The US Securities and Exchange Commission is pivoting away from years of aggressive enforcement actions and embracing tokenization as a vital force for market innovation.

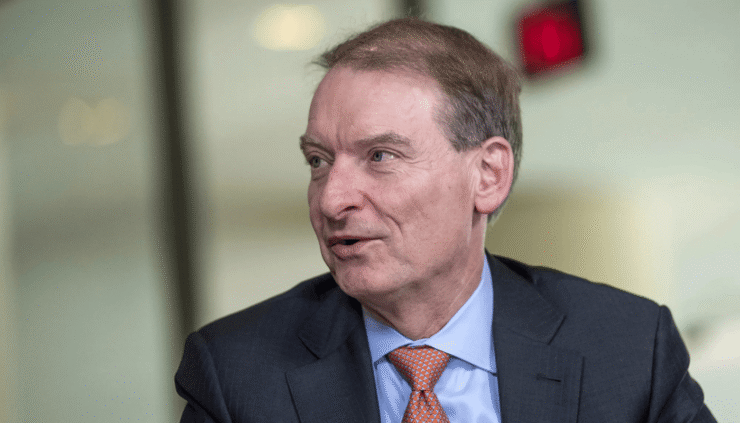

In a wide-ranging CNBC interview on Wednesday, newly appointed SEC Chair Paul Atkins said his agency is committed to fostering a transparent, predictable regulatory environment for digital assets.

“Tokenization is an innovation,” Atkins said.

“And we at the SEC should be focused on how to advance innovation in the marketplace.”

He criticized the approach of former Chair Gary Gensler, whose tenure was marked by a strategy of “regulation through enforcement” that many in the industry saw as adversarial and opaque.

“That day is over,” Atkins declared.

“My whole goal is to make things transparent from the regulatory aspect and give people a firm foundation upon which to innovate and come out with new products.”

Broker-dealer regulation veteran Mel Mattison called this week’s developments “the most game-changing moment of my entire career,” referencing Robinhood’s launch of tokenized US stocks for European users. Speaking on The Coinrock Show, he said;

“These are the things that big companies and rich people used to have,” Mattison said.

“Now, they’re going to be accessible for someone making $85,000 a year.”

Tokenization Gains Institutional Momentum

Since taking office in April, Atkins has earned praise for his pro-innovation stance. Nominated by President Trump on Inauguration Day, he has repeatedly stressed the importance of supporting the digital asset sector while balancing investor protection.

A recent Binance Research report noted that tokenization has become one of the primary catalysts for adoption of crypto and blockchain infrastructure in the United States.

The World Economic Forum echoed this sentiment, describing tokenization as a promising bridge between legacy finance and decentralized systems.

Data from RedStone shows the total value of tokenized real-world assets—excluding stablecoins—topped $24 billion in the first half of 2025. Much of that growth has come from tokenized US Treasurys and private credit markets, which have attracted institutional investors seeking more efficient ways to allocate capital.

Regulatory Actions Match Rhetoric

Atkins’ vision for a more collaborative regulatory approach is already reshaping policy.

In April, the SEC’s Division of Corporation Finance released new guidance clarifying how companies should disclose activities involving digital assets. The update offered issuers much-needed clarity on which tokens may qualify as securities.

The agency also broke new ground last week by approving the country’s first staking-based crypto ETF for Solana, issued by REX Shares and Osprey. The ETF, which launched on Wednesday, allows investors to gain exposure to Solana while earning staking rewards—a milestone many view as a signal of the SEC’s evolving posture.

Major financial institutions are moving quickly to capitalize on this more welcoming regulatory environment. According to Bloomberg, JPMorgan Chase is developing tokenized carbon credit products in collaboration with S&P Global Commodity Insights and other partners.

“Facilitating capital formation is core to the SEC’s mission,” Atkins said.

“And that includes supporting new technologies like tokenization that help businesses grow and create jobs.”

Quick Facts

- SEC Chair Paul Atkins declared an end to “regulation by enforcement.”

- Tokenized assets have surpassed $24B in value this year alone.

- The SEC approved the first Solana staking ETF in the US this week.

- JPMorgan Chase is exploring tokenized carbon credits as a new business line.