Robert Kiyosaki, the acclaimed author of “Rich Dad Poor Dad,” has once again voiced his concerns about the U.S. financial system, positioning Bitcoin as a pivotal asset in the face of potential economic instability. Known for his candid critiques and forward-thinking investment advice, Kiyosaki’s recent statements have ignited discussions among investors and financial analysts alike.

In late February 2025, Bitcoin experienced a significant price correction, dropping to $85,000—a 22% decline from its January peak of $109,000. While such volatility might deter some investors, Kiyosaki perceives it differently. He took to X to express his bullish outlook, stating,

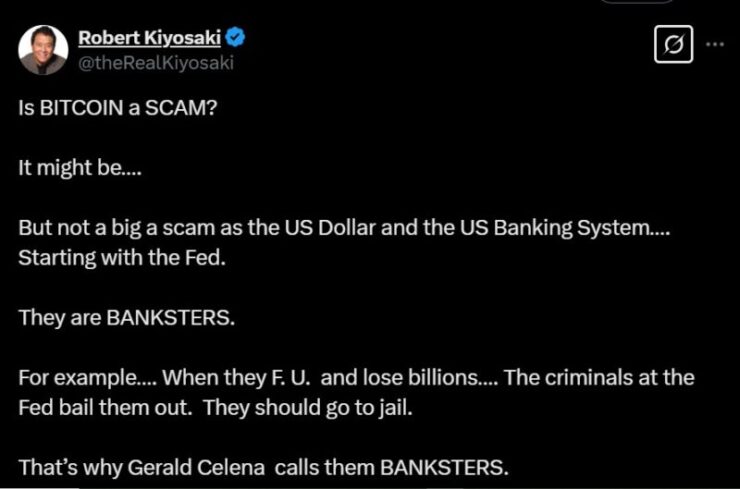

“Is BITCOIN a SCAM? It might be…. But not a big a scam as the US Dollar and the US Banking System…. Starting with the Fed.

They are BANKSTERS.”

This perspective aligns with Kiyosaki’s investment philosophy, which emphasizes acquiring assets during market downturns. He argues that the inherent value of Bitcoin remains unaffected by short-term price fluctuations, suggesting that current dips present favorable entry points for long-term investors.

Critique of the U.S. Financial System

Beyond his views on Bitcoin, Kiyosaki has been vocal about systemic issues within the U.S. financial infrastructure. He has labeled the U.S. dollar and the broader banking system as “scams,” criticizing the Federal Reserve’s monetary policies and the practice of bailing out financial institutions during crises. In his assertions, The problem is not BITCOIN. The problem is the Monetary System and the criminal bankers.

Kiyosaki’s concerns extend to the escalating national debt, which he estimates exceeds $230 trillion when accounting for unfunded liabilities such as Social Security and Medicare. He warns that reliance on foreign nations to purchase U.S. bonds could lead to heightened inflation and a potential collapse of the dollar’s value.

Despite Bitcoin’s recent price volatility, Kiyosaki maintains that the cryptocurrency embodies “money with integrity.” He suggests that Bitcoin’s decentralized nature and limited supply make it a trustworthy store of value, especially when compared to fiat currencies susceptible to inflationary pressures due to excessive money printing.

Kiyosaki’s optimism about Bitcoin’s future is underscored by his ambitious price forecasts. He has predicted that Bitcoin could reach $350,000 by 2025, attributing this projection to the pro-Bitcoin stance of the current U.S. administration. He also referenced artificial intelligence models suggesting Bitcoin’s value could soar to $500,000 by 2025.

Skepticism Toward Bitcoin ETFs

Kiyosaki has expressed reservations about Bitcoin Exchange-Traded Funds (ETFs), referring to them as “bankster’s money.” He cautions investors to prioritize holding actual Bitcoin over ETF representations, suggesting that ETFs might not offer the same benefits as direct ownership of the cryptocurrency.

“Please protect yourself from the BANKSTERS. Buy real gold, silver, and Bitcoin.

No gold, silver or Bitcoin ETFS…. Which are bankster’s money,” he stated

Kiyosaki’s recent statements are consistent with his long-standing views on financial education and investment strategy. Since the publication of “Rich Dad Poor Dad” in 1997, he has advocated for financial literacy and the importance of investing in assets like real estate, gold, silver, and more recently, Bitcoin.

His critiques of the Federal Reserve’s policies and warnings about potential economic downturns have been recurring themes in his commentary over the years.

Quick Facts:

- Robert Kiyosaki remains a strong advocate for Bitcoin, calling it “money with integrity” and a hedge against a failing U.S. financial system.

- Kiyosaki warns that America is “bankrupt,” citing $230 trillion in real debt, including unfunded liabilities like Social Security and Medicare.

- Skepticism on Bitcoin ETFs: Kiyosaki cautions investors against Bitcoin ETFs, referring to them as “bankster’s money” and urging people to own real Bitcoin instead.

- Amid Bitcoin’s recent correction below $79,000, Kiyosaki declared, “Bitcoin is on SALE. I AM BUYING.”, reinforcing his long-term bullish stance.