Quick Facts:

- Polymarket now boasts over 450,000 active traders, reflecting a surge in adoption.

- Interest is shifting beyond U.S. elections, with sports, entertainment, and financial markets seeing increased activity.

- Regulatory challenges remain, but Polymarket has strengthened compliance measures to address concerns.

- Future growth will focus on expanding market categories, improving analytics tools, and securing institutional partnerships.

Decentralized prediction market Polymarket has hit a major milestone, surpassing 450,000 active traders as user interest expands beyond U.S. political betting.

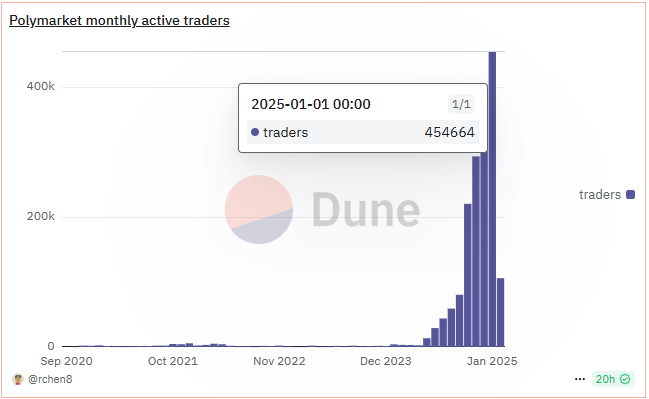

Polymarket’s expansion beyond U.S. elections is evident in its surging trader activity, which reached an all-time high of 450,000 monthly active users in January 2025. This milestone represents a 91% increase from October’s 235,000 traders, reinforcing the platform’s continued growth and mainstream adoption.

Despite the end of election-driven speculation, Polymarket sustained its momentum through Q4 2024, with active traders climbing to 300,000 in November and 350,000 in December. However, this growth comes amid a decline in overall trading volume, which peaked at $2.6 billion in November before settling at $1.23 billion in January.

Open interest, which hit $500 million on November 5 at the height of election-related betting, has stabilized around $100 million

Polymarket built its reputation on high-stakes U.S. election markets, with these millions flowing into bets on presidential races and congressional outcomes. However, recent trends show traders diversifying their focus, fueling demand for prediction markets on sports championships, entertainment events, and macroeconomic indicators.

In the sports sector, users are betting on everything from major league outcomes to player performances, while entertainment speculation includes reality TV results, box office revenue predictions, and music industry awards. Meanwhile, financial markets have become a hotbed for speculation, with traders wagering on interest rate changes, Bitcoin ETF approvals, and stock market movements.

Regulatory Challenges and Compliance Adaptations

Polymarket’s rapid expansion has drawn increased scrutiny from U.S. regulators, particularly the Commodity Futures Trading Commission (CFTC), which closely monitors betting markets that involve financial speculation.

Under former CFTC Chair Rostin Behnam, the agency was widely criticized for its aggressive stance on prediction markets, taking enforcement actions against platforms like Polymarket and Kalshi. Behnam’s CFTC had previously blocked attempts by the likes of Polymarket to expand regulated markets for political event contracts, citing concerns over gambling laws and market integrity.

However, in a clear rebuke of her predecessor’s policies, acting Chair Caroline Pham criticized the prior administration’s approach as “anti-innovation,” arguing that the CFTC should embrace common-sense regulation rather than stifle emerging markets. Her comments signal a potential shift toward a more industry-friendly regulatory environment, which will further boost the adoption of prediction markets like Polymarket.

Polymarket’s Future: Expansion and Innovation

With an active user base exceeding 450,000, Polymarket is gearing up for further expansion, focusing on enhancing its market offerings and refining the user experience. The company is exploring new categories of prediction markets, including global climate events, AI-driven forecasting, and geopolitical risks.

Plans to introduce advanced analytics tools are also in the pipeline, allowing traders to access historical trends, risk assessments, and deeper insights into market dynamics. Additionally, Polymarket is exploring institutional partnerships with data providers, media outlets, and blockchain firms, further strengthening its position as a leader in decentralized prediction markets.