Bitcoin’s recent price recovery has sparked optimism across the crypto market, with the flagship cryptocurrency rebounding from the broader bearish trend that dominated Q1. However, mounting inflation risks could throw cold water on this momentum, leaving investors questioning whether the rally is sustainable or simply a temporary reprieve.

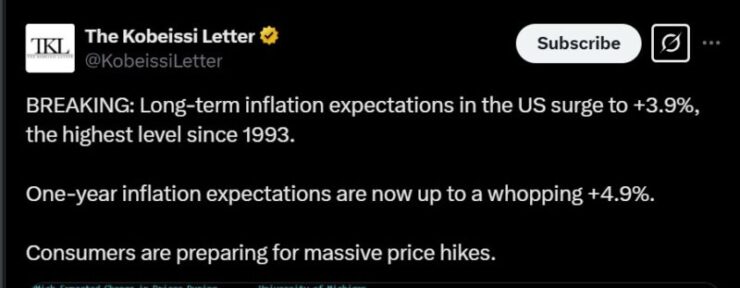

While Bitcoin and key altcoins have shown signs of reversing their Q1 losses, the macroeconomic landscape paints a more complex picture. Recent data reveals that long-term U.S. inflation expectations have surged to 3.9%, marking the highest levels since 1993. Additionally, one-year inflation forecasts are hovering around 4.9%, signaling sticky inflationary pressures in the months ahead.

Rising inflation introduces a significant hurdle for Bitcoin’s bullish prospects. Historically, periods of elevated inflation have coincided with tighter monetary policy, as central banks like the Federal Reserve typically respond by raising interest rates to combat price surges. This, in turn, reduces overall liquidity in the financial system—a key ingredient for sustaining risk-on assets such as cryptocurrencies.

Analysts caution that as inflation persists, investor sentiment is likely to shift towards safer, more liquid assets like cash and bonds, potentially triggering capital outflows from the crypto market. This dynamic played out during previous bull cycles, where aggressive rate hikes curtailed Bitcoin’s upward trajectory.

Technical indicators add weight to these concerns. Bitcoin recently slipped below its critical 200-day moving average, a bearish signal suggesting that the cryptocurrency may face stronger resistance in climbing higher. Some market observers suggest that if inflationary pressures continue to mount, Bitcoin could struggle to maintain levels above $80,000, with a potential bottom forming closer to $60,000.

These levels are being closely monitored, as a break below key support zones could reignite bearish sentiment and lead to further corrections in the broader crypto market.

Is Bitcoin Really an Inflation Hedge?

For years, Bitcoin has been heralded as “digital gold”—a decentralized, finite asset often touted as an effective hedge against inflation. Yet, recent market behavior suggests that Bitcoin still struggles to fully live up to that reputation, especially when compared to traditional safe-haven assets like gold.

Amid mounting recession fears and heightened volatility across global stock markets, gold prices have surged, reaffirming its historic status as a reliable store of value. In contrast, Bitcoin’s performance has mirrored the broader equities market, notably maintaining a significant correlation with the S&P 500. This correlation has raised questions about whether Bitcoin can truly act as a hedge in times of economic stress.

Why Bitcoin Isn’t Yet a Safe Haven

Unlike gold, Bitcoin is still predominantly categorized as a risk-on asset, meaning it thrives in periods of market optimism and ample liquidity but falters when macroeconomic uncertainty intensifies. Its relatively short history, coupled with regulatory ambiguity and high price volatility, has so far kept it from being widely accepted as a defensive asset during downturns.

That said, analysts suggest there are pathways through which Bitcoin’s profile could evolve. Greater institutional adoption and investment by governments could play a pivotal role in shifting Bitcoin’s perception. Furthermore, comprehensive regulatory clarity and global acceptance could encourage more conservative investors to treat Bitcoin as a hedge, potentially reducing its sensitivity to risk-off environments.

While Bitcoin currently lacks the stability of gold during inflationary periods, it has demonstrated strong long-term outperformance. Historically, Bitcoin’s price appreciation outpaces that of gold, making it a more attractive asset for investors willing to stomach short-term volatility for potentially higher returns.

Quick Facts:

- U.S. long-term inflation expectations have risen to 3.9%, the highest since 1993, with one-year expectations at 4.9%.

- Despite being dubbed “digital gold,” Bitcoin’s recent performance has closely tracked traditional stock indices, challenging its role as an inflation hedge.

- Major indices like the Nasdaq Composite have experienced significant declines, reflecting broader economic uncertainties.