The founder of Solana-based Pump.fun has called for urgent guardrails to regulate token launchpads in the wake of the LIBRA memecoin disaster—a controversy that has embroiled Argentine President Javier Milei and sparked a broader debate about the dangers of political endorsements in crypto.

A Political Endorsement Turned Market Catastrophe

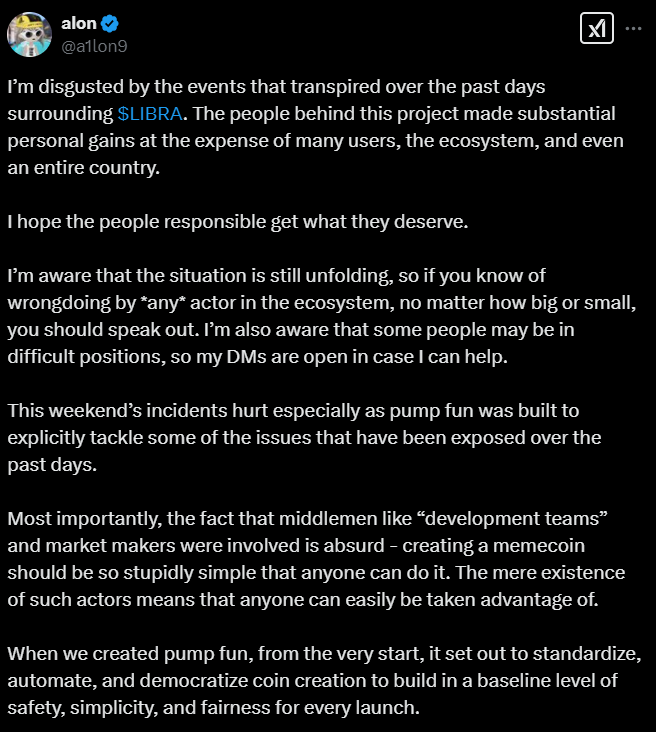

In a February 17 post on X, Pump.fun’s pseudonymous founder, Alon, expressed outrage over what he described as an “insider scam” surrounding the LIBRA token. The meme coin, launched on February 15, was briefly promoted by President Milei as Argentina’s official token, sending its market cap soaring.

However, within hours, the project unraveled. Several wallets siphoned off over $107 million from LIBRA’s liquidity pool, while Milei quietly deleted his tweet. The fallout was immediate—LIBRA’s market cap, which had surged to $4.4 billion, collapsed in just six hours, leaving investors blindsided and fueling accusations of an elaborate rug pull.

Pump.fun Pushes for Stronger Investor Protections

Alon defended Pump.fun’s role in the launch, arguing that the platform was designed to prevent insider-controlled token schemes. However, he acknowledged that more must be done to safeguard investors, urging launchpads to implement stricter security measures.

Among his proposed reforms:

- Educating Users: Ensuring traders understand how to safely and ethically create and invest in tokens.

- User-Friendly Onboarding: Making the crypto space more accessible for new participants.

- Fraud Detection Mechanisms: Reducing the visibility of tokens exhibiting suspicious ownership patterns or trading activity.

These recommendations come amid growing calls for the crypto industry to self-regulate before regulators step in to impose sweeping restrictions.

Meteora Co-Founder Steps Down Amid Scrutiny

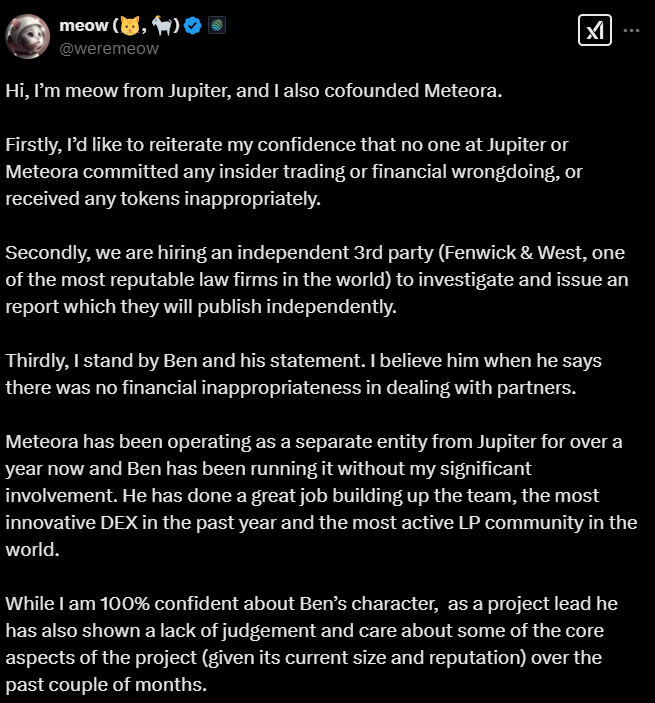

The LIBRA fallout has also shaken other corners of the crypto ecosystem. Ben Chow, co-founder of DeFi project Meteora, resigned from his role on February 18, according to an X post by his fellow co-founder, Meow.

Meow attributed the resignation to Chow’s “lack of judgment and care” over certain aspects of the project but did not elaborate further. Despite speculation linking Meteora to the LIBRA debacle, Meow strongly denied any wrongdoing within the team.

“I’d like to reiterate my confidence that no one at Jupiter or Meteora committed any insider trading or financial wrongdoing, or received any tokens inappropriately,” he stated.

In his own February 17 statement, Chow also denied insider activity, asserting that neither he nor his team had access to privileged information about the LIBRA launch.

“To maintain high levels of confidentiality, very few people in Meteora have access to any launch information,” Chow explained. “Neither I nor the Meteora team compromised the LIBRA launch by leaking information, nor did we purchase, receive, or manage any tokens.”

Legal Action and the Future of Crypto Oversight

In response to the LIBRA controversy, Meow announced that Jupiter would retain the legal firm Fenwick & West to conduct an independent investigation. The firm is currently facing a lawsuit for allegedly helping FTX obscure its relationship with Alameda Research, raising questions about the effectiveness of its oversight.

The LIBRA debacle serves as yet another warning of the risks associated with politically charged crypto projects. As the dust settles, the industry faces a critical decision: proactively implement stronger safeguards or risk external regulatory crackdowns that could reshape the future of crypto innovation.

With investor trust shaken and scrutiny intensifying, how the industry responds to this crisis could set a precedent for future token launches and political endorsements in crypto markets.