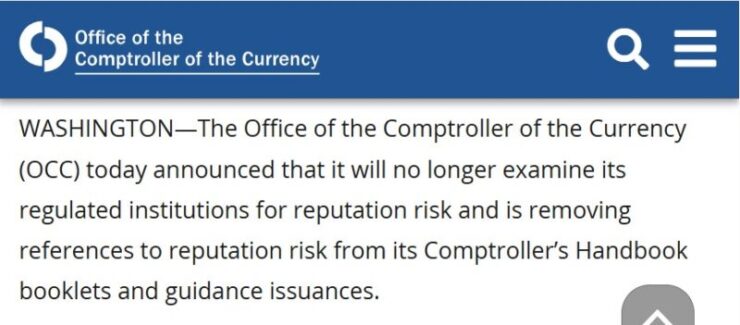

The Office of the Comptroller of the Currency (OCC) has announced it will no longer require U.S. national banks to account for “reputational risk” when evaluating their business relationships. The decision follows persistent criticism from the crypto industry, which argued that the reputational risk factor was often used to pressure banks into cutting ties with digital asset firms.

For years, crypto companies claimed that regulators weaponized the subjective nature of reputational risk, effectively marginalizing lawful crypto businesses by labeling them as potential liabilities to banks’ public image. This practice, they argued, contributed to widespread debanking within the sector.

In a statement released Thursday, the OCC confirmed that it has removed the reputational risk criterion from its supervisory handbook. Acting Comptroller of the Currency Rodney Hood emphasized the agency’s shift in focus, stating,

“The OCC’s examination process has always been rooted in ensuring appropriate risk management processes for bank activities, not casting judgment on how a particular activity may fare with public opinion.”

The move is being welcomed as a major step toward leveling the playing field for crypto firms seeking reliable banking services, while reinforcing the principle that financial regulation should prioritize objective risk management over subjective reputational concerns.

“We support the OCC’s announcement today and believe it is one action among many necessary steps to restore fairness to bank supervision,” Greg Baer, Bank Policy InstituteI President and CEO, said, while reacting to the news.

“Bank exams should be transparent and grounded in objective legal standards. This marks meaningful progress in refocusing oversight on material financial risk, rather than reputational risk, operational risk, corporate governance, vendor management and other matters that do not pose a material threat to safety and soundness.”

Regulators Reassessing Crypto-Banking Relations

In addition to eliminating reputational risk as a standalone factor, the Office of the Comptroller of the Currency (OCC) confirmed it will revise all relevant handbooks and internal guidance to remove mentions of the term. While the OCC stressed that banks are still expected to manage risks appropriately, the agency made it clear that reputational concerns will no longer play a role in regulatory oversight.

This policy shift follows the OCC’s recent clarification that federally chartered banks are permitted to engage in crypto-related activities—a sharp departure from the more restrictive stance taken in previous years. The agency’s updated position represents a broader effort to encourage responsible innovation within the U.S. banking system without penalizing lawful crypto businesses.

Meanwhile, lawmakers have taken steps to codify these changes into law. Last week, the Senate Banking Committee advanced a bill aimed at removing reputational risk considerations from the supervisory toolkit of federal regulators. Sponsored by Committee Chair Senator Tim Scott (R-S.C.), the bill also addresses concerns about other industries facing reputational discrimination, including politically disfavored groups.

The Federal Reserve’s definition of reputational risk—as the potential for negative publicity to harm an institution’s customer base or revenues—has long been criticized for its subjective nature. The combined efforts of the OCC, FDIC, and lawmakers signal a coordinated push to eliminate these ambiguous criteria from the regulatory landscape, providing clearer rules for both banks and crypto businesses moving forward.

Operation Chokepoint’s Legacy Looms Over Crypto Banking Access

The removal of reputational risk from U.S. bank examinations comes against the backdrop of wider political moves to dismantle what many in the crypto industry describe as Operation Chokepoint 2.0. The term, coined by Castle Island Ventures co-founder Nic Carter in 2023, draws parallels to the original Operation Choke Point—a controversial 2013 Department of Justice initiative that pressured banks to cut off services to industries deemed high-risk, including firearm dealers, payday lenders, and later, crypto firms.

Under the banner of mitigating financial crime, critics argued that the program’s broad application led to lawful businesses being unfairly debanked. In recent years, crypto businesses have increasingly felt the weight of similar tactics, as regulators and banks cited reputational risk to justify limiting access to essential banking services.

President Donald Trump has made it clear he intends to bring this chapter to a close. In a recent speech at the Digital Asset Summit, Trump explicitly pledged to end Operation Chokepoint 2.0, calling it a misuse of regulatory authority aimed at stifling lawful industries like crypto. While speculation continues around the possibility of Trump issuing an executive order specifically targeting debanking practices, no formal action has been taken yet.

Quick Facts:

- The OCC has officially removed “reputational risk” from its bank supervision criteria after industry criticism.

- Crypto firms argued the factor was used to justify debanking and restrict access to banking services.

- Acting Comptroller Rodney Hood emphasized the shift focuses on objective risk management, not public opinion.

- The move is expected to improve banking access for compliant crypto businesses and reduce regulatory ambiguity.