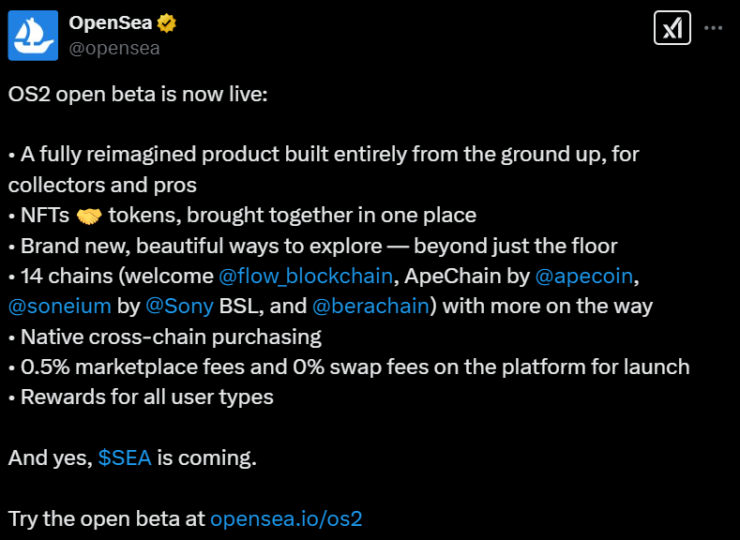

OpenSea’s highly anticipated OpenSea 2.0 (OS2) beta went live on February 13, but just five days later, the NFT marketplace has been forced to revise its points system following backlash from the community.

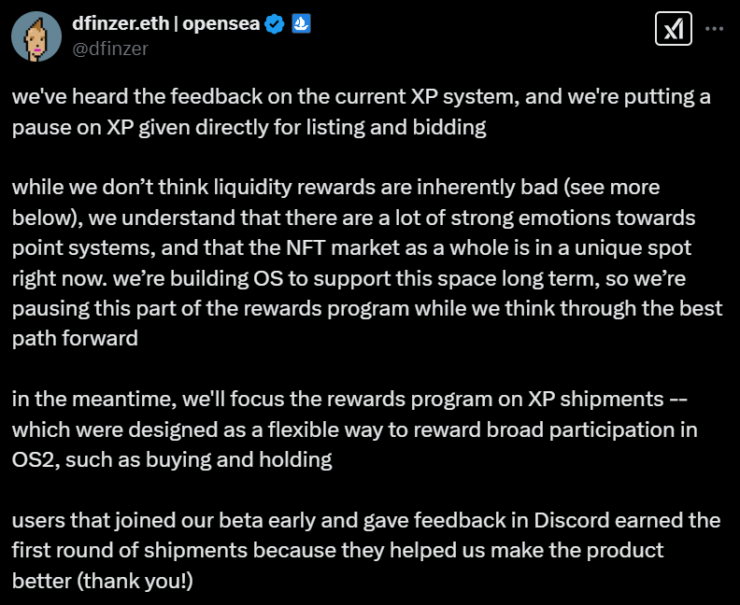

With fears that OpenSea’s XP-based rewards model could replicate the market distortions caused by Blur’s incentive-driven farming, CEO Devin Finzer has announced a pause on XP distribution for listing and bidding activities.

Why OpenSea’s Points System Sparked a Backlash

The NFT space has a love-hate relationship with reward-based trading. While incentives drive activity, they often inflate trading volume artificially pushing up numbers but dragging down actual market value.

Many in the community blame Blur’s aggressive incentives model for accelerating the NFT market downturn, as traders manipulated the system to maximize rewards at the expense of organic price growth.

Finzer acknowledged these concerns in a February 18 statement:

“We’ve heard the feedback on the current XP system, and we’re putting a pause on XP given directly for listing and bidding.”

Despite the controversy, OpenSea’s incentive rollout has supercharged trading activity. The platform processed $26 million in trading volume on February 17, a staggering increase from the $5.8 million recorded on February 12, the day before XP farming began, according to Dune Analytics.

NFT Prices Drop as Volume Surges — A Familiar Pattern

The rapid increase in trading volume hasn’t translated to price gains—a troubling sign reminiscent of Blur’s incentive-driven wash trading cycle.

Major NFT collections have taken a hit in floor price, despite seeing surging volume:

- Pudgy Penguins, Azuki, and Bored Ape Yacht Club have dropped between 4% and 16% over the last week, even as their weekly volume jumped by 75% to 188%, according to DappRadar.

- The Doodles NFT collection appears to have been particularly targeted by farming bots, posting a 1,140% increase in trading volume while its price dipped just 1%.

Adding to the speculation, Doodles recently announced an upcoming token release, further fueling trading spikes.

What’s Next? OpenSea Plans to Revamp XP Incentives

Despite halting XP for listing and bidding, OpenSea isn’t scrapping the rewards program altogether. Instead, Finzer hinted at a revised incentive structure that prioritizes long-term participation.

“In the meantime, we’ll focus the rewards program on XP shipments—which were designed as a flexible way to reward broad participation in OS2, such as buying and holding,” he stated.

These XP shipments have already been distributed to:

- Beta users providing feedback via Discord.

- NFT buyers on OS2, with multipliers based on previous wallet activity.

While OpenSea is attempting to strike a balance between encouraging engagement and avoiding market distortion, the damage may already be done.

The Bigger Picture: Can OpenSea Regain User Trust?

This latest incident underscores a broader issue: NFT marketplaces are still struggling to implement incentive models that drive real adoption without inflating artificial demand.

The fact that OpenSea was forced to course-correct within days of launching its program shows just how fragile community sentiment is in the post-Blur era.

With competitors like Blur, Magic Eden, and LooksRare battling for dominance, OpenSea’s ability to fine-tune incentives while maintaining market integrity will determine whether OS2 strengthens its position or further alienates traders.

What Happens Next? The Future of NFT Incentives

As OpenSea revises its XP system, the marketplace faces a critical test:

Can NFT platforms design sustainable reward mechanisms that drive real user engagement without inflating artificial demand?

The issue isn’t unique to OpenSea. Blur’s token farming model, which drove NFT volumes to record highs, also contributed to price collapses across major collections. Other platforms like Magic Eden and LooksRare have experimented with their own rewards-driven models, but the results have been mixed—showing that short-term incentives often lead to unsustainable market cycles.

For OpenSea, the challenge is twofold:

- Rebuilding Trust – The backlash from users shows that NFT traders are wary of reward systems that appear to encourage artificial trading rather than real adoption. If OpenSea wants to maintain its dominance, it must demonstrate that XP rewards create actual value for long-term holders.

- Staying Competitive – OpenSea can’t afford to fall behind rivals like Blur, which have successfully lured away high-volume traders. At the same time, it must differentiate itself by crafting an incentive system that doesn’t just repeat the same mistakes that caused the NFT market’s last major downturn.

If OpenSea strikes the right balance, it could set a new standard for NFT rewards—one that encourages organic participation rather than speculative farming. But if the XP system continues down the same path, OpenSea risks becoming just another chapter in the NFT market’s ongoing cycle of boom-and-bust speculation.

For now, traders are watching closely, waiting to see if OpenSea can deliver a truly innovative alternative or if it’s just a matter of time before the next rewards-driven market crash.