Quick Facts:

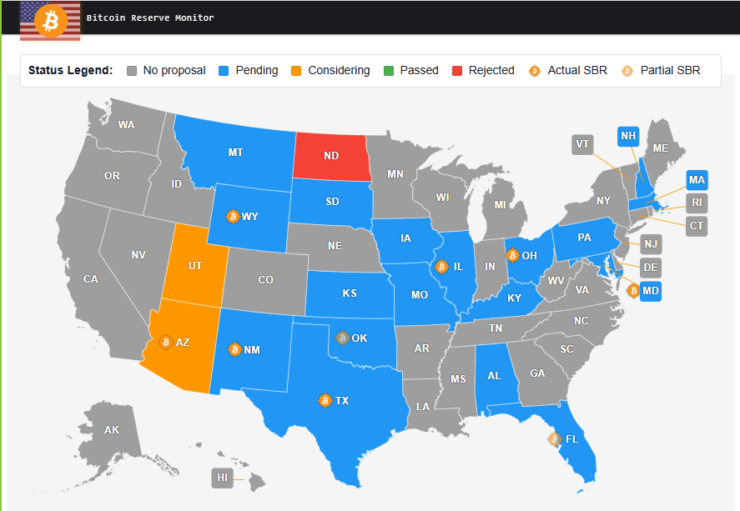

- At least 17 U.S. states have introduced or passed bills to integrate Bitcoin into public funds.

- Utah, Texas, Wyoming, and Kentucky are leading the charge with active Bitcoin reserve proposals.

- Momentum for Bitcoin reserves is growing amid a shifting federal stance under President Trump’s administration.

A growing number of U.S. states are pushing forward with legislation to integrate Bitcoin and other cryptocurrencies into public financial reserves. At least 17 states have either introduced or passed bills aimed at holding Bitcoin as a reserve asset, investing in blockchain-based funds, or allowing the use of crypto for state transactions.

The push for state-backed Bitcoin reserves aligns with President Donald Trump’s campaign pledge to establish a national Bitcoin stockpile, a promise that has yet to materialize at the federal level. Since Trump’s inauguration, his administration has taken proactive steps toward mainstream Bitcoin adoption, with the President signing a series of executive orders aimed at shaping U.S. crypto policy. Among these orders, one specifically directed the creation of a Digital Asset Committee to assess the feasibility of establishing a Federal Digital Asset Stockpile.

States Leading the Bitcoin Reserve Push

Among the states actively pursuing Bitcoin and crypto integration, Texas, Wyoming, Kentucky, and Utah have been at the forefront. Texas has been particularly aggressive, proposing measures to allow the state to hold Bitcoin as a treasury asset, while Wyoming continues its push to establish itself as a regulatory hub for digital assets.

Kentucky’s House Bill 376, introduced by Republican lawmaker T.J. Roberts, seeks to invest state funds in Bitcoin and other digital assets, provided they meet specific market capitalization thresholds. The bill, which does not explicitly name Bitcoin, limits eligible digital assets to those with a market cap exceeding $750 billion, effectively making Bitcoin the only option.

Meanwhile, Utah has advanced its own crypto reserve bill, passing it out of committee and positioning it for further approval. Arizona is following a similar path, with its legislature recently approving a bill that would allow the state’s treasurer to allocate funds into Bitcoin and other digital assets.

Despite these efforts, not all states are on board. North Dakota rejected a similar proposal, highlighting concerns over volatility and regulatory clarity.

Utah Emerges as a Front-Runner in Bitcoin Reserve Legislation

Among the 16 U.S. states actively considering the Bitcoin reserve legislation, Utah has emerged as the closest to implementation, with its Blockchain and Digital Innovation Amendments bill advancing through the state legislature.

On January 28, the Economic Development and Workforce Services Committee passed the bill on third reading with an 8-to-1 majority vote, positioning it for further approval in the state’s legislative process. If fully enacted, the law would grant Utah’s state treasurer the authority to allocate up to 5% of certain public funds to Bitcoin and other qualifying digital assets.

A key provision in the bill states that only digital assets with a market capitalization exceeding $500 billion—averaged over the past 12 months—would be eligible. Although the bill does not explicitly mention Bitcoin, BTC remains the only cryptocurrency that meets the criteria, effectively making it the default option.

If Utah successfully enacts the bill, it could become the first U.S. state to formally incorporate Bitcoin into its financial reserves, setting a precedent for other states exploring similar measures. With Kentucky, Arizona, and Texas also moving forward with their own legislative frameworks