Robinhood has agreed to pay $29.75 million to settle multiple regulatory probes from the Financial Industry Regulatory Authority (FINRA), marking yet another legal challenge for the online trading platform.

The settlement includes a $26 million civil fine and $3.75 million in restitution to customers, stemming from allegations that Robinhood failed to properly supervise transactions, prevent manipulative trading, and enforce Anti-Money Laundering (AML) policies.

This latest penalty underscores the ongoing regulatory pressure on fintech trading platforms, raising concerns about stricter enforcement actions in the future.

According to FINRA’s findings, Robinhood failed to properly oversee its clearing system, especially during the meme stock frenzy between March 2020 and January 2021.

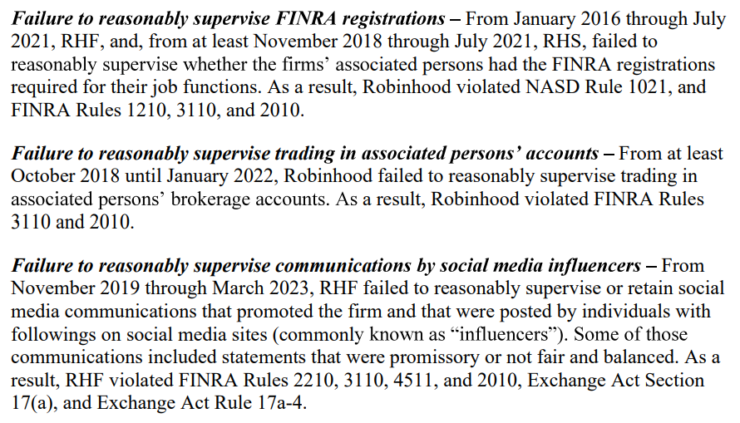

Key violations include:

- Failure to detect and investigate manipulative trades

- Allowing suspicious money transfers to go unreported

- Negligence in preventing third-party account takeovers

- Opening thousands of accounts without properly verifying customer identities

Robinhood was also accused of misleading investors through paid social media promotions, failing to retain records of influencer communications that were “promissory, unbalanced, or misleading.”

The $3.75 million restitution penalty relates to Robinhood’s practice of “collaring” market orders, converting them into limit orders without properly informing customers.

Despite agreeing to the settlement, Robinhood did not admit or deny the charges.

Regulatory Woes Continue for Robinhood

This settlement comes just two months after Robinhood reached a $45 million agreement with the U.S. Securities and Exchange Commission (SEC).

That case involved violations of over 10 securities laws, including failure to preserve electronic customer communications between 2020 and 2021.

While Robinhood admitted to some of the SEC’s findings in that case, the company has repeatedly faced scrutiny over how it handles compliance, trading practices, and customer protections.

Despite Legal Battles, Robinhood Posts Record Profits

Even amid regulatory troubles, Robinhood’s financials paint a different picture. The company reported a record $916 million net income in Q4 2024, with total revenue exceeding $1 billion.

Crypto trading played a massive role, accounting for $358 million of the firm’s $672 million transaction-based revenues—a 200% year-over-year increase. Meanwhile, crypto trading volumes skyrocketed 450% year-over-year to $71 billion.

This explosive growth suggests that regulatory fines have done little to slow down Robinhood’s expansion in the crypto sector.

Robinhood’s settlement highlights a broader regulatory shift in the U.S., where trading platforms are facing greater scrutiny for compliance lapses.

With increasing oversight from FINRA, the SEC, and other agencies, fintech firms will likely face:

- Stricter AML and KYC enforcement

- More oversight of clearing and order execution practices

- Heightened accountability for misleading promotions and social media advertising

As regulatory watchdogs tighten their grip, other trading platforms may be next in line for penalties, forcing firms to improve compliance or risk multimillion-dollar fines.

The Bottom Line

Despite facing back-to-back regulatory settlements, Robinhood remains a dominant force in the crypto and retail trading markets.

However, future regulatory actions could prove more costly, especially as agencies increase scrutiny on fintech platforms.

For now, Robinhood’s ability to balance legal challenges with record-setting profits will determine whether it can maintain its rapid growth or if it will face even harsher penalties in the future.