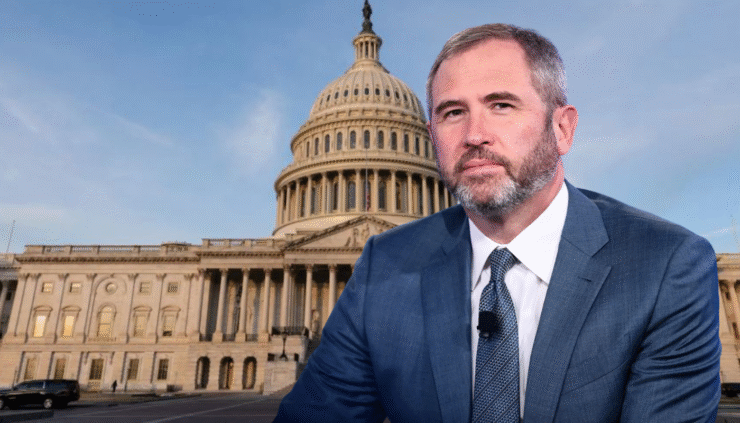

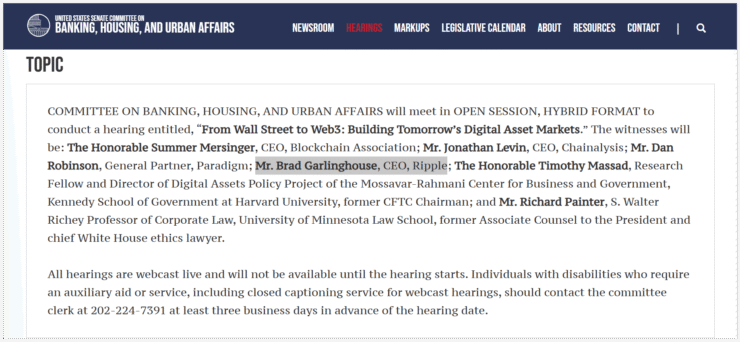

As the U.S. gears up for sweeping changes to digital asset policy, the Senate Banking Committee is set to host a pivotal hearing featuring top voices in crypto and financial regulation. Scheduled for Wednesday, the session will include testimony from Ripple CEO Brad Garlinghouse, Blockchain Association CEO and former CFTC member Summer Mersinger, former CFTC Chair Timothy Massad, and Chainalysis CEO Jonathan Levin, among others.

This hearing comes just as lawmakers prepare to advance long-awaited legislation on stablecoins and crypto market structure. It also signals a shift toward greater engagement by the Senate, which has so far remained cautious in shaping regulatory guardrails for the growing digital asset economy.

In her prepared testimony, Mersinger urges Congress to act decisively.

“The choice before us is not whether to regulate this industry, but how,” she wrote.

“We can either continue down a path of uncertainty that cedes our leadership and exports this innovation to other countries, or we can enact sensible, bipartisan legislation that cements our position as the premier destination for financial innovation for decades to come.”

House GOP Launches “Crypto Week” to Advance Three Key Bills

Meanwhile, momentum is building in the House of Representatives, where Republican leadership has declared this week “Crypto Week.” Starting Monday, the House is expected to begin deliberations on three separate digital asset-related bills.

Among them is the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins), which passed the Senate in June and sets regulatory standards for stablecoin issuance. The House will also take up the CLARITY Act, which aims to provide a comprehensive framework for digital asset market structure—offering regulatory guidance for exchanges, token classification, and investor protections.

In a more politically charged move, the House will debate a bill designed to block the Federal Reserve from launching a central bank digital currency (CBDC), a concept that has become increasingly controversial among conservative lawmakers. The measure reflects broader concerns about financial surveillance and digital privacy, which some Republicans argue a CBDC could exacerbate.

The coordinated push by House Republicans signals that Congress is finally ready to move past discussion and begin shaping actual policy. But the path to bipartisan consensus—particularly in the Senate—remains uncertain.

Political Ties and Ethical Questions Shadow Legislative Push

While the hearing promises to be a milestone for regulatory clarity, it may also open the door to uncomfortable political scrutiny. Ripple’s Garlinghouse, whose company has contributed millions to political campaigns—including $5 million in XRP to Trump’s inaugural fund—will be making one of his first direct appearances before Congress.

The blockchain firm has been increasingly active in Beltway circles, and Garlinghouse’s presence at a March White House crypto summit marked a turning point in Ripple’s public policy strategy.

Adding to the complexity is the testimony of Richard Painter, a former White House ethics lawyer, who is expected to address concerns over potential conflicts of interest related to President Trump’s crypto affiliations. These include his memecoin issued in January, and connections between the Trump family and World Liberty Financial—a crypto firm behind the USD1 stablecoin.

Democratic lawmakers had previously raised alarms over these entanglements during the Senate’s initial vote on the GENIUS Act. Though the bill ultimately passed with bipartisan backing, some senators signaled that closer scrutiny of Trump-linked ventures could shape their future votes on crypto legislation.

Quick Facts

- Ripple CEO, Chainalysis CEO, and ex-CFTC chairs to testify before the Senate this week.

- House GOP launches “Crypto Week” to debate three major bills, including the GENIUS Act and CLARITY Act.

- Ethical concerns loom over Trump’s personal crypto ties, including a memecoin and a stablecoin project.

- Senate aims to pass a comprehensive crypto market structure bill by October.