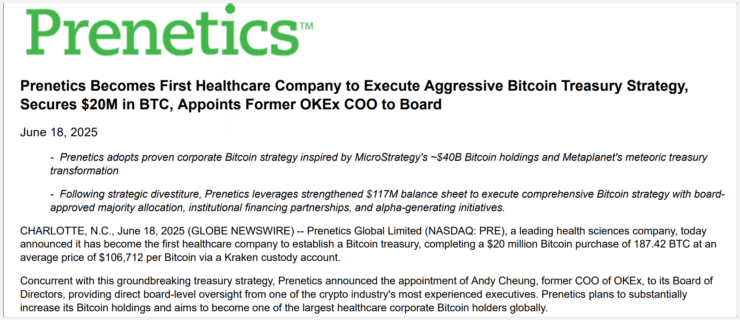

Health tech company Prenetics has made a bold entrance into the digital asset space, acquiring 187 Bitcoin (BTC) for approximately $20 million as part of a newly launched treasury strategy.

According to the firm’s announcement, the purchase was executed via Kraken’s institutional custody platform at an average price of $106,712 per coin. Prenetics described the move as the beginning of a long-term strategy to expand its Bitcoin holdings and become a leading corporate BTC holder within the healthcare industry.

The company hinted at future Bitcoin purchases and signaled possible crypto integrations across its consumer platforms, such as CircleDNA and IM8 Health—including potential support for crypto payments in healthcare services.

Prenetics Adds Kraken Executive Behind Trump’s Bitcoin Pivot

In tandem with its Bitcoin treasury push, Prenetics has expanded its leadership team to include key figures from the crypto world. Andy Cheung, former Chief Operating Officer of OKEx, has joined the board of directors, bringing deep experience in digital assets and exchange operations.

Additionally, Tracy Hoyos Lopez, Chief of Staff for Strategic Initiatives at Kraken, was appointed to Prenetics’ new advisory board. Lopez is best known for her behind-the-scenes role in shaping Donald Trump’s recent embrace of pro-Bitcoin policies. Her addition is expected to guide Prenetics’ institutional and regulatory crypto navigation.

Lopez stated that Prenetics’ strong liquidity position makes it “well-placed to capitalize on the global regulatory shift and the momentum of institutional Bitcoin adoption.”

The company currently holds $117 million in liquid assets across cash, short-term investments, and now Bitcoin. Following the announcement, shares of Prenetics (Nasdaq: PRE) rose over 8.7%, reflecting growing investor optimism about the company’s digital asset pivot.

U.S. Strategic Bitcoin Reserve Plan Gains Traction

Since President Trump’s March executive order calling for a “Strategic Bitcoin Reserve” and a “Digital Asset Stockpile,” speculation has grown over whether the U.S. is formally preparing to include Bitcoin in its national reserves.

Though in early development, the administration confirmed that federal agencies already hold roughly 200,000 BTC—largely from criminal and civil asset seizures. The move has prompted comparisons with corporate Bitcoin treasury strategies from companies like Strategy and Prenetics, both of which have announced aggressive BTC accumulation plans.

One unnamed adviser to the president floated the idea of revaluing U.S. gold certificates to finance the reserve without direct taxpayer burden. Under this proposal, the federal government could use budget-neutral mechanisms rooted in historical monetary tools to fund Bitcoin acquisitions without requiring Congressional appropriation.

Though the legal path remains unclear, the plan aligns with Trump’s broader vision of cementing the U.S. as a dominant global force in crypto—especially as rival nations like China explore digital reserve strategies of their own.

Quick Facts

- Prenetics acquired 187 BTC for $20M via Kraken at $106K per coin.

- Former OKEx COO Andy Cheung joins Prenetics board of directors.

- Tracy Lopez, key Trump crypto adviser, appointed to advisory board.

- Trump’s Strategic Bitcoin Reserve plan may follow gold-backed model.