What was supposed to be a historic moment for Pi Network has quickly turned into a market bloodbath. The project’s long-awaited mainnet launch on February 20 was met with immediate skepticism and a massive 65% price drop in its native token, PI.

Initially trading at $1.84, PI saw a sharp decline to $0.64, wiping out millions in value in just hours. The sell-off began as users were finally allowed to trade their tokens on centralized exchanges, breaking free from the project’s previously closed ecosystem.

Pi Network’s “Open Network” launch was meant to bring new adoption and liquidity to the token, but instead, it has raised serious questions about the project’s stability, credibility, and long-term viability.

Exchange Listings: A Divided Approach

Pi Network secured listings on major trading platforms such as Bitget, OKX, and MEXC, but not everyone was on board. One notable absence? Bybit.

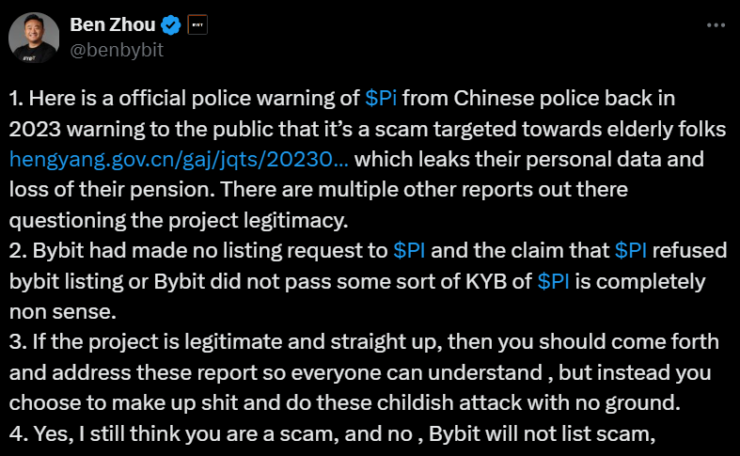

Bybit CEO Ben Zhou took to X to make his position clear: PI will not be listed on Bybit. And he didn’t stop there he outright called the project a scam.

Zhou’s skepticism is rooted in past warnings from Chinese authorities. In 2023, law enforcement in China cautioned investors against Pi Network, claiming the project specifically targeted the elderly in what was labeled a high-risk scheme.

Zhou directly challenged the Pi Network team, demanding answers on the project’s legitimacy and rejecting claims that Bybit ever requested to list PI.

“Bybit had made no listing request to $PI, and the claim that $PI refused Bybit listing or Bybit did not pass some sort of KYB of $PI is completely nonsense,” Zhou wrote.

Bybit’s refusal to engage with Pi Network raises even bigger concerns about the token’s credibility, especially as skepticism continues to build.

Mining or Marketing? The Decentralization Debate

Pi Network has long marketed itself as an accessible, mobile-based crypto mining solution, claiming to have over 60 million users.

However, the reality seems far from transparent. Blockchain explorers only show 9.1 million active users, a stark contrast to the project’s promotional claims.

Even more concerning, Pi Network still lacks independent validators—meaning the entire blockchain is still controlled by its core team rather than a decentralized group of participants. This raises red flags about the actual decentralization of the project and whether its token economy is manipulated or artificially restricted.

What’s Next for Pi Network?

Pi Network’s catastrophic market debut has sent a clear message—investors are wary, and major industry players are questioning its credibility.

While some users are still hopeful for a recovery, the token’s rapid decline, combined with regulatory warnings, exchange skepticism, and lack of transparency, paints a bleak picture.

Unless Pi Network addresses these growing concerns, the project risks being remembered as just another overhyped crypto experiment gone wrong.