Tether CEO Paolo Ardoino has stirred discussion in the crypto community by suggesting that quantum computing could eventually crack lost Bitcoin wallets, bringing dormant BTC back into circulation. However, he also noted that this reality remains far off and does not pose an immediate threat to Bitcoin’s cryptographic security.

Quantum Computing Won’t Break Bitcoin Anytime Soon

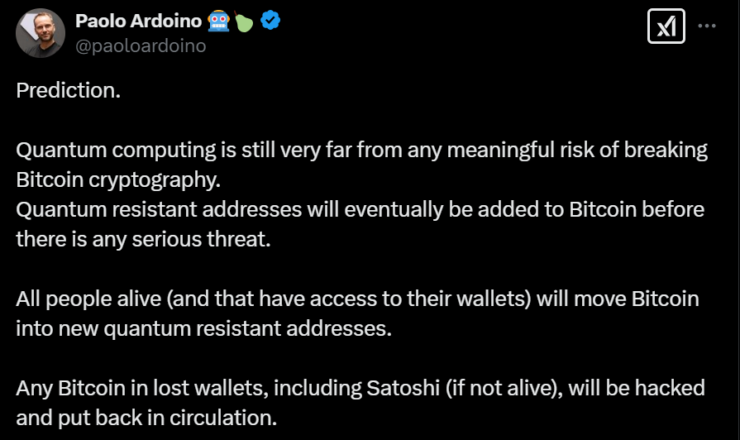

In a February 8 post on X, Ardoino speculated that quantum advancements could eventually breach inactive wallets, including those belonging to Bitcoin’s mysterious creator, Satoshi Nakamoto.

“Any Bitcoin in lost wallets, including Satoshi (if not alive), will be hacked and put back in circulation,” he stated.

However, he reassured the community that quantum technology is still years away from posing a serious risk to Bitcoin’s cryptographic security.

Quantum computers operate on atomic-level phenomena, allowing them to solve complex problems exponentially faster than traditional computers. While the technology is still in its early stages, experts worry that as it advances, it could undermine Bitcoin’s security model, particularly affecting lost or inactive wallets.

Why Lost Bitcoin Wallets Are Most at Risk

One of the main concerns with quantum computing is its potential to crack the cryptographic keys securing Bitcoin wallets. While active wallets are expected to adopt quantum-resistant upgrades as they become available, lost wallets—those with no owner to protect or move the funds—remain vulnerable.

Ardoino believes that when quantum computing becomes advanced enough, Bitcoin holders who still have access to their wallets will be able to transfer their funds to quantum-resistant addresses, shielding them from potential attacks.

Could Satoshi’s Bitcoin Flood the Market?

The idea that Satoshi Nakamoto’s estimated 1 million BTC could be brought back into circulation has sparked debate. Some believe that if these coins were suddenly unlocked, it could lead to a market shock, significantly affecting Bitcoin’s price and scarcity.

Pseudonymous crypto trader Crypto Skull warned their 140,500 X followers that such an event “could theoretically send us back to the stone age.”

Some experts have even proposed that Satoshi’s Bitcoin should be frozen to prevent exploitation by future quantum breakthroughs. However, implementing such a measure would require network consensus, which is highly unlikely given Bitcoin’s decentralized nature.

Bitcoin Maxis Should ‘Plan Accordingly’

Billionaire Chamath Palihapitiya, a well-known Bitcoin advocate, echoed Ardoino’s sentiments in a December X post, emphasizing that quantum computing poses a long-term risk to early cryptographic models.

“The time frame is very much not clear, and it’s not in the immediate time horizon. But if I owned a lot of BTC, my risk posture would be to assume it could happen and plan accordingly,” Palihapitiya advised.

While quantum computing’s full potential remains theoretical, some believe it could challenge Bitcoin’s security model in the coming decades, prompting developers to explore quantum-resistant encryption.

How Close Are We to a Quantum Threat?

A July 2023 Quantum Grad report analyzed how Grover’s search algorithm, a quantum computing technique, could be used to brute-force private keys.

However, the report stated that it would take millions of qubits—the basic unit of quantum computation—to successfully execute Grover’s algorithm on a Bitcoin wallet. Given that current quantum computers operate with only hundreds of qubits, this level of threat is still far from reality.

The Future of Bitcoin Security

While quantum computing remains a distant threat, its potential to disrupt cryptographic security is prompting discussions within the crypto industry. Developers and security experts are already exploring quantum-resistant encryption methods to ensure Bitcoin remains secure in the long run.

For now, Bitcoin holders don’t need to panic. But as quantum technology advances, preparing for potential risks will become increasingly important—especially for those who own large amounts of BTC.