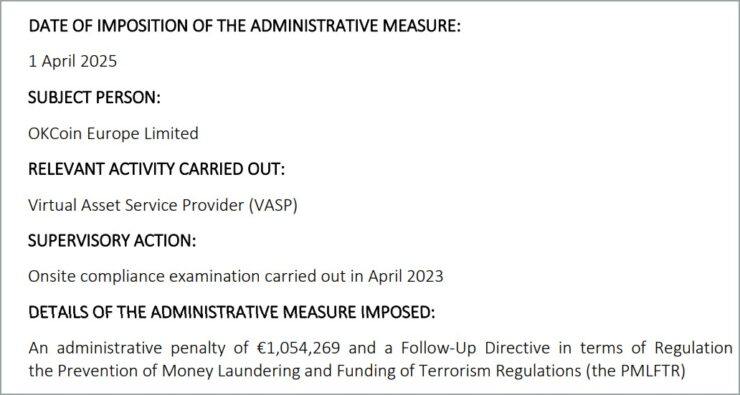

Cryptocurrency exchange OKX has been hit with a €1.1 million ($1.2 million) penalty by Malta’s Financial Intelligence Analysis Unit (FIAU) after the agency uncovered a series of anti-money laundering (AML) violations during a compliance inspection of the company’s local entity, OKCoin Europe Ltd.

The fine stems from an on-site examination conducted in April 2023, which revealed significant gaps in the firm’s risk management framework. According to a notice posted by the FIAU, the review identified several deficiencies in OKX’s approach to AML compliance—some of which were classified as “serious and systematic.”

Specifically, the regulator flagged the company for poor risk assessment protocols and inadequate internal procedures required of a licensed Virtual Asset Service Provider (VASP) operating in the country. OKCoin Europe, the legal entity involved, holds regulatory approval to offer crypto-related services within Malta’s financial ecosystem.

Despite the violations, the FIAU noted that OKX has since moved to rectify the issues highlighted in the report. The company’s response appears to have satisfied certain regulatory expectations, though the decision remains subject to appeal.

Major Oversights in OKX’s Risk Controls and Transaction Monitoring

At the time of the April 2023 compliance inspection, the company had developed a Business Risk Assessment (BRA) meant to evaluate its exposure to financial crime. However, the FIAU determined that the BRA lacked sufficient methodological depth and failed to account for critical factors necessary to properly identify and mitigate the risks of money laundering and terrorism financing.

Although OKX primarily serviced European clients, the regulator emphasized that potential cross-border risks from non-European jurisdictions had been overlooked entirely.

The FIAU’s findings were especially damning in relation to customer-level assessments. Around 50% of the customer files examined lacked any formal risk assessment. Furthermore, in approximately 80% of the reviewed accounts, OKX failed to adequately scrutinize client transactions—despite those transactions collectively exceeding $20 million in value.

One specific case highlighted the scale of oversight: a customer initially classified as low-risk had limited activity in their early years. But in 2021, that same customer suddenly deposited nearly $1.8 million in crypto within a span of just four months—without triggering any meaningful review or risk reclassification. The FIAU found this lack of adaptive scrutiny alarming, citing it as a key example of the platform’s insufficient internal controls.

OKX Responds to Scrutiny with Reforms and Regulatory Cooperation

Despite the severity of the findings, Maltese authorities acknowledged that OKCoin Europe Ltd took measurable steps to rectify its compliance shortcomings in the aftermath of the 2023 inspection. The company reportedly adopted a more proactive posture following the review, demonstrating a willingness to engage constructively with regulators.

In January 2024, the Malta Financial Services Authority (MFSA) formally settled with OKCoin Europe, recognizing what it described as the firm’s “goodwill” in addressing regulatory concerns.

As part of the agreement, the company was fined an additional €304,000 in administrative penalties. Beyond the fine, both parties agreed on a remediation roadmap, which included the appointment of an independent third-party service provider tasked with assessing and strengthening OKX’s internal governance and compliance frameworks.

This cooperative stance appears to have helped soften the regulatory blow, although the reputational impact remains. The case serves as a cautionary example for other crypto firms navigating complex legal environments, illustrating how early, transparent engagement with oversight bodies can help mitigate long-term consequences—particularly in an industry facing growing calls for stricter enforcement worldwide.

Quick Facts

- OKX was fined €1.1 million by Malta’s FIAU for serious and systematic anti-money laundering compliance failures.

- An April 2023 inspection found weaknesses in OKX’s risk assessments and monitoring of over $20 million in customer transactions.

- A separate €304,000 fine was issued by the MFSA in 2024 after OKX showed goodwill and agreed to governance reforms.

- Regulators acknowledged OKX’s corrective actions, including hiring an independent third-party to improve compliance systems.