The North Dakota Senate has overwhelmingly passed a bill that could reshape how crypto ATMs operate across the state, slapping a $2,000 daily transaction cap on users in a push to combat scams and protect consumers.

House Bill 1447, passed 45-1 on March 18, revives a transaction limit previously dropped by the House. The legislation heads back to the House for a final vote before landing on Governor Kelly Armstrong’s desk for approval or veto.

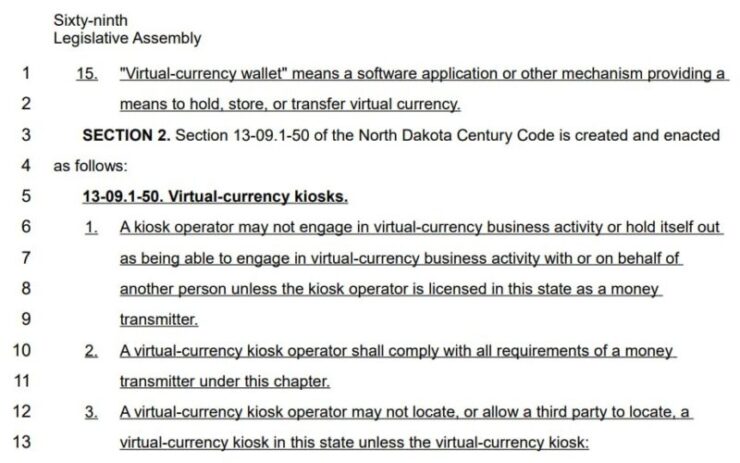

Introduced in January, the bill seeks to enforce stricter rules on crypto ATM operators by mandating state licensing as money transmitters and requiring blockchain analytics tools to detect suspicious activity. Operators must also issue fraud warnings at kiosks and submit quarterly reports listing machine locations, operator names, and transaction data.

Initially, lawmakers debated a $1,000 daily limit, but a House committee relaxed that cap to $2,000 for the first five transactions within 30 days. The Senate’s version eliminates the phased approach, setting a firm $2,000 daily withdrawal cap per user across all machines an operator owns.

“This is about protecting North Dakotans from being easy targets,” said House Representative Steve Swiontek, who championed the bill. “Right now, these machines lack basic safeguards and criminals know it.”

A Growing National Concern

North Dakota isn’t acting in a vacuum. Nebraska’s governor signed similar legislation—the Controllable Electronic Record Fraud Prevention Act—into law just days earlier, aiming to prevent fraud tied to crypto ATMs.

Meanwhile, at the federal level, Senator Dick Durbin of Illinois has proposed sweeping legislation after hearing from a constituent scammed into depositing $15,000 into a crypto ATM to avoid arrest supposedly.

The move comes amid soaring fraud cases linked to crypto ATMs. The Federal Trade Commission reported losses skyrocketing nearly tenfold between 2020 and 2023, with over $65 million lost in the first half of 2024 alone. Older Americans, the data shows, are three times more likely to fall victim.

With 29,822 Bitcoin ATMs—78% of the global total—the United States remains the world’s largest crypto ATM market. Canada trails behind at 9.2%, while Australia ranks third with just over 1,600 machines.

However, growing concerns over money laundering and consumer exploitation force lawmakers to reassess oversight. Requiring blockchain monitoring and capping transactions marks a significant shift toward accountability.

What’s Next? A Signal for Broader Oversight

If signed into law, North Dakota’s measure could set a precedent for other states weighing similar restrictions. The bill reflects a broader trend toward tighter state-level oversight of crypto transactions as regulators race to protect consumers without stifling innovation.

For crypto ATM operators, the message is clear—adapt or face regulation. As digital currencies gain mainstream traction, balancing ease of access with fraud prevention is becoming an unavoidable challenge.

The House is expected to vote on the amended bill in the coming days. A final decision could put North Dakota on the frontlines of crypto ATM reform in the U.S.

Takeaway

North Dakota’s move signals that state governments are no longer sitting idle as crypto ATMs become a favored tool for scammers. Expect other states and potentially the federal government to follow suit as the battle for safer crypto access intensifies.