As discussions intensify around tokenizing U.S. gold reserves, analysts at NYDIG believe the move could unexpectedly boost Bitcoin, even if tokenized gold lacks the trustless nature that defines cryptocurrencies.

While blockchain-based gold tracking is unlikely to replace Bitcoin’s decentralized design, it may increase awareness of digital assets and strengthen Bitcoin’s role as the ultimate digital store of value.

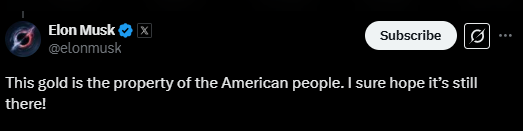

Recent chatter from U.S. officials and tech leaders, including Elon Musk, has reignited calls to audit the nation’s gold reserves — possibly by tracking them on a blockchain. The concept, aimed at improving transparency and trust, has gained support from segments of the crypto industry.

But Greg Cipolaro, NYDIG’s Global Head of Research, remains skeptical about its practical impact. “Blockchains aren’t very smart,” he noted, explaining that while they excel at securing data, they cannot independently verify off-chain assets like physical gold.

Trust vs. Trustless — Why Bitcoin Stands Apart

Unlike Bitcoin, tokenized gold reserves would still rely on centralized verification audits, human oversight, and government reporting.

“Bitcoin was designed to explicitly remove centralized entities,” Cipolaro emphasized.

Blockchain could enhance audits but wouldn’t eliminate the need for institutional trust. As such, tokenizing gold may serve more as a digital accountability tool rather than a competitive form of money.

The conversation comes amid renewed demands for an independent audit of Fort Knox, fueled by Senator Rand Paul and amplified by both Donald Trump and Musk. Despite regular Treasury reports affirming the gold’s presence, conspiracy theories questioning the vault’s contents continue to circulate.

The U.S. Mint claims no significant movement of gold in or out of Fort Knox for years, yet skepticism lingers, a dynamic that could make blockchain tracking of assets more appealing to a distrustful public.

How Tokenized Gold Could Indirectly Fuel Bitcoin Adoption

NYDIG argues that while tokenized gold is no threat to Bitcoin, it could boost Bitcoin indirectly by pushing more investors to understand blockchain’s potential. Increased focus on digital asset infrastructure might validate Bitcoin’s role as the trustless hedge in contrast to government-backed tokenized assets.

The result? Institutional interest may rise, positioning Bitcoin as the next logical step for those exploring digital hedges.

The Takeaway

The U.S. may not be ready to tokenize its gold reserves, but the growing debate underscores a larger shift: trust in traditional systems is eroding, and blockchain is increasingly seen as a solution. Yet, only Bitcoin offers the true decentralization investors seek.

In the race to digitize assets, Bitcoin’s role as the uncontested, trustless store of value may grow stronger.