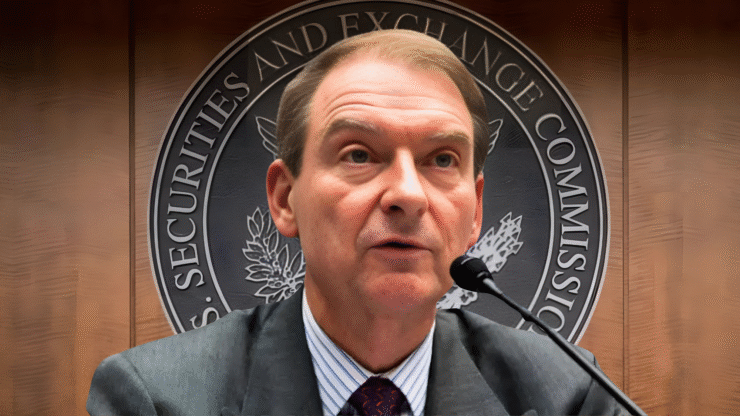

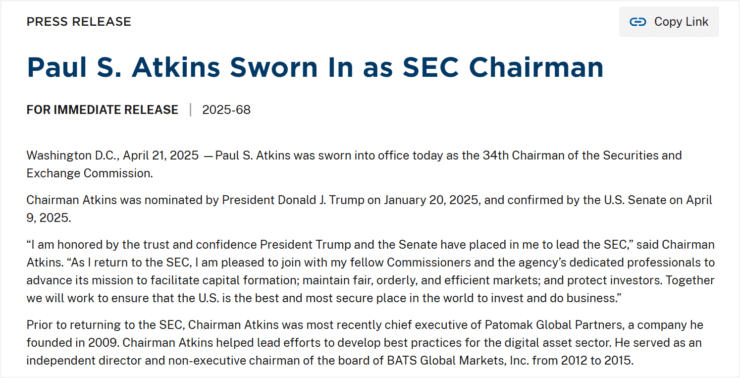

Paul Atkins was officially sworn in as the 34th Chair of the U.S. Securities and Exchange Commission (SEC) on April 21, 2025, ushering in a new chapter for U.S. financial regulation. Known for his pro-market stance and openness to digital asset innovation, Atkins is expected to shift the SEC toward clearer, investor-focused policies.

In his opening remarks, Atkins reaffirmed the SEC’s mission to “facilitate capital formation, ensure fair and efficient markets, and protect investors,” noting that his background in both public service and private enterprise has given him “critical insights” into the real-world consequences of regulation.

“As I return to the SEC, I am pleased to join with my fellow Commissioners and the agency’s dedicated professionals to advance its mission to facilitate capital formation; maintain fair, orderly, and efficient markets; and protect investors,” he said.

“Together we will work to ensure that the U.S. is the best and most secure place in the world to invest and do business.”

Atkins’ confirmation passed by a 52–44 party-line vote, with all Senate Republicans supporting and all Democrats opposing. According to financial disclosures, his net worth of $327 million makes him the wealthiest SEC chair in modern history.

While critics raise concerns over his industry ties, supporters argue that Atkins’ deep financial experience could provide the structure needed to foster regulatory clarity, particularly in the areas of cryptocurrency and decentralized finance (DeFi).

As the Biden-era enforcement wave recedes, Atkins is expected to pivot the agency toward engagement over litigation, clarity over confusion, and growth over regulatory overreach.

Atkins Promises Clarity, Ends Gensler-Era Confusion

In a sharp departure from his predecessor, Gary Gensler, Paul Atkins pledged to eliminate ambiguity surrounding digital asset regulation. During his Senate confirmation, Atkins emphasized that “unclear regulation creates uncertainty and inhibits innovation,” vowing to establish a coherent, market-aligned framework—particularly for crypto and emerging technologies.

Atkins previously founded Patomak Global Partners in 2009, a consulting firm known for helping digital asset companies navigate regulatory complexity. He confirmed that he will resign from Patomak within 90 days, in line with federal ethics rules.

He replaces Gensler, who oversaw aggressive enforcement actions against top crypto firms including Ripple, Coinbase, and Binance, often without establishing clear rules around digital asset classification.

Since Atkins’ appointment, crypto-aligned SEC members—Acting Chair Mark Uyeda and Commissioner Hester Peirce—have reportedly moved to dismiss or restructure several Gensler-era cases, including actions against meme coins and crypto mining projects.

Calling the prior administration’s policies “overly politicized, complicated, and burdensome,” Atkins is signaling a deregulatory agenda focused on expanding investor access, revitalizing capital markets, and redefining the SEC’s role as a neutral facilitator of innovation.

Wall Street Insider Takes Helm as ETF Pressure Builds

With a reported net worth of $327 million, Atkins brings deep financial industry experience and a substantial personal stake in the digital asset ecosystem.

Financial disclosures tied to his confirmation revealed holdings of up to $5 million in Off the Chain Capital LLC, a crypto-focused investment firm where Atkins is listed as a limited partner. His wealth is bolstered by inherited assets through his heiress wife, placing him among the wealthiest individuals ever to lead the SEC.

His appointment continues a trend in President Trump’s second term of nominating financially entrenched regulators with deep Wall Street ties. Atkins’ background at Patomak Global Partners, along with his past SEC service, underscores the administration’s pro-market regulatory approach.

Atkins steps into the role as the SEC reviews over 70 crypto ETF filings, including proposed funds for Solana (SOL), XRP, Dogecoin (DOGE), and the newly trending MELANIA token. Market participants are watching closely to see if his leadership will unlock the next wave of crypto investment vehicles.

Quick Facts

- Paul S. Atkins sworn in as the 34th SEC Chair on April 21, 2025.

- Confirmed by the Senate in a 52–44 vote, reflecting party-line division.

- Pledges to implement clear, innovation-focused regulation, especially for crypto assets.

- Holds significant investments in digital asset firms, including Off the Chain Capital.

- Inherits over 70 crypto ETF filings and leads the SEC through internal restructuring.