Osprey Funds is not backing down in its legal battle against Grayscale Investments, filing a motion for reargument on February 10 to challenge a Connecticut judge’s decision in favor of Grayscale. The dispute revolves around claims of deceptive advertising and alleged unfair market advantages in the Bitcoin exchange-traded fund (ETF) race, a conflict that could have broader implications for competition and regulatory oversight in the crypto industry.

The Legal Battle: Osprey vs. Grayscale

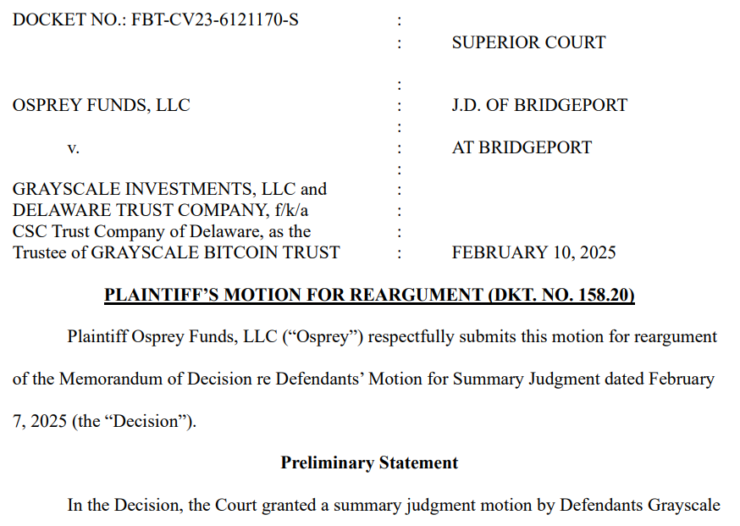

Osprey first sued Grayscale and Delaware Trust Company in January 2023, alleging that Grayscale misrepresented its ability to convert the Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin ETF, misleading investors and unfairly dominating the market. Osprey, which operates its own competing Osprey Bitcoin Trust (OBTC), argued that Grayscale’s promotional efforts created an uneven playing field by misleading potential investors.

However, on February 7, 2024, Judge Mark Gould ruled in favor of Grayscale, citing that Osprey’s claims fell under securities transactions, which are exempt from the Connecticut Unfair Trade Practices Act (CUTPA). The ruling was a setback for Osprey, but the firm is now pushing for a judicial review, arguing that the court made its decision prematurely, before the discovery process had concluded.

Key Arguments in Osprey’s Appeal

Osprey’s latest filing argues that Judge Gould’s decision misinterpreted CUTPA’s scope, particularly in relation to deceptive advertising laws. The firm asserts that:

- The court’s decision expanded CUTPA’s exemption for securities transactions beyond its intended limits, overlooking critical distinctions between Federal Trade Commission (FTC) guidelines and state laws governing deceptive advertising.

- The ruling failed to differentiate between securities transactions and deceptive advertising between competitors, arguing that Grayscale’s marketing efforts misled investors and diverted market share from Osprey.

- Grayscale and Osprey were not engaged in a direct securities transaction with each other, meaning the lawsuit’s claims should not be automatically exempt under securities law.

“Osprey’s claims focus on the extent to which Grayscale’s unfair competition, based on deceptive advertising, diverted market share from Osprey,” the firm’s lawyers wrote in their motion.

The Broader Crypto ETF Landscape

The lawsuit and its subsequent appeals take place against the backdrop of a rapidly evolving Bitcoin ETF market. Just one year after Osprey filed its complaint, the U.S. Securities and Exchange Commission (SEC) approved Grayscale’s long-awaited conversion of GBTC into a spot Bitcoin ETF in January 2024. This approval followed a legal battle in which Grayscale successfully challenged the SEC’s earlier rejection of its ETF application.

Meanwhile, Osprey has also been looking to solidify its position in the crypto ETF space. In July 2024, Osprey sought to settle its claims against Grayscale for under $2 million, though Grayscale declined the offer. More recently, in January 2025, Osprey filed plans with the SEC to convert OBTC into a spot Bitcoin ETF, following a failed acquisition deal with Bitwise.

What This Means for Crypto Market Competition

Osprey’s persistence in challenging Grayscale underscores the fierce competition in the crypto asset management sector. The firm’s legal battle could set important precedents for:

- How courts handle deceptive advertising claims in the cryptocurrency sector.

- The extent to which traditional securities exemptions apply to digital assets and financial products.

- The competitive landscape for firms looking to establish a foothold in the Bitcoin ETF market.

With institutional adoption of Bitcoin ETFs continuing to grow, the outcome of this legal dispute could shape how crypto firms compete in a market that is rapidly becoming a major part of the traditional financial ecosystem. Whether Osprey succeeds in its bid for judicial review or not, this case highlights the increasing regulatory scrutiny and legal complexities surrounding crypto-based financial products.