Pakistan is doubling down on its ambitions in the digital asset space, unveiling a new Bitcoin reserve strategy during a high-profile meeting at the White House with members of former President Donald Trump’s crypto advisory team.

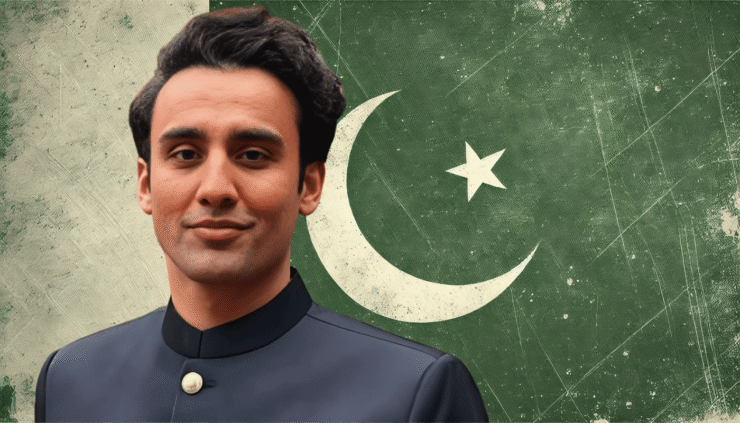

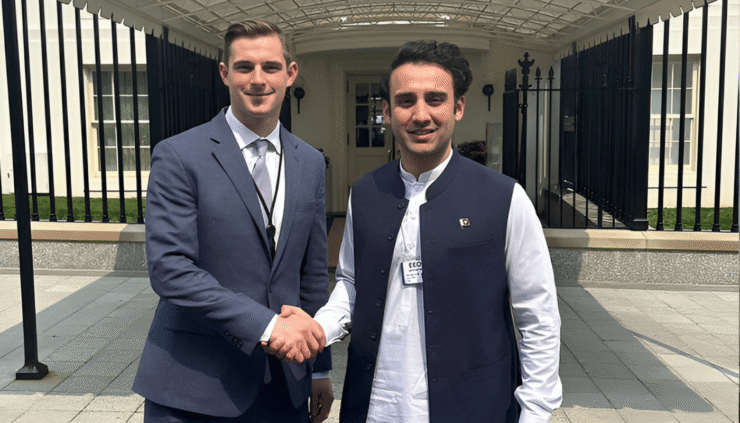

Bilal Bin Saqib, Pakistan’s Minister of State for Crypto and Blockchain, met with Robert “Bo” Hines, Executive Director of Trump’s Council on Digital Assets, to outline a bold national strategy centered on long-term Bitcoin holdings and crypto-powered infrastructure.

According to Saqib, the Strategic Bitcoin Reserve is a cornerstone of Pakistan’s vision to become a major player in the global digital economy. “From launching our Bitcoin Reserve to integrating crypto into AI and mining zones, we’re creating a real framework for modernization,” he said after the meeting.

The two sides discussed bilateral opportunities around digital finance, decentralized infrastructure, and regulatory collaboration—positioning the engagement as a key moment in U.S.–Pakistan tech diplomacy. Hines, a prominent voice in Trump-era crypto policy, expressed openness to deeper cooperation as the U.S. seeks to maintain leadership in the evolving global asset landscape.

Pakistan Broadens Crypto Push With Energy, Legal Plans

Following the White House meeting, Bilal Bin Saqib held further discussions with the White House Counsel’s Office, focusing on blockchain governance and international regulatory cooperation.

These conversations come amid Pakistan’s broader plan to weave digital assets into its national economic development. A central proposal involves redirecting 2,000 megawatts of surplus energy toward Bitcoin mining and AI data centers—an initiative aimed at transforming unused electricity into economic productivity, infrastructure, and tech-sector jobs.

Domestically, Pakistan is also building out a formal regulatory architecture. On May 21, the Ministry of Finance approved the creation of the Pakistan Digital Assets Authority (PDAA)—a new regulatory body charged with supervising crypto exchanges, custodial services, stablecoins, and DeFi platforms.

The PDAA is expected to lead licensing, compliance, and oversight efforts, reinforcing Pakistan’s commitment to building a responsible and transparent blockchain ecosystem.

IMF Flags Bitcoin Mining Plan Amid Energy Crisis

The plan to allocate 2,000 megawatts of power to crypto mining has raised red flags with the International Monetary Fund (IMF), which is currently negotiating a financial package with Pakistan.

On May 31, the IMF formally requested clarification from the Finance Ministry, questioning whether diverting substantial power toward Bitcoin and AI infrastructure aligns with the country’s existing economic obligations—especially given ongoing energy shortages and fiscal instability.

The IMF’s inquiry puts added pressure on Islamabad to reconcile its crypto ambitions with the practical realities of a fragile power grid and constrained national finances. It also highlights the growing skepticism from international institutions as developing nations explore blockchain and AI as paths to modernization.

Quick Facts

- Pakistan unveiled its Strategic Bitcoin Reserve plan during White House meetings with Trump’s crypto advisory council.

- The government plans to use 2,000 megawatts of surplus energy for Bitcoin mining and AI data centers.

- Pakistan’s Finance Ministry approved the creation of the Pakistan Digital Assets Authority (PDAA) to regulate crypto platforms.

- The IMF has raised concerns over the energy allocation plan, citing risks tied to ongoing energy and economic challenges.