Ripple’s Chief Technology Officer, David Schwartz, has stirred debate within the cryptocurrency community by asserting that the company should prioritize its own interests when selling XRP, rather than acting in favor of token holders. His comments come at a time when investor scrutiny over Ripple’s XRP holdings is intensifying, raising questions about corporate responsibility, market impact, and the long-term strategy for XRP.

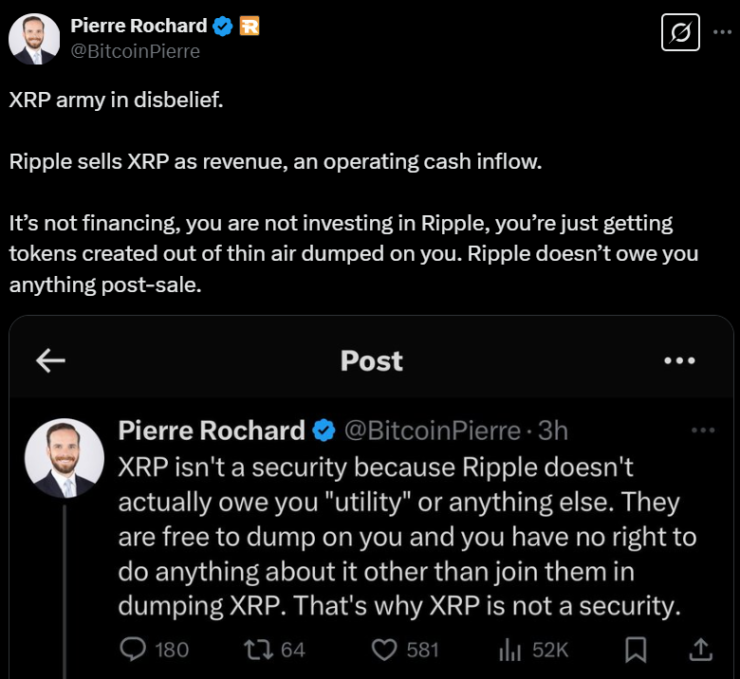

The controversy began when Pierre Rochard, Vice President of Research at Riot Platforms, took to X on March 5 to issue a stark warning to XRP holders:

“XRP isn’t a security because Ripple doesn’t actually owe you ‘utility’ or anything else. They are free to dump on you, and you have no right to do anything about it other than join them in dumping XRP.”

Schwartz not only agreed but doubled down on the sentiment, responding:

“100% correct. IMO, Ripple can, will, and should act in its own interest. You should not expect Ripple to act in your interest to the detriment of its own interest or those of its shareholders.”

This admission highlights the fundamental difference between XRP holders and Ripple shareholders, reinforcing the argument that XRP’s price movements should not be directly tied to Ripple’s corporate decisions—a key point in past legal battles over XRP’s classification as a security.

A Dormant $7 Billion XRP Wallet Raises New Questions

Investor anxiety was further fueled just two days earlier when blockchain investigator ZachXBT uncovered a dormant XRP wallet containing over $7 billion worth of tokens, suspected to belong to Ripple co-founder Chris Larsen.

“XRP addresses activated by Chris Larsen still hold 2.7B+ XRP ($7.18B), and these addresses tied to him transferred $109M+ worth of XRP to exchanges in January 2025,” ZachXBT revealed on March 3.

While many of these addresses have been inactive for over six years, speculation remains over whether Larsen still has access to these holdings. If these tokens were to re-enter circulation, they could significantly impact XRP’s market dynamics.

XRP’s Brief Rally and Market Realities

The discussion over Ripple’s XRP holdings comes amid an eventful period for the token. On March 3, XRP saw a brief price rally, outperforming much of the crypto market alongside Cardano (ADA) and Solana (SOL). The surge followed an announcement that the U.S. government’s Digital Asset Working Group had proposed including these three altcoins in a new national crypto reserve alongside Bitcoin (BTC).

Despite the initial excitement, XRP failed to sustain its upward momentum, peaking at $2.99 before falling back to $2.50. Analysts have warned that the rally may have been premature, as the proposed U.S. crypto reserve still requires congressional approval a process that could take months or even years.

What This Means for XRP’s Future

Schwartz’s remarks reinforce a clear reality for XRP investors: Ripple operates as a for-profit entity with obligations to its shareholders, not to individual XRP holders. While Ripple’s success may align with XRP adoption in some areas, its corporate actions will always prioritize financial stability and strategic growth.

The bigger question now is: How will Ripple’s continued XRP sales impact long-term market confidence? With dormant wallets resurfacing, regulatory uncertainty, and shifting investor sentiment, the future of XRP remains a complex and evolving story.

For investors, the key takeaway is understanding the true relationship between Ripple and XRP and making informed decisions based on that reality, rather than speculation.