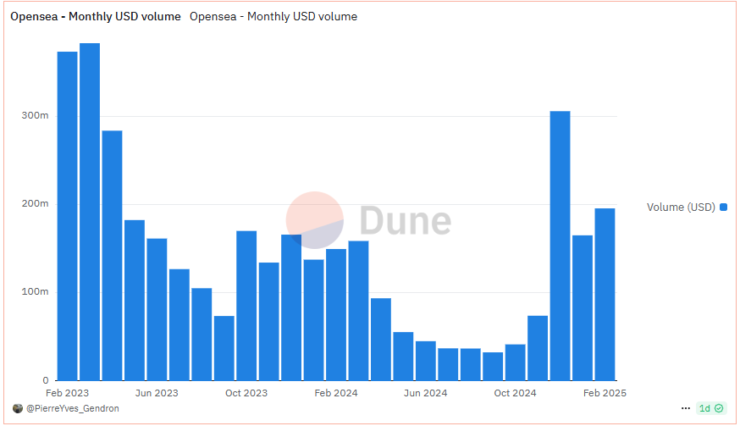

OpenSea has made a powerful comeback in the NFT marketplace, reclaiming dominance with a massive surge in market share. Over the past week, OpenSea’s grip on Ethereum NFT marketplace volume skyrocketed to 71.5%, a staggering rise from just 25.5% four weeks ago. This explosive growth follows the announcement of its native SEA token on February 13, 2025, signaling a major shift in the competitive landscape of the NFT space.

The unveiling of the SEA token has been the driving force behind OpenSea’s resurgence. Since the announcement, OpenSea’s daily trading volume soared to an average of $17.4 million, a significant jump from the pre-announcement average of $3.47 million. Additionally, daily transactions more than doubled, spiking from 6,100 to 14,700 trades in just a matter of weeks. The bulk of this growth occurred over the past week, with OpenSea’s market share leaping from 42.4% to 71.5%, outpacing competitors like Blur and reaffirming its position as a leading NFT marketplace.

Incentive Challenges and User Pushback

Despite this surge in market share, OpenSea has faced challenges regarding its incentive rollout. The platform introduced an XP-based rewards system aimed at encouraging user engagement, but it quickly drew criticism. Users raised concerns that the incentives could promote wash trading, undermining genuine participation and ecosystem health. In response, OpenSea paused the XP program to address community feedback, signaling its commitment to improving the trading experience and ensuring a fair marketplace.

The leading NFT Marketplace also came under fire in early February when rumors suggesting that it would implement Know Your Customer (KYC) verification as a prerequisite for a speculated token airdrop began to spread.

The speculation started circulating on X after a website link, allegedly tied to the OpenSea Foundation, circulated on the Elon Musk owned social media . The site reportedly included a terms of service section that outlined full KYC requirements, including age verification and potential VPN restrictions for certain regions. OpenSea, however, quickly refuted the claims, clarifying that no such KYC requirement exists. A few days later, the Opensea foundation launched its Opensea version 2 product, confirming a token airdrop without any KYC requirements.

Navigating a Competitive NFT Market

OpenSea’s resurgence comes amid an increasingly competitive NFT landscape. Platforms like Magic Eden have been strong contenders, holding a 36.7% market share with $122.47 million in monthly trading volume as of August 2024. Magic Eden maintained its dominance for six consecutive months, highlighting the fierce competition among NFT marketplaces.

The broader NFT market, however, has seen fluctuations. Global art sales, including NFTs, dropped by 4% last year to approximately $65 billion due to economic uncertainties. High inflation and rising interest rates contributed to decreased speculative buying in the digital art sector, causing many platforms to pivot their strategies to retain users and drive engagement.

Quick Facts:

- Market Share Surge: OpenSea’s Ethereum NFT market share increased from 25.5% to 71.5% within four weeks.

- Trading Volume Increase: Daily trading volumes rose to $17.4 million post-SEA token announcement.

- Incentive System Suspension: OpenSea paused its XP-based incentives following user feedback.

- Competitive Landscape: Platforms like Magic Eden have also seen significant market share, indicating a competitive NFT marketplace environment.