Ripple’s long-running legal clash with the U.S. Securities and Exchange Commission appears to be drawing to a close, with the company confirming it will not pursue a cross-appeal against the agency. This decision marks a likely final chapter in one of the most closely watched enforcement cases in crypto history.

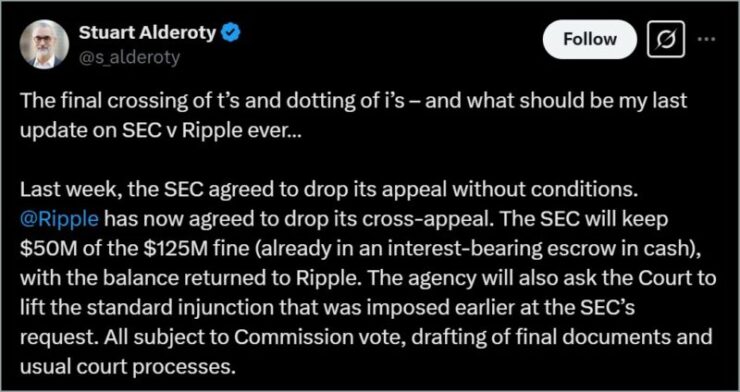

The news was confirmed by Ripple’s Chief Legal Officer, Stuart Alderoty, in a post on X, where he referred to it as potentially his “last update” on the case. The announcement comes just days after Ripple CEO Brad Garlinghouse revealed that the SEC had dropped its own appeal related to a key part of the court’s earlier decision.

A cross-appeal would have allowed Ripple to challenge other aspects of the case that may not have gone in its favor, but the firm has opted for closure instead of prolonged litigation.

Under the final settlement terms, the SEC will retain $50 million from the originally imposed $125 million fine; an amount that has been held in an interest-bearing escrow account. The remaining $75 million will be refunded to Ripple. Alderoty also noted that the SEC plans to ask the court to remove the standard injunction it had previously requested, further easing the restrictions on Ripple’s operations.

With this move, Ripple signals a clean break from the legal entanglements that have overshadowed its growth strategy for over four years, as it now looks ahead to scaling its cross-border payment services and on-chain solutions globally.

Details of the Court Ruling

This agreement follows the SEC’s recent decision to abandon its appeal of a 2023 ruling that sided with Ripple on the legality of its retail XRP sales.That ruling, issued by U.S. District Judge Analisa Torres, established a critical precedent: Ripple’s programmatic sales of XRP to retail buyers via exchanges did not constitute securities transactions under U.S. law. The court found these sales occurred through blind bid/ask processes, removing the expectation of profits tied directly to Ripple’s efforts—an essential component of the Howey Test.

However, the court did determine that Ripple’s direct sales of XRP to institutional investors did violate securities laws. As a result, the company was ordered to pay a $125 million fine; far less than the nearly $2 billion in penalties and interest initially sought by the SEC.

SEC’s Ripple Settlement Reflects Bigger Shift in Crypto Policy

The Ripple settlement highlights a sweeping shift in the U.S. Securities and Exchange Commission’s regulatory posture toward the crypto industry since the start of President Donald Trump’s second term. With former Chair Gary Gensler stepping down in January, the agency has pivoted away from its previously aggressive stance, marking the end of a chapter defined by contentious enforcement actions and sweeping claims that most digital assets were unregistered securities.

Under Gensler, the SEC took legal action against major players in the space, including Coinbase, Binance, Ripple, and Kraken, urging them to register with the agency and often accusing them of securities law violations. However, the Ripple case—ironically one of the most high-profile in the crypto world—predated Gensler’s appointment and has now become a symbol of the agency’s changing direction.

Now led by Acting Chair Mark Uyeda, the SEC has begun to soften its regulatory tone, forming a dedicated crypto task force under Commissioner Hester Peirce, rescinding controversial accounting guidance, and revisiting rules impacting digital asset classification and mining practices.

Perhaps most notably, the agency has dropped several lawsuits and investigations in recent weeks—including against Coinbase, OpenSea, Immutable, and ConsenSys—indicating a broader strategic reset. With pro-crypto figure Paul Atkins nominated to take over as SEC Chair, this trend suggests a clearer, more collaborative framework for crypto regulation may finally be on the horizon.

Quick Facts:

- Ripple has opted not to file a cross-appeal, signaling an end to its four-year legal battle with the SEC.

- As part of the settlement, the SEC will retain $50 million from the original $125 million fine; the rest will be returned to Ripple.

- The SEC will request the court to lift the earlier-imposed injunction, further easing restrictions on Ripple.

- This resolution reflects the SEC’s broader regulatory shift under the Trump administration’s pro-crypto stance.