North Carolina is the latest state eyeing cryptocurrency as part of its public financial strategy. Lawmakers have introduced bills that could allow up to 5% of state retirement funds to be allocated to digital assets, marking a bold shift toward integrating crypto into traditional pension systems.

The move positions North Carolina alongside a growing number of states exploring Bitcoin and digital asset reserves as a hedge and potential growth driver.

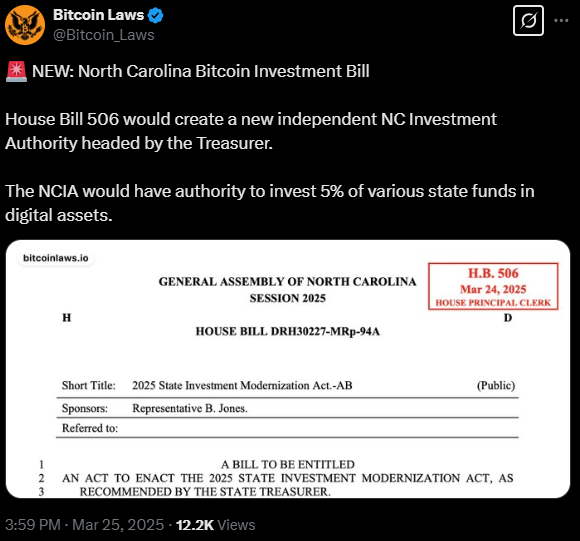

House Bill 506, known as the Investment Modernization Act, was introduced on March 24 by Representative Brenden Jones. A matching bill, Senate Bill 709, followed a day later. Both propose creating an independent body, the North Carolina Investment Authority to oversee digital asset investments for the state’s retirement funds.

The bills cast a wide net, defining digital assets to include cryptocurrencies, stablecoins, NFTs, and other electronic assets offering economic or proprietary rights. Interestingly, there’s no market cap requirement giving the authority flexibility to invest in emerging or smaller digital assets if deemed appropriate.

Careful Risk Assessment and Secure Custody Required

The proposed Investment Authority would be tasked with thoroughly evaluating the risks and rewards of each digital asset and ensuring secure custody solutions are in place, a nod to the complexities and security challenges tied to crypto investments.

Unlike some Bitcoin reserve bills circulating in other states, North Carolina’s proposal doesn’t mandate Bitcoin holdings or long-term accumulation. Instead, it leaves room for strategic discretion based on market conditions and asset profiles.

These new retirement bills come just days after North Carolina’s Senate introduced a separate Bitcoin-specific proposal—the Bitcoin Reserve and Investment Act (Senate Bill 327) on March 18.

That bill calls for up to 10% of public funds to be invested specifically in Bitcoin, stored in a multi-signature cold wallet. The BTC could only be liquidated during a severe financial crisis and with approval from two-thirds of the General Assembly.

It also outlines the formation of a Bitcoin Economic Advisory Board to oversee the fund, a sign of growing state-level recognition of Bitcoin’s potential as a “financial innovation strategy.”

According to Bitcoin Laws, North Carolina joins a growing wave of crypto legislation sweeping across the US. So far, 41 Bitcoin reserve bills have been introduced in 23 states, with 35 still active—highlighting intensifying interest in digital assets within government finance.

Even the federal government is taking steps. Earlier this month, former President Donald Trump signed an executive order creating a Strategic Bitcoin Reserve and a Digital Asset Stockpile, both initially funded through cryptocurrencies seized in criminal cases.

What’s Next

If passed, North Carolina’s bills could set a precedent for other states considering crypto as part of retirement and reserve fund strategies. It’s a clear signal that digital assets are no longer viewed as fringe investments—but as potential tools to diversify and future-proof public funds.

As debates over regulation, risk, and reward continue, North Carolina may become a testing ground for how crypto fits into mainstream government finance.