Michael Saylor’s Strategy is back in the headlines after scooping up nearly $531 million worth of Bitcoin last week, reinforcing its status as the world’s largest corporate holder of the asset.

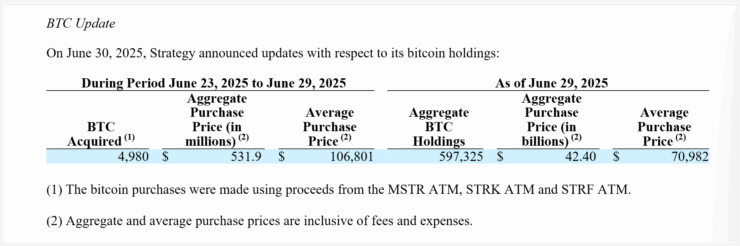

According to a Monday filing with the U.S. Securities and Exchange Commission, Strategy acquired 4,980 BTC at an average price of $106,801 per coin. The purchase was completed as Bitcoin rebounded from $101,000 to over $108,000 by week’s end, marking a notable shift in sentiment after recent market jitters.

This latest haul increases Strategy’s total Bitcoin reserves to 597,325 BTC. The company has now spent roughly $42.4 billion on its holdings, with an average acquisition price of just under $71,000 per Bitcoin.

Strategy has consistently used market dips as an opportunity to expand its treasury. Last week’s buy came on the heels of similar hints by Saylor on social media that another accumulation was imminent.

Year-to-Date Bitcoin Gains Edge Toward 86,000 BTC

With its recent purchase, Strategy has now added 85,871 BTC in 2025 alone, representing a value of nearly $9.5 billion. That figure is approaching the pace of 2024, when the company amassed 140,538 BTC across the year.

The firm’s Bitcoin yield rose slightly to 19.7%, inching toward Strategy’s stated goal of reaching a 25% yield by year-end 2025.

Meanwhile, on-chain analysts noted a related movement of 7,383 BTC — worth about $796 million — from Strategy’s treasury to three new wallets on Sunday. Blockchain analytics platform Lookonchain described the transfers as “likely for improved custody,” underscoring the scale of the company’s internal storage logistics as its holdings approach 600,000 BTC.

Saylor Reflects on Strategy’s Bold Bitcoin Pivot

Before confirming the latest acquisitions, Saylor took to X to revisit Strategy’s earliest days in Bitcoin, sharing a 2020 interview with RealVision’s Raoul Pal.

In that conversation, Saylor explained how he became convinced that Bitcoin was the ultimate long-term play.

“There’s a lot of traders in the market. They don’t understand the mindset of long,” Saylor said at the time, referencing the firm’s decision to go “irresponsibly long” on Bitcoin in August 2020.

Since then, Strategy has inspired dozens of other public companies to consider Bitcoin as a reserve asset, fueling what some analysts call a corporate arms race for digital scarcity.

As Strategy nears 600,000 BTC, many market watchers believe the firm’s relentless buying will continue to be one of the most significant forces shaping Bitcoin’s supply dynamics in the years ahead.

Quick Facts

- Strategy acquired 4,980 BTC last week for $531 million.

- The firm now holds 597,325 BTC bought for $42.4 billion total.

- Year-to-date Bitcoin gains stand at nearly 86,000 BTC.

- Saylor reaffirmed Strategy’s commitment to holding Bitcoin “long” as the core treasury strategy.