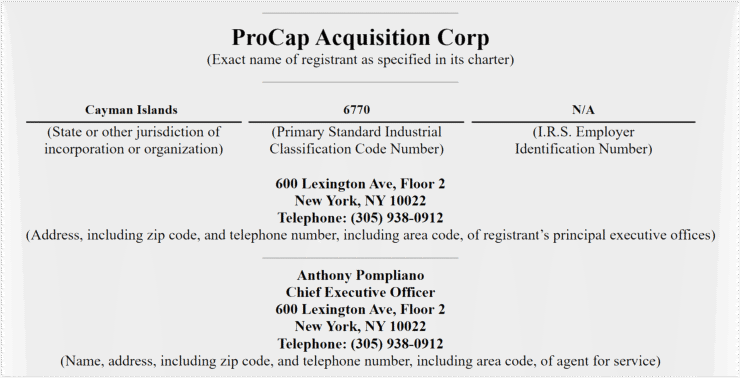

Anthony Pompliano, a well-known figure in the crypto world, has filed to raise $200 million for a new SPAC (special purpose acquisition company) targeting fintech and digital asset startups. The vehicle, called ProCap Acquisition Corp., will list on the Nasdaq under the ticker “PCAPU”, according to filings with the U.S. Securities and Exchange Commission this week.

Each $10 unit in the offering includes one Class A share and one-third of a warrant, giving investors potential upside if a merger is completed. The SPAC will seek companies with high growth potential in financial services, crypto, and fintech, especially those that would benefit from going public and accessing deeper capital markets.

Pompliano, host of “The Pomp Podcast” and a vocal presence on social media, is leveraging his media influence and investment background to help source and elevate acquisition targets. His goal: use reputation and reach to create a next-gen public company at the intersection of finance and decentralized technology.

Media Influence and Investing Power SPAC Vision

With experience in tech, media, and investing, Pompliano is positioning ProCap as an extension of his broader business strategy. He previously held roles at Facebook and co-founded Morgan Creek Digital, and now runs Professional Capital Management, an investment firm that integrates media platforms for deal sourcing.

ProCap’s IPO filing highlights the value of Pompliano’s content ecosystem—including a daily newsletter, his podcast, and millions of social media followers—as more than just marketing. These assets are positioned as strategic levers to amplify any future acquisition’s visibility and success.

While no target company has been identified yet, ProCap’s filing states a preference for firms with sustainable competitive advantages and the potential to scale rapidly in the public markets.

Pompliano maintains sole control of the SPAC sponsor and has secured 5.75 million founder shares for $25,000, or less than half a cent per share—a typical structure in SPACs that gives sponsors high upside. An additional 430,000 units will be acquired in a private placement concurrent with the IPO.

Pompliano Bets Timing and Reputation Beat SPAC Skepticism

SPACs focused on digital assets have had a mixed track record in recent years. Several high-profile crypto SPACs failed to complete mergers or saw share prices slump post-deal, largely due to regulatory scrutiny and market volatility.

Still, Pompliano believes ProCap Acquisition Corp. can stand apart. With a resume that includes early investments in Coinbase and a massive online presence, he aims to create a credible vehicle for crypto-native acquisitions in a market hungry for public exits.

The timing may work in his favor. Bitcoin’s recent rally past $94,000 has reignited institutional interest in digital assets, potentially giving ProCap a competitive edge as it searches for high-potential targets.

ProCap’s management team includes professionals with backgrounds in venture capital, M&A, and crypto compliance, suggesting a blend of traditional finance discipline and digital-native expertise. Whether that balance is enough to succeed in an unpredictable SPAC environment remains to be seen.

Quick Facts

- Anthony Pompliano is launching ProCap Acquisition Corp., a $200M SPAC targeting crypto and fintech.

- The SPAC will trade on Nasdaq under ticker “PCAPU.”

- The offering includes Class A shares and partial warrants for upside on a successful deal.

- The initiative highlights a broader push for institutional crypto exposure via public vehicles.