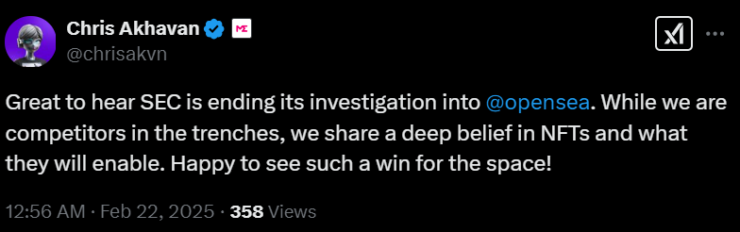

Chris Akhavan, chief business officer at NFT marketplace Magic Eden, noted that despite being a competitor, he sees this as a broader industry win.

“While we are competitors in the trenches, we share a deep belief in NFTs and what they will enable. Happy to see such a win for the space,” Akhavan posted on X.

Pseudonymous crypto commentator Beanie, who has over 223,800 followers, suggested that the decision could catalyze the next NFT bull market.

“OpenSea did a wonderful thing for the NFT industry by facilitating some regulatory clarity. I’m sure it has come at great cost as well. So we should all be thankful for that,” Beanie stated.

A Shift in SEC Strategy?

The timing of the SEC’s decision is significant. Just hours earlier, the agency agreed to drop its lawsuit against Coinbase, which had accused the exchange of operating as an unregistered securities broker.

These moves hint at a possible shift in regulatory approach, where the SEC may be retreating from its aggressive enforcement actions against digital asset firms, possibly due to growing legal challenges and industry pushback.

Had the SEC classified NFTs as securities, it could have imposed stricter compliance requirements on NFT platforms, drastically altering the industry’s trajectory. Finzer reiterated that such a ruling would have stifled innovation and harmed NFT creators.

What’s Next for OpenSea?

The closure of the investigation frees OpenSea to focus on its future, including the upcoming launch of its SEA token. Announced by the OpenSea Foundation on Feb. 13, the token is expected to be available in multiple jurisdictions, including the U.S., though details on its utility and distribution remain unclear.

However, OpenSea still faces challenges. The marketplace recently faced backlash over its airdrop reward system, which some users criticized for favoring wash trading over genuine community support. Following the backlash, OpenSea paused the program, signaling that user concerns remain a key issue.

Final Thoughts – A Turning Point for NFTs?

With OpenSea emerging unscathed and the SEC backing off high-profile enforcement cases, this moment could mark a turning point for the NFT industry.

The decision reinforces the argument that NFTs are not securities, offering a stronger foundation for legal clarity and institutional adoption.

While OpenSea moves forward, the broader question remains: Is the SEC shifting away from aggressive crypto regulation, or is this just a temporary retreat? The NFT market may have won this battle, but the regulatory war is far from over.