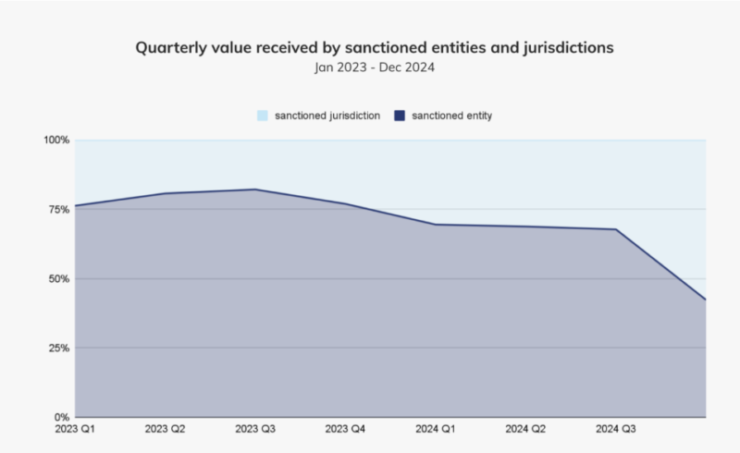

A new report from blockchain analytics firm Chainalysis has revealed a sharp rise in cryptocurrency activity among countries facing U.S. sanctions, with nearly $16 billion in digital assets funneled into these regions throughout 2024. This figure represents a staggering 39% of all illicit crypto transactions recorded last year.

The report singles out Iran as a primary contributor to the surge in illicit crypto activity. In 2024, Iranian exchanges experienced a 70% year-over-year increase in crypto outflows, totaling $4.2 billion. These spikes in outflows closely correlated with key geopolitical events, such as Iranian missile launches, and increasing public distrust in the government. Notably, Bitcoin accounted for a significant portion of these transactions, with its censorship-resistant and self-custodial nature making it an attractive option for users amid economic crises.

The Iranian government maintains tight control over its domestic crypto infrastructure, which became evident when authorities abruptly froze exchange withdrawals in December 2024. This measure aimed to curb capital flight as the Iranian rial hit historic lows, with inflation rates hovering around 40-50%. Despite these restrictions, many Iranians turned to decentralized assets like Bitcoin to preserve their wealth during the economic turmoil.

Global Trends: Cryptocurrencies in Sanctioned Jurisdictions

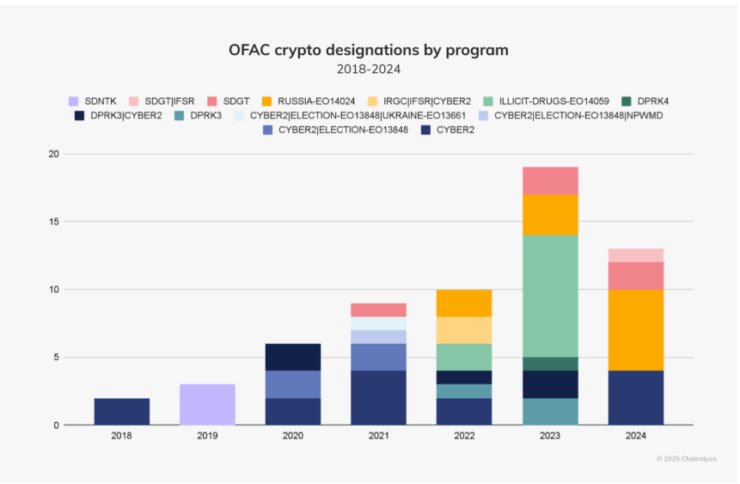

In 2024, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) intensified efforts to crack down on the use of cryptocurrencies by sanctioned nations, focusing heavily on disrupting Russia’s wartime economy, Iran’s growing crypto adoption, and illicit activities linked to cybercrime and organized crime networks. As Western sanctions continue to isolate them, both countries have been actively exploring alternative payment infrastructures to maintain international trade. In 2024, both nations expanded efforts through BRICS partnerships, exploring stablecoin-based trade settlements as a way to bypass U.S.-dominated financial networks.

Russia, in particular, made a significant policy shift by legalizing crypto mining and allowing the use of cryptocurrencies for international payments — a move aimed at bolstering its economy amid tightening sanctions. Meanwhile, Iran has focused on strengthening its crypto exchanges and increasing its Bitcoin mining operations to maintain liquidity and support its heavily sanctioned economy.

Despite OFAC’s aggressive clampdown, Chainalysis highlights the persistent challenge posed by no-KYC (Know Your Customer) crypto exchanges, particularly those operating in Russian-speaking regions. Many of these exchanges have managed to evade sanctions by rebranding under new names and domains, allowing them to continue facilitating illicit transactions.

These unregulated platforms provide an avenue for sanctioned individuals and entities to launder money, finance illicit activities, and engage in cross-border transactions without oversight, undermining global sanctions regimes.

Cryptocurrency Mixers: Tools for Sanction Evasion

The report also sheds light on the role of cryptocurrency mixing services, such as Tornado Cash, in obfuscating transaction trails. In 2024, over 24% of Tornado Cash’s total inflows were linked to stolen funds, indicating its use in laundering illicit assets and evading sanctions.

These mixers complicate efforts by regulatory bodies to trace and control illicit financial flows, presenting challenges in the enforcement of international sanctions.

While Tornado Cash has been frequently spotlighted for this role in laundering illicit crypto proceeds, it’s crucial to acknowledge its legitimate use cases — most notably highlighted when Ethereum co-founder Vitalik Buterin used the privacy mixer for an anonymous donation to Ukraine during the early days of Russia’s 2022 invasion.

Quick Facts:

- Sanctioned entities, particularly in Iran and Russia, accounted for 39% of illicit cryptocurrency activity in 2024.

- Iranian exchanges experienced a 70% increase in crypto outflows, reaching $4.2 billion, as the nation sought alternatives to traditional financial systems.

- Over 24% of Tornado Cash’s inflows in 2024 were tied to stolen funds, highlighting its role in laundering illicit assets.