After a strong resurgence in late 2024, NFT trading volume has collapsed by 63% since December as the broader crypto market struggles with volatility and macroeconomic uncertainty. Despite growing interest in AI-powered NFTs and digital collectables with real-world utility, the downturn raises questions about whether this is a temporary correction or a long-term decline for the NFT market.

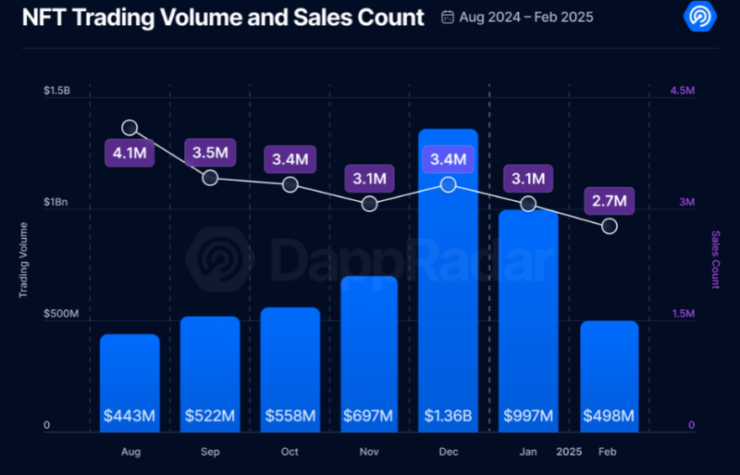

According to a March 6 report by DappRadar analyst Sara Gherghelas, NFT trading volumes have suffered consecutive monthly drops:

- December 2024: $1.36 billion in total NFT trading volume.

- January 2025: A 26% decline from December.

- February 2025: Another 50% drop, bringing total losses to 63% since December.

“While NFTs had been showing signs of a comeback in recent months, their momentum has slowed since the start of the year,” Gherghelas stated.

She attributed the downturn primarily to its correlation with crypto prices, as NFTs historically follow broader market trends.

The NFT decline coincides with a broader crypto market cooldown.

- Bitcoin (BTC) surged above $109,000 on Jan. 20, briefly setting a new all-time high, before dropping below $88,000 in February.

- The overall crypto market cap hit $3.71 trillion on Dec. 9, 2024, before losing a significant portion of its gains amid mounting economic uncertainty.

- Trump’s proposed trade tariffs in February fueled concerns over market stability, further discouraging speculative trading across crypto and NFT markets.

AI-Powered NFTs and Utility-Based Digital Assets

Despite the plunge in trading volume, NFT adoption is evolving.

DappRadar reports that daily active users interacting with NFT platforms increased by 6% in February, reaching 3.5 million. This trend reflects a shift away from speculation and toward digital assets with real-world applications.

“The increasing integration of artificial intelligence into NFT projects signals a shift toward more dynamic, interactive digital assets with enhanced utility,” Gherghelas noted.

This suggests that while speculative NFT trading may continue to decline, projects focused on engagement, interactivity, and real-world use cases could drive the next wave of Web3 adoption.

DappRadar’s report highlights which NFT segments continue to see demand:

- Profile Picture (PFP) NFTs – Remain the most traded category, generating $243 million across 76,385 sales.

- Gaming NFTs – Recorded $41 million in trading volume, with 421,853 assets traded.

- Sports NFTs – Led in transaction count, with 659,097 sales and $7.7 million in volume.

The NFT market saw its worst year since 2020 in 2024, with $13.7 billion in trading volume—a steep decline from its peak in 2022, when NFT trading volumes hit $57.2 billion.

However, NFT technology is maturing. With rising interest in AI-enhanced digital collectables, metaverse integration, and enterprise blockchain solutions, the industry could be on the verge of reinvention rather than collapse.

What’s Next for NFTs?

If crypto prices stabilize and macroeconomic uncertainty eases, NFTs with real-world utility could emerge as the dominant force in Web3.

While speculative hype has faded, the NFT market is not dead—it’s simply shifting toward a more sustainable, utility-driven future.