Quick Stats

- OpenSea denies KYC will be required for any airdrop

- Rumored Token: Speculation suggests OpenSea may launch a governance or rewards token

- OpenSea has lost significant ground to rival marketplaces offering token incentives

- OpenSea’s Response: Company continues to refute rumors while staying silent on any potential token launch

Leading NFT marketplace OpenSea has firmly denied rumors suggesting that it would implement Know Your Customer (KYC) verification as a prerequisite for a speculated token airdrop.

The speculation started circulating on X after users shared unverified claims that OpenSea might be gearing up for a token launch similar to Blur’s BLUR or LooksRare’s LOOKS airdrops. The claims intensified after a website link, allegedly tied to the OpenSea Foundation, circulated on X . The site, which was reportedly discovered on Monday, included a terms of service section that outlined full KYC requirements, including age verification and potential VPN restrictions for certain regions.

OpenSea, however, quickly refuted the claims, clarifying that no such KYC requirement exists.

Despite the denial, speculations about the OpenSea token continue to gain traction, with analysts and users believing that the whole charade was a plan that was dragged back by the team after it was leaked and the subsequent wild community reactions followed.

“P.P.S. Apparently it got backtracked. You could believe “this is simply not true” or you could think that it was simply a pulse check that got “leaked” and backtracked: wouldn’t be the first time.” – @OGDfarmer on X

Speculation Ramps Up as OpenSea Faces Competitive Pressure

The NFT sector has undergone major shifts over the past year, with Blur and other emerging marketplaces aggressively challenging OpenSea’s dominance. Blur’s BLUR token airdrop in 2023 played a pivotal role in capturing market share, offering token incentives for high-volume traders and encouraging liquidity migration.

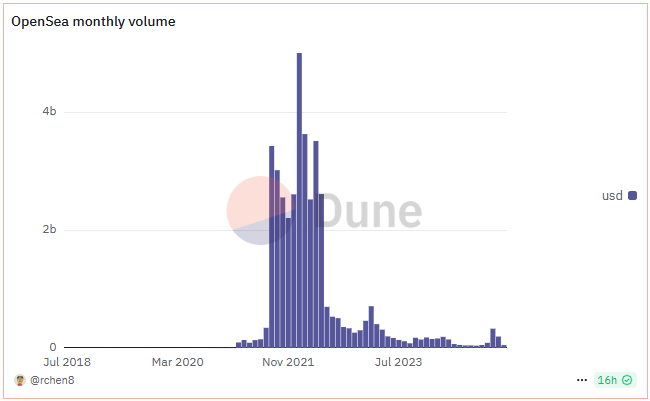

OpenSea, once the undisputed leader in NFT trading, has seen its market share eroded by these platforms with more aggressive incentive models. Trading volume experienced a significant drop since the previous bull run in 2022, when the platform notched a record $2.7 billion of volume in a single day.

While OpenSea has introduced fee reductions, optional creator royalties, and other incentives, traders continue to speculate whether it will follow the trend and release a native token to retain high-volume users.

The speculation intensified after OpenSea launched its OS2 update last month, which featured a redesigned interface and introduced an Experience Points (XP) system that rewards user activity. Many in the NFT community view this point-based system as a precursor to a token airdrop, similar to how Blur and other platforms structured their own rewards before launching native tokens.

Further fueling the rumors, OpenSea registered an entity called OpenSea Foundation in the Cayman Islands last December. Blockchain data has also revealed wallet movements linked to OpenSea, hinting at potential undisclosed initiatives.

Despite the growing speculation, OpenSea’s leadership has remained silent on whether a token launch is in the works. The uncertainty has left traders divided, with some positioning themselves for a possible airdrop while others remain skeptical, citing OpenSea’s history of resisting industry trends.