Ripple Labs is expanding its reach beyond payments and remittances, as it has officially filed a new trademark application hinting at a forthcoming crypto custody and wallet service.

The move indicates Ripple’s intention to tap into the growing demand for secure digital asset storage solutions, further solidifying its position as a key financial service leader in the cryptocurrency ecosystem.

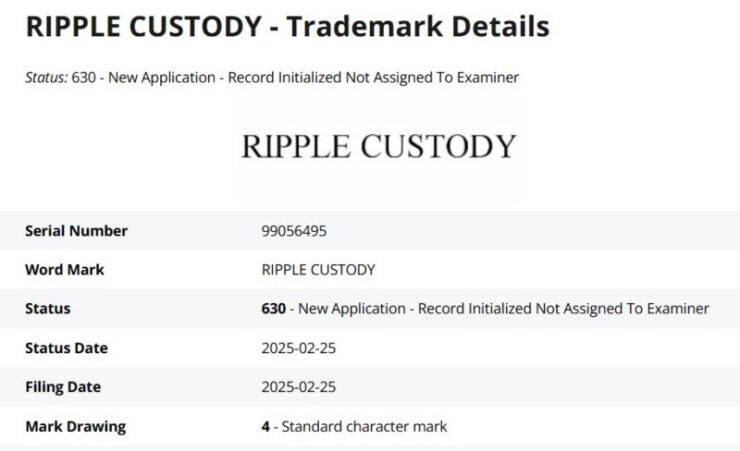

On March 11, Ripple Labs submitted a trademark application via Justia Trademarks for a service under the brand name “Ripple Custody”. According to the details of the filing, the trademark covers a range of financial services, specifically highlighting: Electronic financial services for receiving and disbursing digital assets, Custody and storage of digital currencies; as well as Cryptocurrency wallets and virtual currency management

While Ripple has not publicly confirmed specific product launch timelines, the language of the trademark filing suggests the company is preparing to offer a comprehensive custodial solution, potentially aimed at institutional clients seeking secure storage for cryptocurrencies.

This strategic filing reflects Ripple’s continued effort to diversify its product offerings beyond its core XRP-based cross-border payment solutions, positioning itself in key digital asset market infrastructure areas.

Crypto Custody Services: A Growing Market Trend

Ripple’s move comes amid a broader industry push toward crypto custody solutions, particularly catering to institutional investors. As regulatory clarity around digital assets slowly improves under the Donald Trump-led regime, demand for compliant, secure, and user-friendly custodial services has surged.

Major players such as Coinbase Custody, BitGo, and Anchorage Digital have all made significant strides in offering institutional-grade crypto storage services.

The emergence of traditional financial giants, including Fidelity Digital Assets and BNY Mellon, into the custody space has further signaled the market’s potential. These institutions have recognized the importance of safeguarding digital assets in a regulatory-compliant manner, driving competition and innovation within the sector.

Ripple’s trademark filing suggests it aims to carve out its share of this growing market, leveraging its established reputation and network to attract both crypto-native institutions and traditional finance entities.

Ripple’s Broader Strategy Amid Ongoing Legal Battle

The timing of Ripple’s trademark application is particularly noteworthy, given the company’s ongoing legal battle with the U.S. Securities and Exchange Commission (SEC). Despite regulatory hurdles, Ripple has demonstrated resilience, continuing to expand its business lines and global footprint.

Its recent developments, including partnerships with central banks exploring central bank digital currencies (CBDCs) and the ongoing push into tokenization solutions, align with Ripple’s apparent long-term vision of becoming a central figure in the infrastructure supporting the digital economy.

Ripple’s latest trademark filing is just one piece of a broader strategy to solidify its presence in key global markets. In a significant development announced last week, Ripple revealed that it has obtained full regulatory approval from the Dubai Financial Services Authority (DFSA), allowing it to offer cross-border crypto payment services within the United Arab Emirates (UAE).

The license grants Ripple the ability to operate within the Dubai International Financial Centre (DIFC)—one of the UAE’s leading financial hubs renowned for its fintech-friendly regulatory environment and independent tax policies. The DIFC’s progressive stance on blockchain adoption makes it an attractive destination for crypto companies seeking regulatory clarity and operational flexibility.

Quick Facts:

- Ripple has filed a trademark application for a new crypto custody and wallet service under the name “Ripple Custody.”

- The filing covers digital asset storage, crypto wallets, and virtual currency management services.

- Major financial and crypto firms are increasingly focusing on providing secure custody services to meet institutional demand.