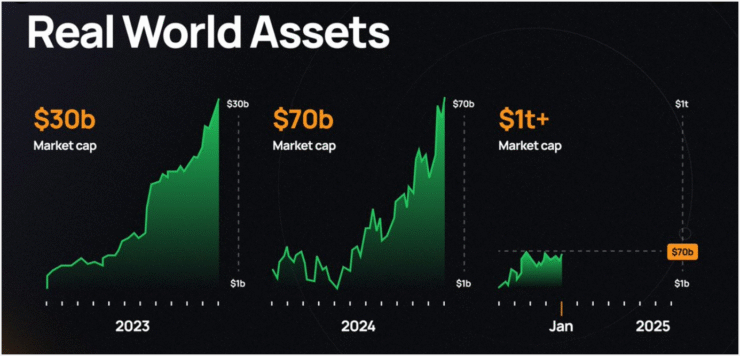

The real-world asset (RWA) tokenization market has surged by more than 260% in the first half of 2025, climbing from $8.6 billion in January to over $23 billion, according to a new Binance Research report shared with Cointelegraph.

This explosive growth aligns with increasing regulatory clarity in the U.S., which is driving greater institutional trust in blockchain-based financial infrastructure. RWA tokenization—the process of issuing digital representations of real-world instruments like credit or tangible assets on public ledgers—is rapidly emerging as one of the most promising applications of crypto technology beyond speculation.

Private credit currently leads the RWA sector, making up 58% of the market, followed by tokenized U.S. Treasury securities at 34%—a signal that even conservative financial instruments are gaining traction on-chain.

“As regulatory frameworks become clearer, the sector is poised for continued growth and increased participation from major industry players,” the report stated.

With momentum building and compliance standards taking shape, RWA tokenization is fast becoming a foundational component of digital finance’s next chapter.

Regulatory Gaps Persist, But Investor Confidence Grows

Despite lacking a bespoke legal framework, RWA tokens are steadily gaining ground in the U.S. under broader crypto regulations. The SEC currently classifies RWAs as securities, yet institutional interest continues to grow.

Recent regulatory developments have indirectly supported the sector. On May 29, the SEC released updated guidance on crypto staking—a move many see as a sign of regulatory maturity. Alison Mangiero, head of staking policy at the Crypto Council for Innovation, called the update “a step toward more sensible regulation,” suggesting a positive ripple effect across crypto verticals like RWAs.

More targeted legislation could be on the horizon. Lawmakers are preparing for a Senate vote on the GENIUS Act, a bill designed to define the legal landscape for stablecoin issuance and collateralization. If passed, it could lay down important groundwork for broader tokenized asset compliance.

On the investor side, macroeconomic trends are also shaping the shift. As Bitcoin trades in a narrow range, more capital is flowing into RWAs as a yield-generating hedge, highlighting a rising preference for assets that blend crypto infrastructure with traditional finance stability.

Bitcoin Institutional Adoption Spurs RWA Expansion

A parallel trend supporting the RWA boom is the growing use of Bitcoin by institutions. More companies are adding Bitcoin to their corporate treasuries, a move that signals increasing long-term adoption and trust in digital assets.

According to BitcoinTreasuries.NET, at least 124 publicly traded companies now report Bitcoin holdings on their balance sheets—a number that continues to grow. This mirrors the corporate behavior last seen in 2020, when firms like MicroStrategy and Tesla made high-profile BTC purchases.

Today’s environment, however, offers even stronger tailwinds. The presence of regulated spot Bitcoin ETFs, improving legal clarity, and persistent inflation concerns are all contributing to a more favorable landscape for both Bitcoin and adjacent sectors like RWAs.

Quick Facts

- RWA token market surged 260% in 2025, now at $23B.

- Private credit and U.S. Treasuries dominate tokenized asset volume.

- SEC updates and the GENIUS Act drive legal clarity.

- Bitcoin’s institutional adoption supports broader token demand.

- At least 124 public firms now hold BTC as a treasury asset.